Bonds are supposed to be the “safe” asset class. Compared with equities, commodities and even real estate, bonds are the rocks that anchor portfolios. Thanks to their steady-eddy coupons and principal repayments, bonds are typically the lower volatility class and provide plenty of ballast to a portfolio. It’s no wonder retirees and older investors generally have a higher percentage of their portfolio in bonds.

But bonds aren’t risk free. And, we’re not talking about credit risk from lower borrowers either.

Duration can wreak havoc on a bond portfolio – even one full of safe government bonds. And the current environment and potential rate increases are exactly why investors need to get serious about their duration risk and adjust accordingly.

Don’t forget to check our Fixed Income Channel to learn more about generating income in the current market conditions.

An Inverse Relationship

After nearly a decade, things are changing. In this instance, inflation and the growing economy have finally gotten out of hand. In the post-pandemic world, consumer and producer prices have risen by amounts not seen since the 1980s. To that end, the Federal Reserve is planning on raising benchmark interest rates once again after dropping to zero at the start of the pandemic.

For bond investors, this is a major issue.

The thing is, bonds and rising interest rates are like oil and vinegar – they don’t mix very well. When interest rates rise, bond prices will fall. The reason is that when a new similarly maturing and credit-rated bond comes to market, it will have a higher interest/coupon to reflect the interest rate change. As a result, bonds currently on the marketplace will drop in price to match that new yield.

For investors owning individual bonds and holding them until maturity, the drop in price isn’t a big deal. Your coupon will still be the same and you’ll still get the bond’s face value back in full when it matures.

However, for investors owning bond ETFs or mutual funds, the problem is very real. That’s because funds are constantly rolling over their portfolios of bonds to meet their mandates. An intermediate-term bond fund will always look to own bonds of 5 to 7 years, for example. As bond prices fall, so will the prices for the underlying funds, and that fall in prices will stick.

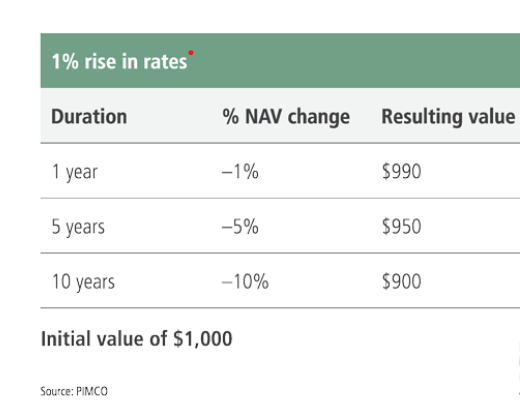

The measure of this drop is derived from something called duration. By looking at factors like present value, yield, coupon, final maturity and bond features, duration looks to calculate just how badly your bonds will decrease in value when rates rise, or vice-versa. Bonds with higher durations get crunched worse than those with shorter durations. This chart from investment manager PIMCO illustrates how duration can affect bond prices.

Source: PIMCO

For example, a bond ETF with an average duration of 2.5 years would see a 2.5% drop in price on a 1-percentage-point increase in interest rates. That would drop a $1,000 initial value down to $975. However, a 12-year average duration bond would fall around 12% for the same increase in interest rates. This bond portfolio would now only be worth around $880.

Shorten Up

The way to fight duration risk is to simply shorten up your portfolio. All fund sponsors publish duration information for their ETFs and mutual funds. Investors can use this info to figure out how badly their bond holdings will get crunched as the Fed pulls the trigger and raises rates. If that’s a dip you can stomach and you’re holding out for the long haul, then you might not have to do anything.

However, you can use this information to potentially move down the duration curve by switching into shorter-term bonds. For example, the very popular Vanguard Total Bond Market ETF (BND) has a duration of 6.86. It’s shorter-focused sister, the Vanguard Short-Term Bond ETF (BSV), has a duration of 2.73. By selling BND and buying BSV, investors can still keep their overall allocations the same while removing duration risk. Nearly all bond types these days – from high yield to municipal debt – feature funds that allow for shortening up duration risk.

Another option could be to barbell a bond portfolio. This involves investors keeping their longer-duration bond funds, and adding a dose of limited-term or ultra-short duration bonds to their mix. Funds like the BlackRock Short Maturity Bond ETF (NEAR) or SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) feature durations measured in months rather than years. The combination of both long and short durations acts to both balance and smooth out a bond portfolio.

Finally, getting active may prove to be the best way for investors to win. Since active managers aren’t tied to an index, they can shift their portfolios around to reduce duration risk. Even better is that it can find a balance between higher-yielding bonds and shorter maturities to maximize returns. Investors looking to go active should focus on “total return” or “go anywhere” bond funds.

Be sure to check our Portfolio Management Channel to learn more about different portfolio rebalancing strategies.

The Bottom Line

Bonds aren’t always the safest asset class. With the Fed raising rates, duration risk is now on the table for fixed income investors. And that means managing duration risk, understanding how it plays into your portfolio, and what to do about it are all vital steps.

Make sure to visit our News section to catch up with the latest news about income investing.