Realty Income Corporation (O ) is classified as a real estate investment trust (REIT) that owns, manages and leases a diversified portfolio of over 5,000 commercial, manufacturing and distribution properties around the country.

Shareholders of the company have enjoyed monthly dividends for 48 years, which have steadily increased over time. This consistency has Wall Street calling Realty Income Corp. the “Monthly Dividend Company.” Realty’s largest tenants are well-known companies like Walgreens Boots Alliance Inc. (WBA ), FedEx Corp. (FDX) and Dollar General Corp. (DG ).

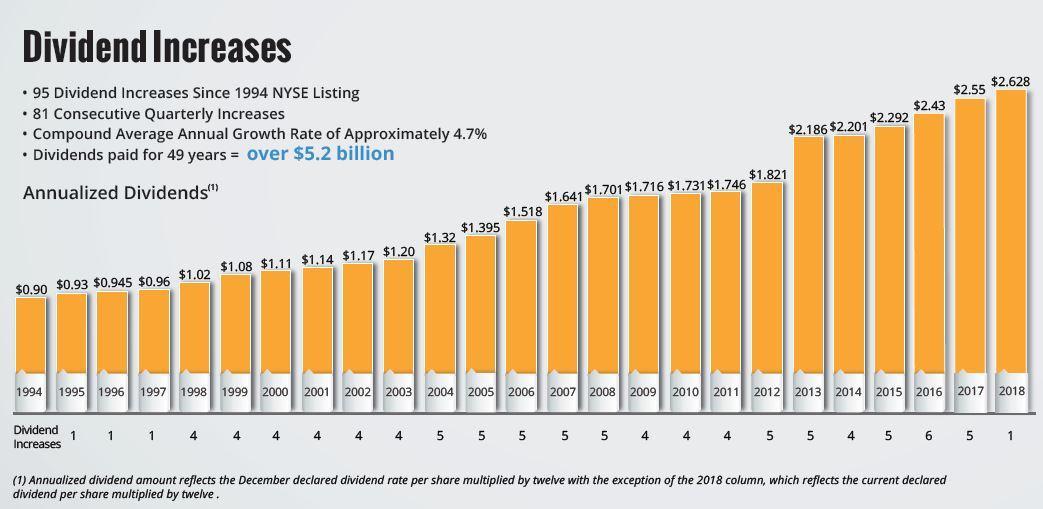

The stock has also performed very well over the long-term horizon, with a 16.3% compound average annual total return since the company’s NYSE listing in 1994. The stock has also delivered 570 consecutive monthly dividends, with a 4.7% compound average annual dividend growth since 1994. To be this consistent in its dividends, the company has maintained a strong portfolio of tenants. Currently, Realty Income boasts a healthy 98.3% occupancy rate over a diversified portfolio of 47 different industries.

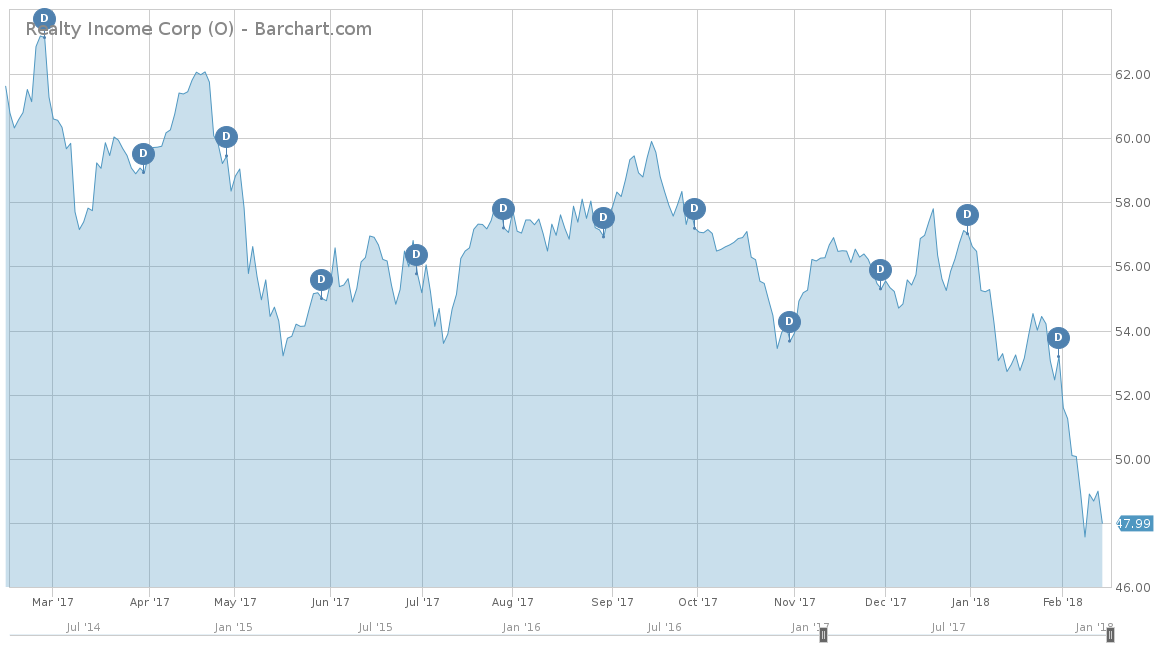

So far, for 2018, like the rest of the stock market, Realty Income has gotten off to a rocky start and is down 14.99%. The stock also lagged in 2017, with a return of 3.61%, considerably lower than the S&P 500’s total return of 21.83%. The stock has also underperformed over the last five years, with an average annualized return of 6.35% versus the S&P 500’s annualized 11.86%. When compared to one of Realty Income’s industry peers, Federal Realty Investment Trust (FRT ), Realty Income’s returns don’t look that bad. FRT is down 16.98% on a year-to-date basis and was down 3.76% in 2017. Federal Realty has also underperformed over the longer term, with a 3.36% annualized average rate of return over the last five years.

For investment concepts, visit our Dividend Investing Ideas Center.

Fundamentals

Even though the stock price has been relatively stagnant, the company’s revenues have been anything but. Over the last five years, Realty has had a very high average annual revenue increase of 21.8%. This seems to be a trend going forward as well, as analysts expect the company to close out its 2017 with a revenue of $1.21 billion, making it an increase of nearly 10% over the previous year. Analysts expect a 6% increase in 2018 as well, with revenues increasing to an estimated $1.29 billion.

From an earnings-per-share perspective, Realty Income has performed in a more stable manner with a 4.4% average growth per share over the last five years. Analysts expect the company to announce on February 21, 2018 that Realty Income will have a 2017 year-end EPS of $1.20 per share. This would equal a 6.19% increase from 2016. In 2018, the average estimates are at $1.28 per share, resulting in a 7.50% increase.

Strengths

The greatest success behind the company’s stable history is due to its ability to generate lease revenue that will support the payment of its monthly growing dividends. It uses five investment disciplines to achieve this goal.

The first is that the company targets well-located, freestanding single-tenant commercial properties. It remains disciplined in its acquisition underwriting process and executes long-term net lease agreements. Realty Income also maintains a conservative balance sheet, which helps it get through any economic cycle. Finally, the company actively manages its portfolio to maintain high occupancy. In fact, the company has never had lower than a 96% occupancy level since 1996. As of the third quarter of 2017, Realty is near its all-time high of occupancy levels at 98.3%.

To view other retail REITs that pay a dividend, click here.

Growth Catalyst

With a company as consistent as Realty Income, quick growth is not an easy task.

However, with the stock being down nearly 15% on a year-to-date basis, income investors may find that this is an excellent buying opportunity. Even though the company barely missed its Q3 2017 earnings, analysts expect it to hit the mark in February when it announces its Q4 2017 earnings. If the earnings beat expectations, the stock price should see some quick gains with income investors again in favor of the “Monthly Dividend Company.”

Dividend Analysis

With a REIT structure, the company is designed to pay the majority of its cash flows in the form of dividends to its shareholders, hence, the higher payout ratio of 88.2%. Realty currently pays an annual payout of $2.63 per share, which is equal to a yield of 5.28%. Although this yield is lower than some of the other REITs out there, Realty Income’s dividend is by far the most consistent. The company has raised its dividend for 22 years, with its most recent hike coming last month for a 3% increase. This would be the company’s 95th dividend increase since 1994.

To find more high-quality dividend stocks, check out our Dividend Screener. You can even screen stocks with DARS ratings above a certain threshold.

Potential Risks

With bond yields seeing big gains, a large risk to Realty Income is a rising interest rate market. The 30-Year Treasury is now yielding well above the 3% mark, so investment-grade corporate bonds are yielding considerably higher. In a rising interest rate market, investors usually begin selling off their dividend stocks in exchange for interest-paying bonds. This “flight to quality” is very common in REITs and utility companies, which have seen a lot of price appreciation over the last several years. If bond yields continue to rise while offering less volatility of a stock like Realty Income, expect the stock to suffer.

The Bottom Line

Realty Income has shown a history of consistency with very strong revenue growth, thanks to its excellent portfolio management of its diversified tenant portfolio. A potential growth catalyst could be in the form of bringing in more non-retail tenants. Nevertheless, its management’s primary focus on slow-and-steady growth has enabled the company to pay dividend more than 570 times in a row.

Check out our Best Dividend Stocks page by going Premium for free.