Sherwin-Williams (SHW ) recently celebrated its 150th anniversary in 2016. Founded in 1866 by Henry Sherwin and Edward Williams, the company has grown to more than 40,000 people and produced sterling returns over the last few years.

The Paint Job

Sherwin-Williams makes and distributes paints, stains, supplies and equipment for the construction, industrial, marine and automotive markets, and also operates a line of retail stores. It organizes itself into four segments:

- Paint Stores Group (66% of sales): operates 4,180 exclusive stores for its branded products in the U.S., Canada and the Caribbean. This group saw an increase of 8.1% in net sales and 13% of profits in 2016.

- Latin America Coatings Group (5% of sales): manufactures and sells related products via 339 company-operated stores in Latin America. This group saw a 7% decline in sales in 2016.

- Consumer Group (13% of sales): sells branded and private-label products through retailers in North America, Europe and Latin America. This group saw a mild increase of 0.4% in net sales and 3.4% increase in profits for 2016.

- Global Finishes Group (16% of sales): manufactures and sells a portfolio of Original Equipment Manufacturers (OEM) products from 288 company-operated branches in more than 100 countries. This group saw a decline in the sales of 1.4%, but managed to increase profit by 18.4% due to better cost control and lower raw-material costs in 2016.

The Near-Term Outlook

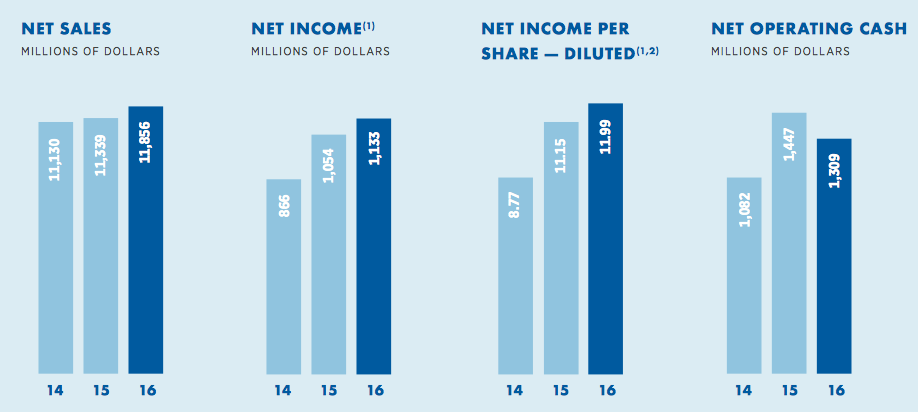

The last few years have been sound for Sherwin-Williams regarding financial results. Their EBITDA crossed $2 billion, in 2016, for the first time in the company’s history. They have now posted record sales and earnings for five straight years in a row.

In March 2016, the company announced its biggest acquisition to date when it decided to strike out Valspar (VAL) from its list of competitors. More than a year later, the acquisition process is still not complete due to regulatory reasons. It is now expected to be completed this month. The 2016 cash balance of nearly $900 million couldn’t have come at a better time as it can be used to pay off the debt for the Valspar deal. Both companies have highly complementary offerings that strengthen Sherwin-Williams’ position as a premier global paints and coatings provider, especially in the Asia-Pacific and EMEA region.

The company has a long track record of integrating acquisitions into their business. It acquired the famous Dutch Boy line of paints and Dupli-Color Products Company in the 80s, architectural coating line from of DeSoto Inc in the 90s (a move that eventually made Sherwin-Williams the world’s largest supplier of custom paints for the private-label market) and Duron Inc. more recently in 2004 (third-largest paint retailer at the time): These are some examples from the history books. The company expects annual synergistic efficiencies from the Valspar deal to add up to $280 million within two years of completing the transaction and $320 million annually on a long-term basis. The Sherwin-Williams Company expects 2017 to be a resolute year for paints and coatings owing to projected growth in domestic demand. The recent increase in oil prices, however, is likely to put pressure on the prices of raw materials. Investors should note that raw material constitutes 85% of the cost of goods sold for most paint products.

As an Investment

Sherwin-Williams has been growing dividends for 38 years. Even though the yield is a modest 1% (due to high stock price), the company has recorded a growth of 18% in the last five years. Even though, overall, its Free Cash Flow (FCF) has increased by 46% from $730 million in 2012 to $1.07 billion in 2016, the company has seen only two down years in 2014 and 2016, wherein there was a drop of around 4% and 12%, respectively. It would be prudent to keep a tab on it in the upcoming years. Given that the payout ratio is still a manageable 24%, investors can feel reasonably confident about receiving dividends in the near future.

Find more data about the stock price movement and dividend payout history of Sherwin-Williams by clicking here.

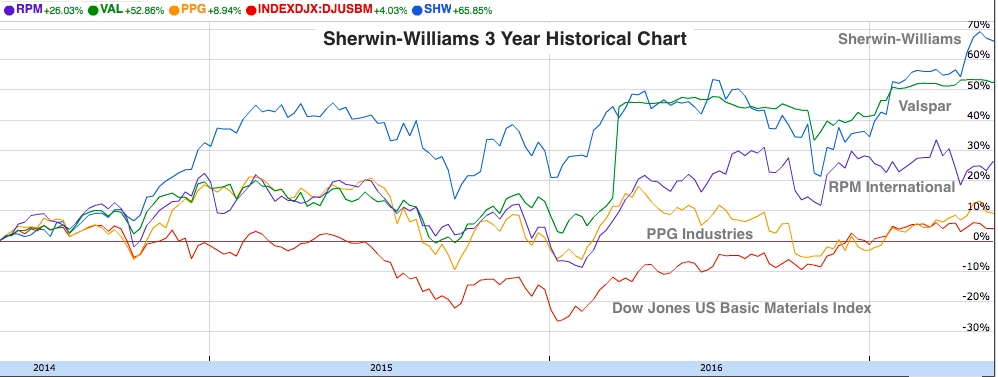

The Sherwin-Williams stock is currently at an all-time high. It returned 23% in the last six months and 35% since the U.S. elections in November (after losing value in October due to a weak earnings report). The numbers appear stark when compared to the Dow Jones U.S. Basic Materials Index in the last five years (185% vs. 44%). Peers like Axalta Coating, PPG Industries (PPG ) and RPM International (RPM ) have not been matching up to Sherwin in the recent years except for Valspar Corp. No wonder Sherwin Williams decided to acquire Valspar, as stated earlier in the article. Valspar has excellent stand-alone credentials for investors. It has been growing dividends for 35 years, has a low payout ratio and strong dividend growth in recent years.

Dow Chemicals (DOW ) and DuPont (DD ) are also competitors of Sherwin Williams. Check out the implications of the merger deal between these two giants here.

With the stock at an all-time high, one could expect the P/E ratio to be high as well, but that would be incorrect in this case. The Cleveland-based company has a P/E ratio that is better than some of its peers (i.e. PPG Industries, Axalta Coating, RPM International) and comparable to someone like Valspar. So, despite the stock being at an all-time high, it is not unreasonably priced.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters.

The Bottom Line

Sherwin-Williams has 150 years of history in sustained performance. The paint company has weathered recessions, world wars and still managed to remain bright and shiny. That is the biggest differentiating factor for investors looking to add the company to their long-term portfolio. Raw material costs are likely to have the near-term impact on profitability, but the company is expected to leverage its newly acquired market share to find cost-saving opportunities. The company would be expected to grow its dividend as the current yield comes out as small only because the stock price has risen at a rapid pace in the recent past.

Stay up to date with next week’s major corporate changes regarding dividends in our News section on Dividend.com. Start your free trial to Dividend.com Premium account here.