Located in Hsinchu, Taiwan, and founded in 1987, Taiwan Semiconductor Manufacturing Company Limited (TSM ) is the world’s largest semiconductor foundry. Many companies have been heading toward the fabless design, leaving TSMC as the leader for companies looking for the latest fabrication technologies.

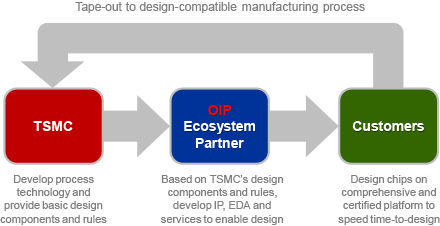

TSMC has the broadest ranges of technologies and services in the Dedicated IC (integrated circuit) Foundry segment of the semiconductor industry. The strategy embodies an integrated approach that bundles process technology options and services while collaborating with partners to ensure that all services supporting those technologies represent the best practices in the Dedicated IC Foundry segment. These practices have helped TSMC deliver the largest portfolio of process-proven IP and libraries and the IC industry’s most advanced design ecosystem.

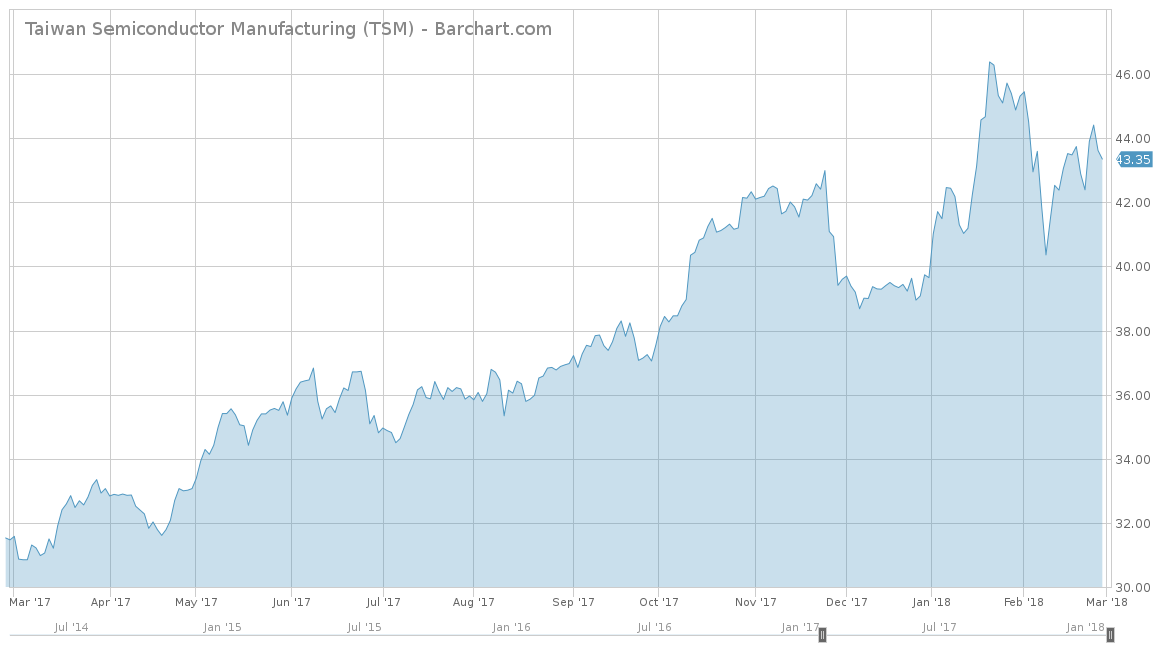

For 2018, TSMC stock has outperformed the S&P 500 and is up over 9.33% versus the S&P’s return of 1.50%. Over the last trailing one-year, Taiwan Semiconductor has performed very well with a 37.75% gain, more than doubling the S&P 500’s return of 14.82%. TSMC has also performed better over the long haul and is up a cumulative 137.53% for the trailing five-years, outperforming the S&P 500’s 79.17% return for the same time. However, when compared to its largest competitor, Texas Instruments Inc. (TXN ), TSMC holds up over the shorter term more than the longer term. For 2018, TXN is up 3.74% but has a trailing one-year return of 41.41%. Over the trailing five-years, TXN has had a cumulative return of 214.71%, greatly outperforming TSMC and the S&P 500.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

Overall, the fundamentals of the company are outstanding, with the company having a very high 13.46% average revenue growth for the trailing five-years. TSMC has not seen anything less than double-digit growth in any of the last five years except for 2017, where it saw modest growth of 3.11%. For 2018, analysts expect TSMC to increase its revenue by 10.99% to $36.65 billion and up 8.54% to $39.78 billion in 2019.

From an earnings-per-share (EPS) perspective, Taiwan Semiconductor has performed even better, with an average EPS growth of 19.8% for the trailing five-years. However, 2017 also saw a modest uptick in EPS growth of 3.19%. Analysts are fairly confident with the company’s ability in its long-term growth, with an EPS estimate of $2.41 per share, equal to an 8.07% gain for 2018. Same goes for 2019, where analysts estimate an EPS of $2.62 per share, which would equate to an 8.71% gain.

On a price-over-earnings viewpoint, TSMC is currently reporting a measure of 19.3 and a five-year average of 15.6. This is considerably lower than the S&P 500’s P/E of 25.63 and also lower than Texas Instrument’s P/E of 20.0.

Strengths

Taiwan Semiconductor has always insisted on building a strong, in-house research and development capability that helps to provide the most advanced and comprehensive portfolio of dedicated foundry process technologies. With these superior processes and capabilities, TSMC has become the leader in this industry and maintains dominance by serving major successful customers like Apple, Inc. (AAPL ), Qualcomm (QCOM ), Nvidia (NVDA ) and Advanced Micro Devices. TSMC has seen great success with its Open Innovation Platform®, which brings together the thinking of its customers and partners under the common goal of reducing design time while also making each application purely customized for its end function.

One of TSMC’s largest clients has been Apple, as it has been providing the company with the A9 chips that are used in the iPhone 6s, iPhone 6s Plus and iPhone SE. TSMC also become the sole manufacturer of A10 chips used in both the iPhone 7 and 7 Plus models. As of 2017, TSMC has seen even more success thanks to the release of the iPhone 8, iPhone 8 Plus and the iPhone X, all of which use the A11 bionic chip. Thanks to the exclusivity that TSMC has with Apple now, Apple accounts for about one-fifth of TSMC’s overall sales and will most likely grow in 2018.

Growth Catalyst

TSMC’s dominance and continued growth come from the company being the exclusive supplier of the A12 processor that are used in the new Apple iPhones for 2018. These new A12 processors will be using TSMC-improved 7nm process, which will vastly improve the operating speeds of the new models. However, it must be noted that the company expects to see lower revenues from high-end smartphones.

The lower-than-expected growth from high-end smartphones from Apple is likely to be compensated by the rising demand from the cryptocurrency industry wherein the currency miners are looking for high-end semiconductor products that can assist them in their daily operations. In the third quarter alone, TSMC saw $350 to $400 million of revenue from crypto-miners, which was equal to around 4 to 5% of total revenues. If the demand for cryptocurrency like Bitcoin continues, expect the demand for TSMC’s chips to continue to flourish.

Dividend Analysis

Taiwan Semiconductors has a very high dividend growth rate of 15%, however it was reset in 2014 when growth stalled. Therefore, the company has only three consecutive years of growing its dividend, which is currently paying $0.92 per share. The dividend is currently equal to a 2.12% yield, which is well above the Semiconductor – Integrated Circuits average yield of 0.56% The company’s stock is also comparable to the 2.33% yield that Texas Instruments is currently paying as well.

Potential Risks

The semiconductor industry is highly cyclical, with consumer products acting very volatile throughout the course of the year. TSMC is heavily tied to the smartphone market, so if companies like Apple see a decline in sales, so will TSMC. If Apple also decides to outsource its semiconductors to another company or even to create its own semiconductors “in-house”, this would be a devastating blow to TSMC’s future revenue.

The Bottom Line

TSMC has a lot of continued potential thanks to its exclusivity with Apple along with its potential to ride along the cryptocurrency craze. The company has mastered working with its customers to find a product that can both increase design speed and lower overall costs. If Apple continues to see success with its iPhones in the years to come, expect TSMC to directly benefit.

Check out our Best Dividend Stocks page by going Premium for free.