Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

BP Prudhoe Bay Royalty Trust trended this week as investors were attracted by the blockbuster dividend, although there are pitfalls. Texas Instruments garnered views as the semiconductor company unveiled its quarterly results. Meanwhile, Citigroup and Caterpillar took the third and fourth place in the list, respectively, as both firms reported solid quarterly results.

BP Prudhoe Bay Pays Sky-High Dividend, But Concerns Abound

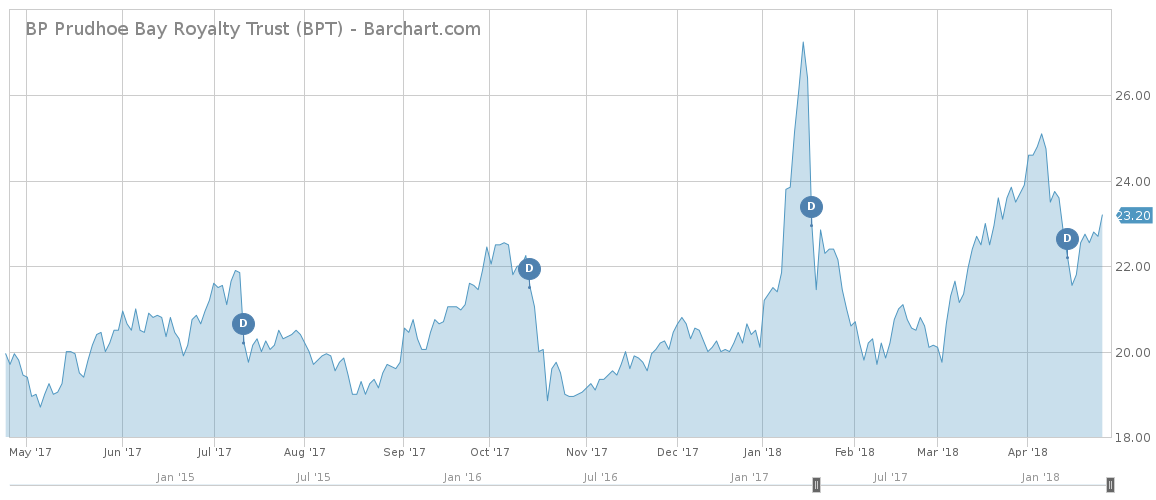

BP Prudhoe Bay Royalty Trust (BPT ) has taken the first place in the trends list this week with an increase in viewership of 101%, as readers were attracted by the oil and gas trust’s high dividend. BP Prudhoe has an annualized payout of $5.1 per share and yields as much as 22%, considerably higher than the basic materials average of 2.51%.

As is true with many trusts paying a high dividend, investors should be aware of the potential pitfalls. First, BP Prudhoe’s production is dropping at high rates. In the first quarter of 2018, actual average daily production stood at 83,000 barrels, almost 10,000 barrels lower compared to the same period last year. In its most recent annual report, BP Prudhoe said that it expects royalty payments to the trust to continue through 2020, meaning that in two years the fund will be worthless.

Still, the situation may take a positive turn if oil prices improve. In essence, a bet on BP Prudhoe is a bet on rising oil prices. The trust will particularly benefit if crude surges above $100 per barrel, seemingly a far-fetched possibility at the moment. Still, Saudi Arabia reportedly wants to see oil prices close to $100 per barrel, indicating that a deal with Russia to limit crude supplies will be extended beyond the current agreement.

At the current dividend yield, BP Prudhoe would have to remain listed for another five years for investors to recover their investment, something that is only possible if oil prices rise. Shares in BP Prudhoe are up 16% in the past 12 months, benefiting from higher oil prices.

However, what is concerning is the fact that in the past five years the trust’s stock has dropped more than 71%.

Texas Instruments Surges on Blockbuster Forecasts

Texas Instruments (TXN ) has seen its viewership rise more than 70% this week, as investors were eagerly awaiting the company’s financial results, which sometimes are used as a proxy for the general health of the economy. The markets sighed a breath of relief after the company emerged with second-quarter results that beat analysts’ expectations.

Texas Instruments, which provides chips to a large array of electronic product makers, said demand was strong in the automotive and industrial sectors. The company estimated that second-quarter net income will be $1.39 a share compared to $1.22 forecasted by analysts. In the first quarter, the company’s net income stood at $1.37 billion or $1.35 per share, up from $997 million and $0.97 per share a year earlier.

As a result, shares in Texas Instruments surged nearly 4% on Wednesday, although they remain down 3% in the past five days and 2% since the beginning of the year. With a payout ratio of nearly 50%, Texas Instruments pays an annual dividend of $2.48 per share, representing a yield of 2.42%.

The company’s chips are used in almost any electronic device because their main task is to convert human inputs into electronic signals. This means that the market for its products is stable, although the downside is that revenue growth is more difficult to achieve.

Citigroup Seeking New Chairman as O’Neill Set To Retire

U.S. banking giant Citigroup (C ) has seen its viewership advance 59% in the past week, as the company is on the lookout for a new chairman after Michael O’Neill announced plans to leave. At the annual meeting on Tuesday, O’Neill, who is 72 and his retirement is mandatory under Citigroup bylaws, said the search for a new chairman has already started. Among the candidates being reviewed are current CEO Michael Corbat.

On April 25, Citigroup confirmed it would pay a quarterly dividend of $0.32 per share on May 25, representing a yield of nearly 2%. With a payout ratio of just under 20%, Citigroup has much leeway to make further hikes, although it would have to balance shareholder returns with its business needs. Wells Fargo (WFC ), the only other large bank with an independent chairman, gives back nearly 35% of its profits to shareholders, while JPMorgan Chase’s (JPM ) payout is 25%.

Citigroup’s stock is up more than 2% in the past 30 days as the bank’s most recent financial results beat expectations. Bolstered by lower corporate taxes and strong revenue from the trading division, Citigroup earned $1.68 per share in the first quarter compared to $1.61 expected by analysts.

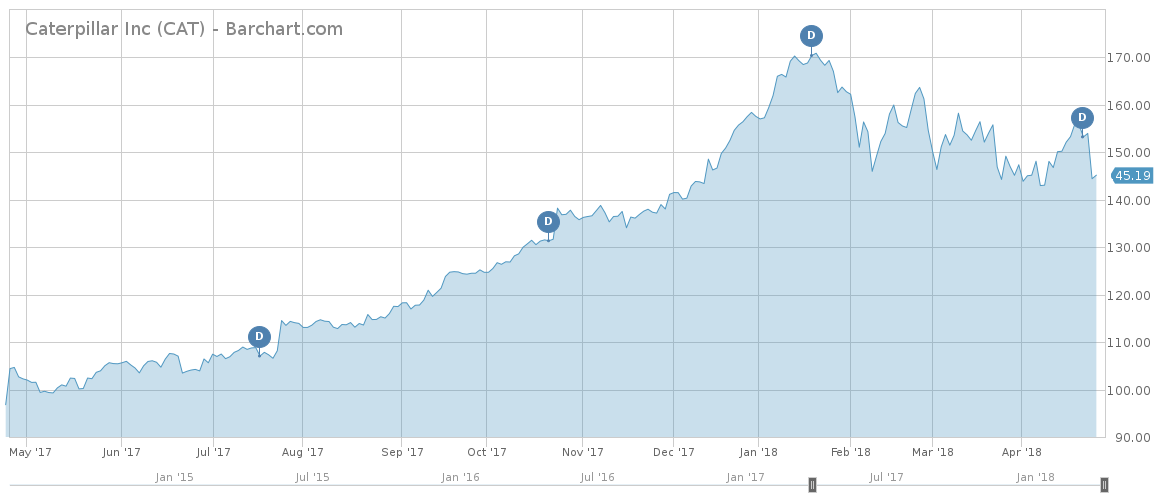

Caterpillar Tumbles on Poor Guidance

Heavy machinery producer Caterpillar (CAT ) has seen its traffic rise 36% for the week, as the company reported blissful results for the first quarter but warned about an impending drawback. Shares in Caterpillar were initially up on the results but reversed gains and are now down nearly 7% in the past five days.

Caterpillar beat expectations both on earnings and revenue in the first quarter – $2.82 per share versus $2.13 expected and $12.9 billion compared to $12.1 billion forecast, respectively. Caterpillar also raised its outlook for 2018 by $2 per share to a range of $10.25 to $11.25. The results were chiefly due to high demand in many of the company’s end markets and cost cut drives.

However, Caterpillar CEO Jim Umpleby warned that first-quarter earnings would be the “high-water mark” for 2018, sending shivers through the markets. Umpleby said earnings may suffer in the coming quarter because the firm expects investments to be higher.

The Bottom Line

Oil and gas royalty trust BP Prudhoe Bay pays an impressive annual dividend of 22%, but it may cease its existence in two years if oil prices fail to improve dramatically. Texas Instruments reported blockbuster earnings results, while Citigroup is seeking for a new chairman given the impending retirement of Michael O’Neill. Finally, Caterpillar recorded strong results for the first quarter but warned the best of 2018 may already be behind it.