PepsiCo (PEP ) is most notably famous for its Pepsi-Cola soft drink. The company has now ventured into food, snacks and other non-carbonated drinks, comprising 22 brands. It is a major Fortune 500 company that generates over $63 billion in annual sales and has a market capitalization of nearly $155 billion.

The company has broken down its 22 brands into three distinct segments. Its “Good For You” segment consists of nutritious products that include fruits, vegetables, whole grains, low-fat dairy, nuts, seeds and key nutrients, with limits on sodium, sugar and saturated fat that meet global dietary requirements. These brands include Aquafina, Tropicana, Naked, Quaker, Gatorade and Sabra. Its “Better For You” segment offers snacks baked with lower fat content, snacks with whole grains, and beverages with fewer or zero calories and less added sugar. This segment has major brands like Baked Lay’s, SoBe Lifewater, Stacy’s, H2OH!, Pepsi Next and Propel. Finally, the “Fun For You” segment consists of the more tasty portion of PepsiCo’s business and has brands like Fritos, Pepsi, Mountain Dew, Cheetos, Doritos and Tostitos.

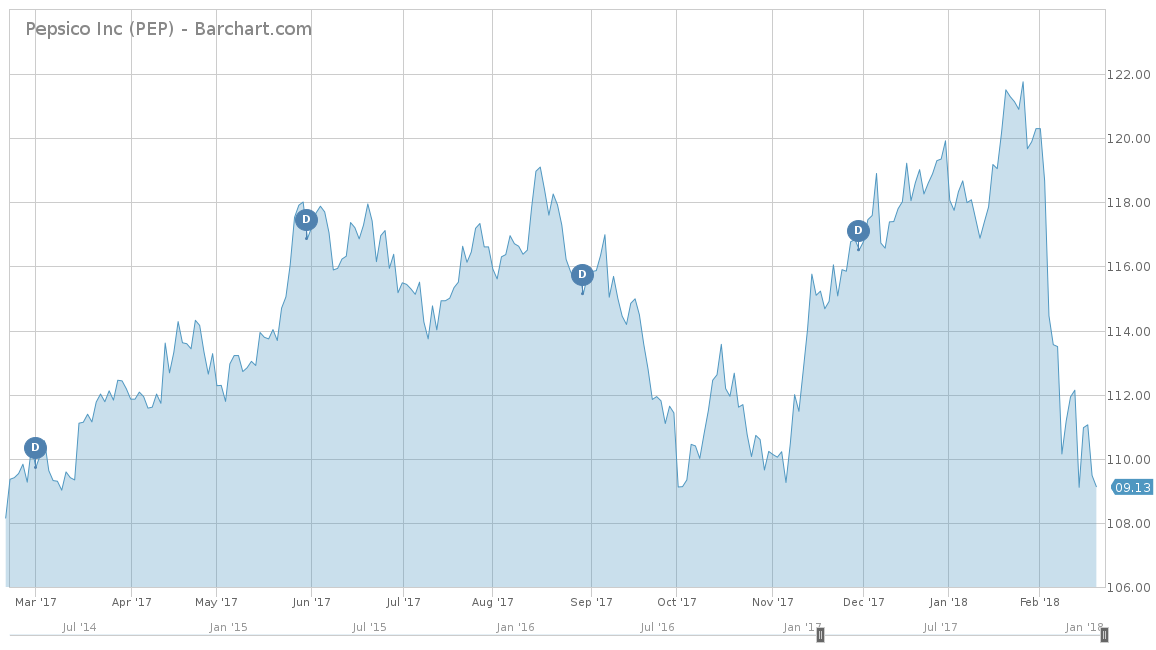

To start off 2018, PepsiCo has gotten off to a bad start and is down nearly 9% on a year-to-date basis. This was after a relatively good 2017 in which the stock was up 17.64%. Over the longer term, PepsiCo has shown a moderate return of 45% over the trailing five-years. Compared to the S&P 500, PepsiCo is underperforming since the index is up 1.80% on a year-to-date basis and is up over 79.6% for the trailing five-years. PepsiCo’s largest rival, Coca-Cola Co. (KO), is also down 4.69% on a year-to-date basis, but it underperformed PepsiCo with a 2017 return of 14.23%. Over the trailing five-years, Coca-Cola is also up only 13.55%, greatly underperforming both PepsiCo and the S&P 500.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

Pepsi Company has been struggling as of late with revenue growths, as evidenced by its negative 0.6% average revenue growth over the last five years. Most of this stemmed from the 5.4% decline in 2015 and the 0.4% decline in 2016. However, it looks like, as of 2017, Pepsi’s revenues are on the rebound. The company saw positive revenue growth of 1.2% to $63.53 billion for last year. Analysts predict a very positive 2018 and 2019 for PepsiCo, with revenue estimates coming in at $65.36 billion and $67.47 billion, respectively. These estimates represent a 2.88% gain in 2018 and a 3.23% gain in 2019.

From an earnings-per-share perspective, PepsiCo has performed even worse with a negative 2.9% average over the last five years. Its biggest hit resulted in the fourth-quarter EPS of negative $0.50 per share, versus the expected $1.30 per share. This hit in EPS was a result of the major tax bill that was passed. Although it has lowered the overall tax rate for the company going forward, it imposed a one-time mandatory tax on the company’s internationally accumulated earnings equal to $2.5 billion. This negative EPS in the fourth quarter saw the company’s 2017 total EPS drop off by 22% from the year prior. Going forward, analysts feel that Pepsi is back on track for earnings growth and expect an estimated EPS in 2018 of $5.71 per share and 2019 at $6.15 per share. These estimates would represent increases of 68.93% and 7.71%, respectively.

On a price-over-earnings viewpoint, PepsiCo is currently reporting a fairly high measure of 31.95 and a five-year average of 23.2. This is considerably higher than the S&P 500’s P/E of 25.23 but lower than Coca-Cola’s P/E of 41.67. However, with its recent earnings drop in 2017, expect its P/E multiple to return back to the 20 range in the near future.

Strengths

PepsiCo’s strength has been its recent ability to consolidate its various brands into a more focused, margin-increasing synergistic strategy. In 2010, PepsiCo consolidated about 80% of its North American beverage system, which allowed the company increased control over packaging and deeper integration between its snack and beverage product lines. This efficiency provides almost $1 billion in cost savings to PepsiCo’s bottom line and management has agreed to continue this project on an annual basis.

Although the soft drink business has also been on the decline, PepsiCo has managed to drive sales by matching consumer trends and needs. This is evidenced by the company’s focus on its “guilt-free” brands, which now account for 45% of total sales.

Growth Catalyst

According to the company’s fourth-quarter 2017 earnings call, the recent tax bill will be the largest growth catalyst to PepsiCo. The first is that its overall corporate tax rate decreased from 35% to 21%, which will show immediate savings to the bottom line. The second is the ability to repatriate its offshore earnings back into the United States. The third benefit is that the bill decreases its net deferred tax liabilities, meaning that the company’s tax-deferred items will now be taxed lower than initially expected. The fourth benefit is that it provides greater mobility with its international cash going forward. Finally, the tax bill will drive higher cash-on-cash returns on U.S. capital projects, as capital spending is immediately deductible for the next five years.

Dividend Analysis

PepsiCo has shown a great continued tradition of raising its dividend, having nearly 45 years of consecutive dividend hikes. In its most recent earnings call, the company hiked its dividend by another 15%, which will be paid in June 2018. Currently, the stock is yielding 2.94% and is paid quarterly. Although lower than Coca-Cola’s yield of 3.57%, PepsiCo’s dividend is considerably higher than the average best beverages-soft drinks dividend stocks yield of 1.50%.

To see why PepsiCo is a Core Dividend stock, click here.

Potential Risks

The largest risk to PepsiCo is that soda and other carbonated beverage sales are continually dropping. In 2016, soda consumption sunk to its lowest level in 30 years, with water as the most popular beverage in the United States. However, Pepsi has begun to neutralize this threat as evidenced by owning Aquafina, a major bottled water brand and other non-carbonated beverages like Gatorade, SoBe Lifewater and Propel.

The Bottom Line

Overall, with the new tax bill reform in place, PepsiCo looks to show immediate growth opportunity for 2018 and 2019. However, over the long run, PepsiCo needs to face the facts that soda and other carbonated beverages are falling out of favor with consumers. If PepsiCo does not continue to make changes to satisfy consumer demand, it will struggle going forward.

Check out our Best Dividend Stocks page by going Premium for free.