Walmart Incorporated (WMT ) is the world’s largest retailer, with over $500 billion in sales as of fiscal 2018. The retailer has nearly 11,700 stores in 28 countries, serving over 260 million customers each week. Over the last fifty years, the company has transitioned from a low-price retail storefront into a full-service supercenter, neighborhood market, discount store and e-commerce giant.

The company can trace its roots back to 1962, when it was originally founded by Sam Walton. The Walmart Discount Store was first opened in Rogers, Arkansas, and consists of electronics, apparel, toys, home furnishings, health and beauty aids, hardware and more in about 106,000 square feet. In 1988, Walmart opened its first Supercenter, which combined the traits of a discount store with elements of a grocery store that is open on a 24-hour basis. In 1998, Walmart opened up its Neighborhood Market stores, a smaller-footprint option for communities in need of a pharmacy, affordable groceries and merchandise.

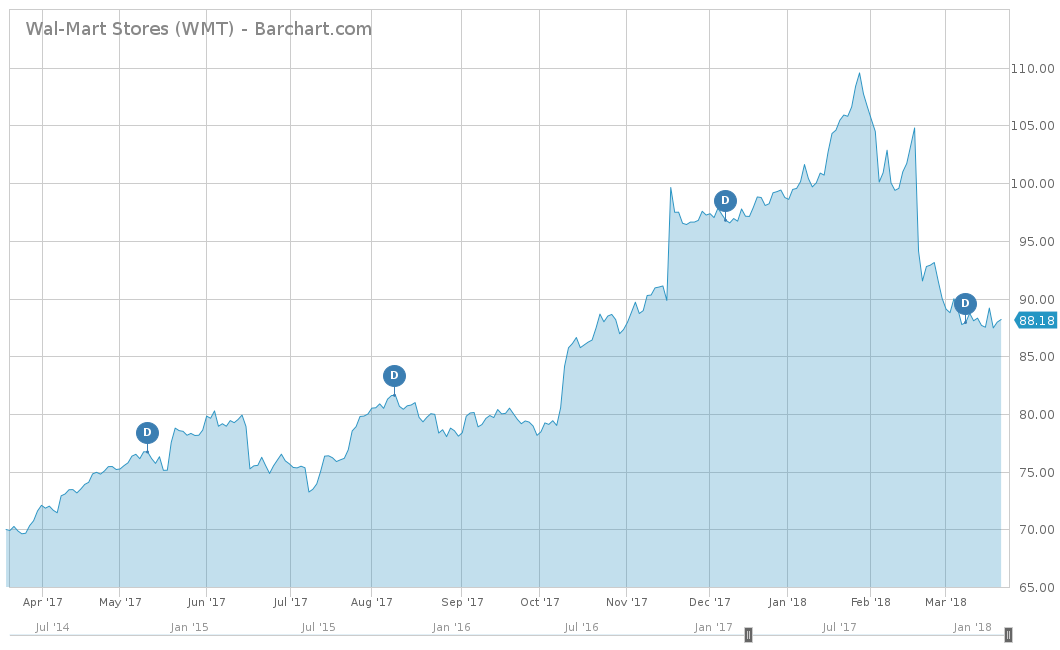

On a year-to-date basis, Walmart’s stock price has underperformed and is down 10.70%. WMT has also underperformed in the longer term, with a cumulative 20.58% return for the trailing five years. The S&P 500 Index has outperformed WMT in both time periods, with the index down nearly 1.4% year-to-date and up 75.44% for the trailing five years. However, when compared to Target Corporation (TGT ), Walmart outperformed over the trailing five years despite losing out in the short run.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

Over the last five years, Walmart has had a steady growth rate of 1.7% for its revenues. However, in 2016 and 2017, the company saw revenue declines of 0.7% and 0.8%, respectively. With its fiscal year 2018 ending in February 2018, revenues saw a gain of 3.09% to just over the $500 billion mark. Analysts believe the company will continue its slight growth in 2019 revenues to $510 billion and in 2020 revenues to over $525 billion. This would equate to just over a 2.10% and 2.80% increase each year.

On an earnings-per-share basis, Walmart has performed poorly with a negative 0.7% average annual EPS growth for the last five years. The company has seen negative earnings growth since 2016 and most recently saw another decline in its fiscal 2018. Last month, Walmart announced an EPS of $3.28 per share, a drop of over 25%. The company attributes this to a deceleration to 23% of its e-commerce growth in Q4 from 50% in Q3. Analysts see earnings growing over the next two years, with estimates at $4.43 per share and $4.91 per share, which is equal to increases of 35.06% and 10.84%.

On a price-over-earnings multiple, WMT currently has a 19.85, which is below that of the S&P 500’s 25.38 but higher than Target’s 13.45 measure.

Strengths

Walmart’s largest strength comes with its economies of scale and its large distribution network. This helps the company gain additional volume while also driving costs per unit down. Walmart has over 150 distribution centers, which act as the hubs of activity for its business. Walmart’s distribution operation is one of the largest in the world, servicing stores, clubs and direct delivery to customers. The company has a transportation fleet of 6,100 tractors, 61,000 trailers and more than 7,800 drivers. This distribution center pipeline, paired with its over 11,000 storefront locations, allows Walmart to have a huge advantage over its competitors.

Growth Catalyst

Walmart’s largest growth potential comes from possibilities in its e-commerce market. In 2016, Walmart made waves by acquiring Jet.com for $3 billion. This was a move to begin thwarting the rapid growth from the world’s biggest e-commerce retailer, Amazon Inc. (AMZN). Although Amazon currently remains supreme leader in the e-commerce world with over $120 billion in U.S. online sales, Walmart has plenty of upside with $23 billion in its online sales.

One major difference that Walmart has over Amazon is that roughly 60% of its sales derive from perishable goods, something that Amazon cannot distribute to its online customer base as quickly as Walmart can. Using its distribution centers and thousands of stores, nearly every consumer in the United States is located relatively close to a Walmart. This allows online buyers the option of either delivery or pickup from a local Walmart store in their area, something that Amazon cannot currently compete with.

Dividend Analysis

Walmart stock has a yield of 2.43%, which is a higher yield than the Best Discount, Variety Stores Dividend Stocks average of 1.21%. The company pays its dividend on a quarterly basis to equal a total annual amount of $2.08 per year. Walmart has one of the longest track records of raising its dividend, raising it 43 years in a row.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Find all the companies that have increased their dividends for more than 25 consecutive years on our 25-Year Dividend Increasing Stocks page, and for more than 10 consecutive years on our 10-Year Dividend Increasing Stocks page.

Risks

One of the biggest risks to Walmart is also its biggest growth opportunity. With the ever-changing trends in the online retail and e-commerce world, analysts, shareholders and management expect Walmart to see growth in these areas. However, with growing competition from both Amazon and other major retailers, Walmart’s growth could drop off like it did in the last quarter, causing the stock to plummet.

The Bottom Line

Although Walmart’s stock price has had a very rocky start to 2018, there is plenty of opportunity for growth. The company has always found a way to stay ahead, when all other retailers have failed. If shareholders can stay patient with the recent pullback, expect the stock to rebound as its e-commerce sales continue to grow.

Check out our Best Dividend Stocks Page by going Premium for free.