Intel Corporation (INTC ) is one of the world’s largest semiconductor companies with products in PCs, smartphones, tablets, drones and many more applications. Intel is most famously known for its x86 series of microprocessors, which was first introduced in 1978 and is still being used today. As of 2017, Intel had annual revenues of over $62 billion and is 47th on the Fortune 500 list.

On Monday, April 2, Apple Inc. (AAPL ) indicated its plan that it will start developing its own MacBook chips in 2020, thus ending its contract with Intel. After this was announced, Intel’s shares were down over 8% and eventually closed down 6.07% for the day. However, this does not come as a surprise. The iPhone and iPad devices use the A-series chip, which is Apple’s own in-house made chips.

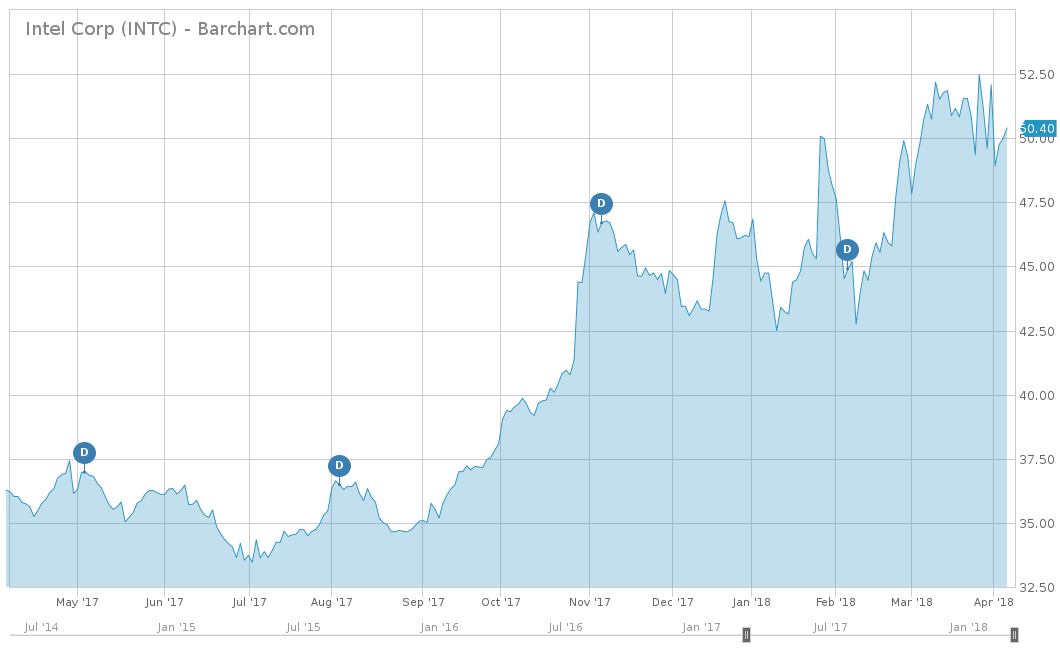

On a year-to-date basis, Intel has fared really well in comparison to the S&P 500 and is up 9.25% versus the S&P 500’s return of negative 0.35%. This is even with the 6% drop on Monday, the stock still remains one of the best performers in the market for 2018. Over the last five years, Intel has also performed very well and is up a cumulative 140.31%. This is almost double the return of the S&P 500, which was up 71.33% for the same time. Over the long term, Intel has successfully transitioned its technological advancements into beneficial partnerships with companies like Dell Technologies, Lenovo Group Ltd. and of course, Apple Inc.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

Over the last five years, Intel has seen slow and steady revenue growth, with an average of 3.3%. Over the last 2 years, the company was able to grow its topline by 5% to 7%. Even in Q4 2017 the company was able to beat revenue estimates despite bearing the brunt of a $5.4 billion charge related to the new tax reform. The biggest growth in earnings came from the company’s Data Center Group, which grew its revenues 20% on a year-over-year basis, attributing to $5.6 billion of the company’s overall revenue. Analysts expect Intel to continue its slow-growing trend with estimates of $65.0 billion and $67.31 billion in 2018 and 2019, respectively.

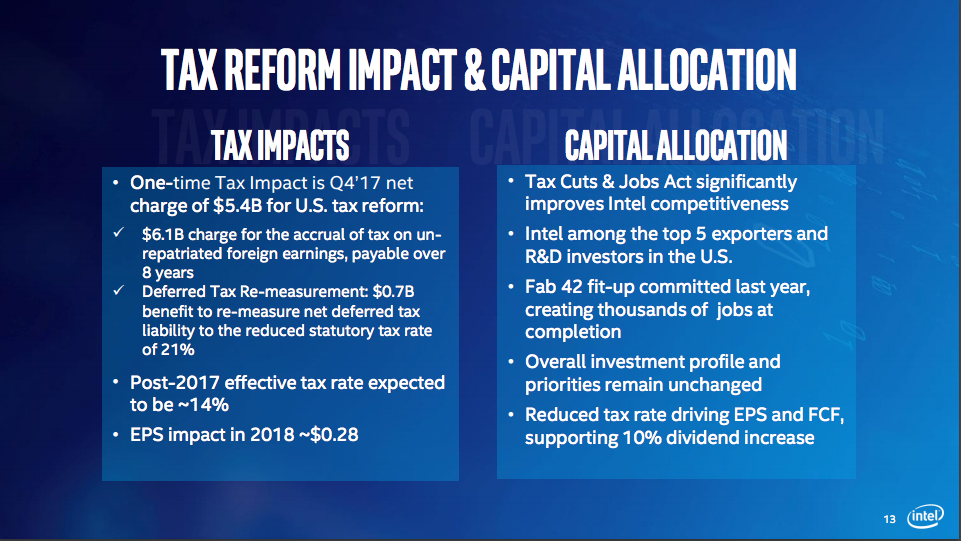

From an earnings per share perspective, Intel was affected by the recent tax reform and saw a decline in the fourth quarter of 2017, leading to a year-end total of $1.99 per share. This represents the second decline in earnings in a row for Intel. Despite the recent declines in earnings, analysts project that Intel will be back to earnings growth in a big way with loft expectations of $3.50 per share and $3.80 per share estimates in 2018 and 2019. Like most U.S. companies in the fourth quarter of last year, the tax reform plan had a one-time charge, which negatively affected earnings. However, going forward the company should start seeing the tax savings as early as 2018, thus supporting the expectations of analysts. For instance, Intel expects its post 2017 effective tax rate to be 14%, considerably lower than in years past. This also should add an estimated $0.28 per share of earnings for 2018.

Strengths

Intel is the leader in microprocessors in the PC world, with its Core, Xeon, Atom, Pentium and Celeron processors. The company currently gets more than half of its revenues from its Client Computing Group, which consists of its PC and Server revenue sales. As expected, Netbook microprocessor (MPU) revenue outperformed Desktop MPU revenue, 37% versus 22%. This was fully expected as the consumer base has been gradually shifting from desktop PCs to more handheld and convenient options like Notebooks. However, as its PC microprocessing revenues is currently its strength, it can become a weakness if it does not adapt to the changes in the industry.

The future of Intel really depends on its company-wide shift in 2016 where the company decided to restructure its business from a PC processor maker to a major player in high-growing data-centric business verticals. In 2017, the Data Center Group saw an increase of 20%, seeing revenues grow to $5.6 billion from $4.7 billion in 2016. Even better, this segment saw a nearly 60% increase in its operating margins showing that the company’s new focus is beginning to seem like the right move. The largest growth within this segment came from its Cloud segment, up 35% from 2016. This move toward Cloud technology, including applications of the Internet of Things (IoT) and 5G communications should continue to drive Intel’s revenue growth.

Seeing Intel’s change in direction is a very good sign that the company is focused on growth and very willing to adapt to the needs of consumers, instead of sticking to the declining trend of PC processors. Seeing that the Data Center Group has immediately seen very high growth is a great sign that the company is moving in the right direction with considerably more upside.

Growth Catalyst

In 2017, Intel successfully acquired Mobileye, hoping to build on the company’s leading position in autonomous automobiles. This would undoubtedly lead to a whole new source of revenue for Intel, as this is a relatively untapped market with many competitors and no clear leader. In January 2018, the Intel CEO in his keynote address at the Las Vegas electronics show rolled out a self-driving Ford Fusion, which was the first of a 100-vehicle test fleet run by Mobileye.

This Fusion has twelve cameras, radars, laser scanners and computing technologies. It also has three high-resolution cameras at the front of the car that enable it to see a 180-degree view field so the car can process images up to 300 meters ahead. During that show, Intel also announced a collaboration with Chinese carmaker SAIC Motor, to develop Mobileye’s technology in China. This acquisition is a clear win for Intel and it looks that the original $14.5 billion price tag is already starting to pay off.

Dividend Analysis

Intel is one of the higher-yielding stocks in the technology sector, with a current yield of 2.38%, which is considerably higher than the technology average of 1.26%. The company has also recommitted to growing its dividend, as evidenced by its recent hikes for the last three years in a row. Most recently, the company announced a 10.1% increase in January 2018 after its earnings call. The new rate hike will give shareholders a quarterly dividend of $0.30 per share, equal to $1.20 per annum.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Risks

The largest risk for Intel revolves around the risk of Apple no longer using their chips. Apple is the clear leader in technology and its competitors tend to follow suit. If Apple benefits from moving its chip building in-house, its competitors may do the same and end their resulting business with Intel.

However, even though Apple’s news made investors panic causing the stock to tank on Monday, Apple’s business only represents 5% of Intel’s overall revenue. The transition of its MacBooks is likely to take place in 2020, so Intel does have nearly two full years to make up for the loss in future revenue.

The Bottom Line

When looking at Intel’s fundamentals, its current focus on its Data Center Group and non-PC based revenues, and its acquisition of Mobileye, the company looks like a great buy. Although the stock tanked after the Apple news was released, it really will be a smaller impact than originally anticipated. There is a reason why Intel is up over 9% year-to-date while the rest of the market has been struggling just to be positive. Intel will benefit in a big way from the tax plan in 2018 and if it gets traction in the driverless car segment, expect the stock to bust through the $60 range.

Check out our Best Dividend Stocks page by going Premium for free.