Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week’s trending stocks center on both the Bank of Nova Scotia and the Royal Bank of Canada, which analysts upgraded this week, causing both stocks to rise. After releasing a major production big budget movie, Netflix’s stock continues to hit new all-time highs. Finally, the Powershares QQQ saw the week’s biggest ETF inflows.

You can view our previous Trends article here, which revolved around CVS’s plan to buy Aetna, along with other merger news and a major share buyback program.

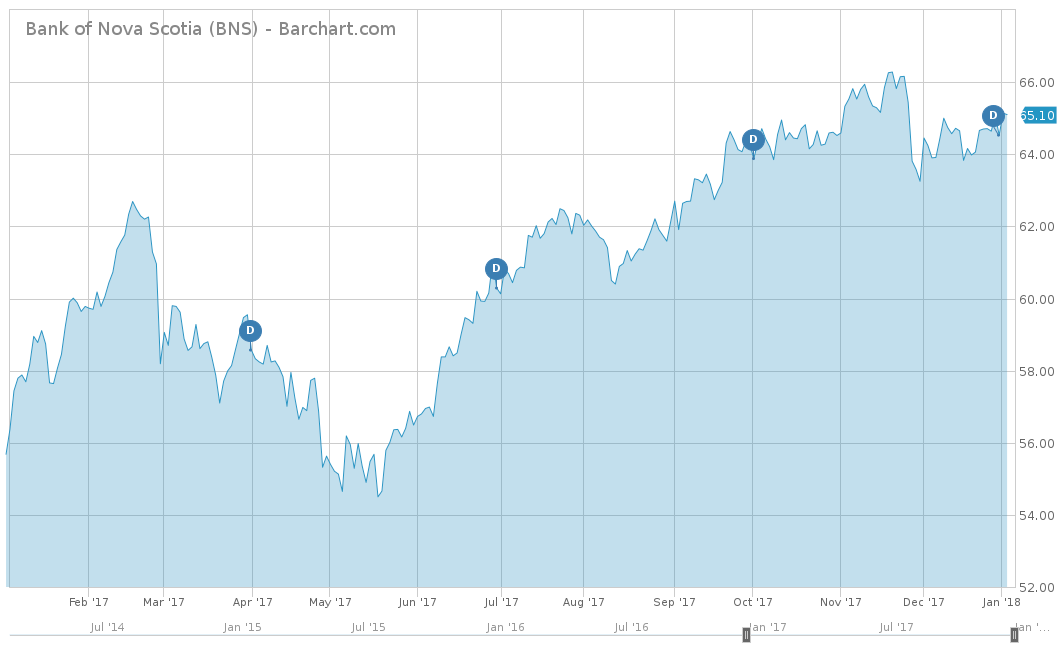

Bank of Nova Scotia Set to Outperform in 2018

Bank of Nova Scotia (BNS ) was this week’s top-trending topic with an increase in viewership of 68%. The stock went into ex-dividend on December 29. Analysts from National Bank Financial issued the company’s projected earnings at $7.43 per share for 2018. Upon this news, National Bank Financial issued an outperform rating with a target price of $88.00. Along with National Bank Financial, several other analysts upgraded their price targets for BNS. CIBC and Canaccord Genuity both lifted their price targets to $92.00, while Royal Bank of Canada raised its target to $91.00. In total, eight analysts now have an outperform rating on BNS.

Over the last five days, the price of BNS has gone up 0.71%. For the trailing one-year, the company has increased 15.47% but only 12.14% for the trailing five-years. The company currently pays $2.50 per share on an annual basis, which is equal to a 3.84% yield. The bank has a strong earnings growth record, which has led to dividend increases in 43 of the last 45 years, making Bank of Nova Scotia one of the most consistent records for dividend growth among major Canadian corporations.

To view other dividend-paying foreign money center stocks, click here.

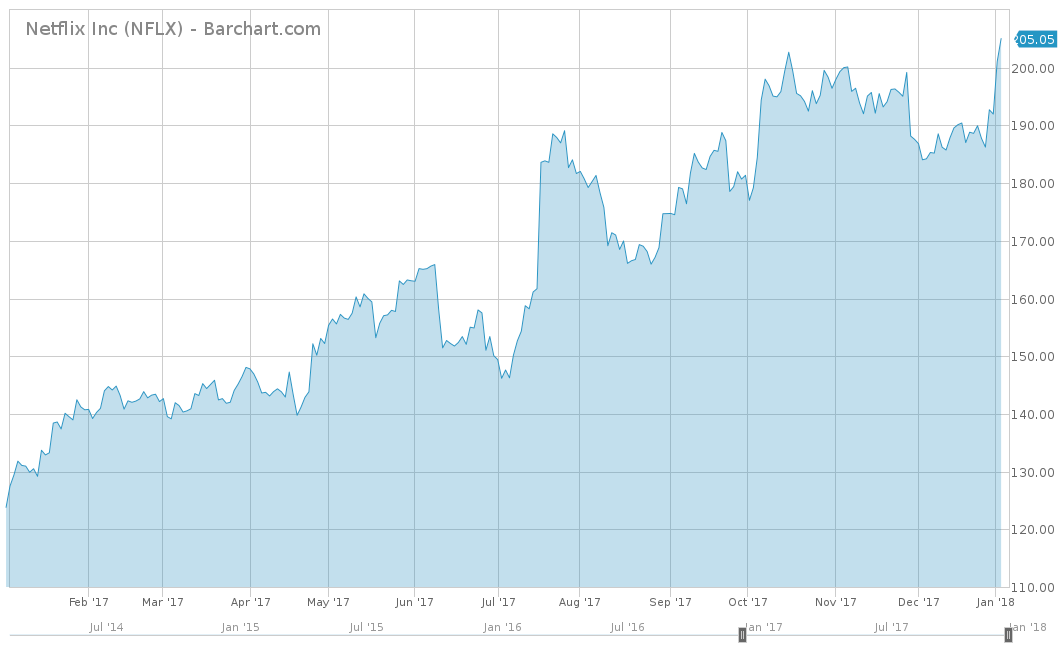

Netflix Continues to Hit All-Time Highs

Netflix Inc. (NFLX) was the second-most trending topic this week, up 56%, after the stock continued its 2017 rally into 2018. The stock is now trading at new all-time highs near the $206 per share amount. Both Macquarie Research and Loop Capital Markets analysts have recently announced a price target increase to $220 and $241, respectively. The recent rally also was in part due to the announcement of a sequel to the Will Smith featured movie Bright, which had a $90 million production budget. Since its Dec. 22 premiere, Bright has been the number one movie on Netflix in over 190 countries, according to the company.

Over the last five days, the stock has rallied and is up 10.10%. Netflix has also been one of the best performers of 2017, with the company’s stock price up over 60% for the trailing one-year. Netflix has also been one of best-performing stocks over the trailing five-years, up over 1,386%. Netflix does not currently pay a dividend.

For the top 11 Internet software stocks that do pay a dividend, click here.

QQQ Sees Big Inflows

PowerShares (QQQ) was the third-most trending stock this week, up 49% after it added over 11.2 million shares last week. This was an increase of 3.1% and now the ETF has almost $58 billion in assets under management. The fund has over 61% of its holdings in information technology, which was the best performing sector in 2017. Its top holdings are Apple Inc. (AAPL ), Microsoft Corp. (MSFT ) and Amazon Inc. (AMZN).

Over the last week, the fund is up 2.23% and up 33.87% for the trailing one-year. Over the trailing five-years, the fund has performed very well and is up over 140%. The fund, which is mostly made up of technology companies, pays a nominal dividend of $1.32 per share, which is equal to a yield of 0.82%.

For the other Large Cap Growth ETFs, click here.

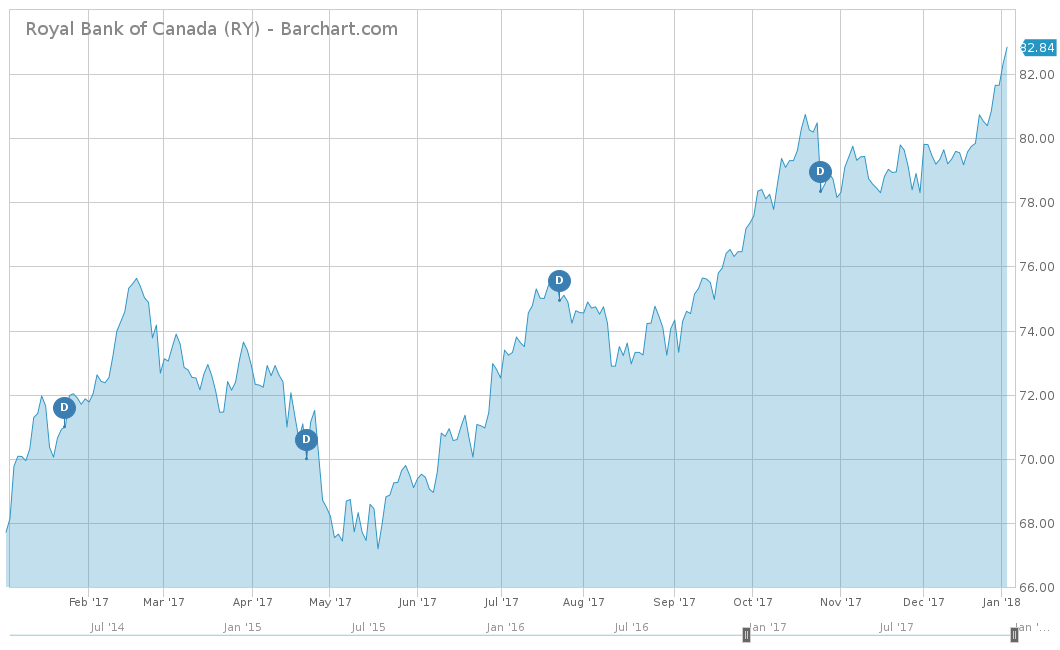

Royal Bank of Canada Stock Upgraded

The fourth-most trending topic this week revolves around the Royal Bank of Canada (RY ), which is up 38% in viewership. Several analysts upgraded the Canadian bank, giving the stock a boost in the early trading days of 2018. For instance, Scotiabank upgraded the stock to $111.00 while National Bank Financial upgraded it to $105.00.

Royal Bank of Canada is up 2.47% for the last five days and is up 1.46% for 2018 so far. The stock has also performed fairly well in the last year, up 21.57%. However, it is up only marginally for the last five years, up only 34.81% for the entire time period. The stock has a fairly high dividend that is currently yielding 4.39% for an annual payout of $3.64 per share. The company has also shown a history of raising its dividend, as evidenced from the increases witnessed during each of the last three quarters.

Check out our Dividend University section to learn more about dividend investing.

The Bottom Line

Most of this week’s trends centered around Canadian banks that were upgraded by analysts. Bank of Nova Scotia has eight analysts announcing a ‘Buy’ rating while the Royal Bank of Canada had three analysts saying the same. Netflix continues to see new highs in its stock price as the company sees viewership success in its own big budget production movies. Finally, the Powershares QQQ ETF had a large increase in assets during this week.

For more Dividend.com news and analysis, subscribe to our free newsletter.