The phrase “time is money” used to mean something in finance. In a world where negative bond yields are becoming reality, time no longer has the same value.

With the global economy in a state of flux, more and more investors have decided to park their money in traditional safe havens like U.S. Treasury bonds. The rush to government bonds has pushed Treasury yields to record lows. According to many industry observers, it’s only a matter of time before we see negative yields.

It’s not a far-fetched idea, either.

The European Central Bank (ECB) and Bank of Japan (BOJ) have already adopted negative interest-rate policies – moves that impact government bonds. Observers like Michael Bazdarich, product specialist and economist at global fixed-income asset manager Western Asset, believe it’s only a matter of time before the Federal Reserve adopts a similar approach. The Fed has already slashed interest rates to zero and embarked on a new quantitative easing regime following the COVID-19 outbreak.

The article explores the implications of negative yields and what it might mean for investors.

Learn more about mutual funds here.

Negative Rates

When interest rates go negative, financial institutions are effectively penalized for hoarding cash or parking it at the central bank. A negative-rate policy is meant to encourage financial institutions to lend out their money to boost consumption and economic growth.

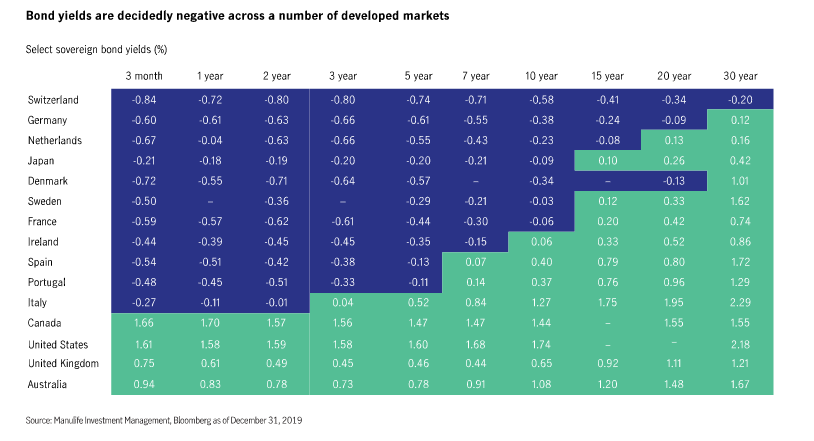

Negative interest rates have direct implications for bond investors. Even in countries where rates are positive, investors with exposure to fixed-interest portfolios will be impacted as portions of the yield curve turn negative. Case in point: by November 2019, the value of government bonds, globally, with negative yields stood at a whopping $17 trillion, according to Manulife research.

How to Respond to a Negative Yield Environment

A negative-rate environment isn’t the end of the world for bond investors. Ultimately, bond funds help investors generate steady cash flow during economic downturns, recessions or other periods of instability. They will continue to do so even in a negative-rate environment.

As we’ve seen in Japan over the past few decades, low and negative bond yields don’t necessarily mean negative returns in bond markets. In fact, investing 100 yen in the Japanese bond market in 1995 would have yielded you higher returns than an equivalent investment in Japanese stocks.

That’s because Japan’s bond yield curve slopes upward, offering the opportunity for capital gains through a process called “roll down.” A roll down involves buying and holding a bond for a period of time and then realizing capital gains as it approaches maturity.

Investors who purchase negative-yielding bonds are essentially betting that the value of the asset will keep rising. That’s not a bad bet when you consider that institutions like the European Central Bank are about to restart their asset purchase program.

Last July, the ECB auctioned 4 billion euros worth of 10-year German government bonds at a negative yield but at a premium price. The price of that same bond has increased since the auction, which means investors are still benefiting despite the negative yield.

Investors who are particularly concerned about negative interest rates may have to reevaluate their portfolios and adopt a slightly more aggressive strategy to increase yield. This could mean diversifying into other asset classes or increasing exposure to stocks. For example, consumer staples stocks tend to outperform during periods of economic instability, so funds that have exposure to these sectors could outperform in this environment.

Use the Mutual Funds Screener to find the funds that meet your investment criteria.

Beyond increasing exposure to other assets, investors who are concerned about negative rates can protect their returns by remaining diversified globally and choosing quality bond funds over lower-quality equivalents with higher yields. Keeping costs down can also help you realize long-term gains. This may require you to rethink future return expectations and focus more on preservation as opposed to growth-at-all-costs.

Don’t forget to learn more about strategic asset allocation here.

The Bottom Line

The era of ultra-loose monetary policy is unlikely to end anytime soon. Central banks around the world are aggressively cutting interest rates to prop up their economies. Whether this strategy will yield positive results is up for debate, but for bond investors, the time to prepare is now.

Be sure to check our News section to keep track of the latest updates from the mutual fund industry.