Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

It’s often said that political instability is the bane of the financial markets. That was certainly the case earlier this week after a failed repeal of Obamacare in the U.S. House of Representatives triggered the biggest loss of the year on Wall Street. However, markets have rebounded amicably, as investors hold onto hope that the Trump administration will still be able to push through economic reforms.

This week’s Trends report keeps a pulse on the latest political developments and draws attention to more active investment strategies. With the first quarter officially behind us, yield-seeking investors are eyeing new possibilities as the Trump rally slowly loses its zeal.

Compare this week’s Trends report with our March 17 edition, which looked at the impact of the Federal Reserve’s decision to raise U.S. interest rates.

Premium members can learn more about the “Trump Slump” by reading Dividend.com’s latest Market Wrap article.

Dividend Appreciation Index Tops Weekly List

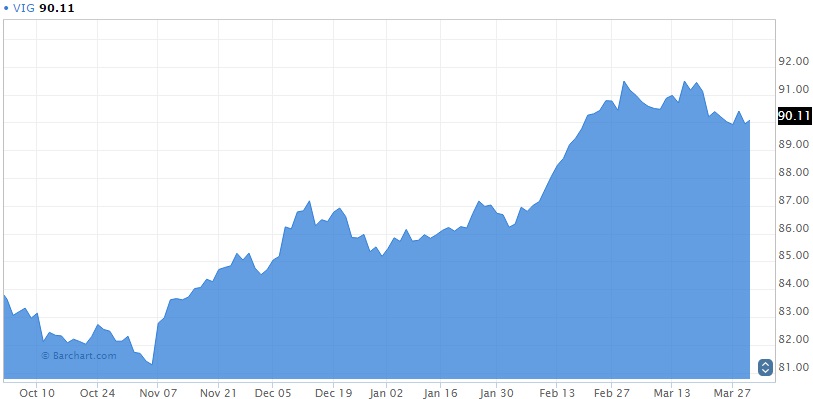

Inflows into U.S.-listed exchange-traded funds (ETFs) soared in the first quarter, with dividend-focused securities seeing a growing share of the action. The Vanguard Dividend Appreciation Index Fund (VIG ) takes the top spot on our weekly list with a 48% rise in traffic.

Earlier this month, VIG also made another prestigious list, ranking second in total weekly inflows, according to weekly FactSet data.

VIG is a high-risk, high-reward play that provides direct exposure to the Nasdaq U.S. Dividend Achievers Select Index. The ETF offers a convenient way to track the performance of U.S. companies with a solid record of growing their dividend year after year.

Dividend-focused ETFs have benefited from the large upswing in equities that began with the November 8, 2016 presidential election. Like the broader equities market, gains in the VIG have slowed in recent weeks amid political wrangling in Washington.

Compare VIG’s holdings with the following 25-Year Dividend-Increasing Stocks. Like the name implies, this list features companies that have successfully increased their annual dividend payouts every year for the last 25 years.

Bargain Hunters Seek Out Dividend Discounts

Dividend-based stock valuation was also on the market’s radar this week, with a 2015 article on the Dividend Discount Model seeing a 44% rise in traffic.

The Dividend Discount Model allows investors to estimate the present value of a stock based on important assumptions about its future dividend performance. This simple yet effective formula provides a quick assessment of whether a particular dividend stock is undervalued or overvalued.

The concept of valuation is critical for investors trying to navigate the current market environment. The S&P 500 has returned more than 17% year-over-year, including double-digit percentage gains since the election. Many analysts are warning of a broad correction, while others are calling for steady growth under the new administration in Washington. The Dividend Discount Model offers an effective way to cut through the noise in a market facing considerable uncertainty.

For more investment concepts, visit our Dividend Investing Ideas Center.

Trump Applauds Ford Motor Company in Executive Tweet

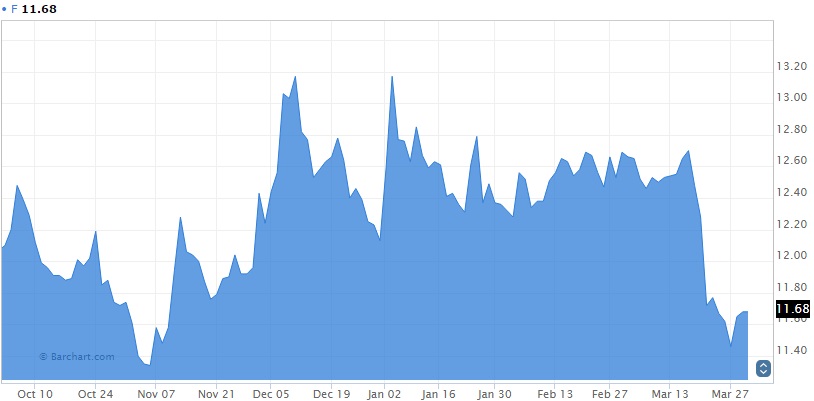

A tweet from the U.S. president put Ford Motor Company (F ) on the map this week. The Detroit-based auto giant takes the No. 3 spot on our weekly list with a 40% rise in viewership. Ford’s decision to invest $1.2 billion in three Michigan facilities resonated with the Commander-in-Chief, who tweeted all about it on March 28. “Major investment to be made in three Michigan plants,” Trump wrote in an official presidential tweet on Tuesday. “Car companies coming back to U.S. JOBS! JOBS! JOBS!” The tweet has since been liked more than 100,000 times and shared over 23,000 times.

Ford is a member of the consumer goods sector, which has an average dividend yield of 1.83%. Compare all the top dividend plays in the sector by clicking here.

You can also keep track of Ford Motor Company’s next ex-dividend date by using our free Ex-Dividend Date Search function.

Verizon Communications Enters TV Streaming Business

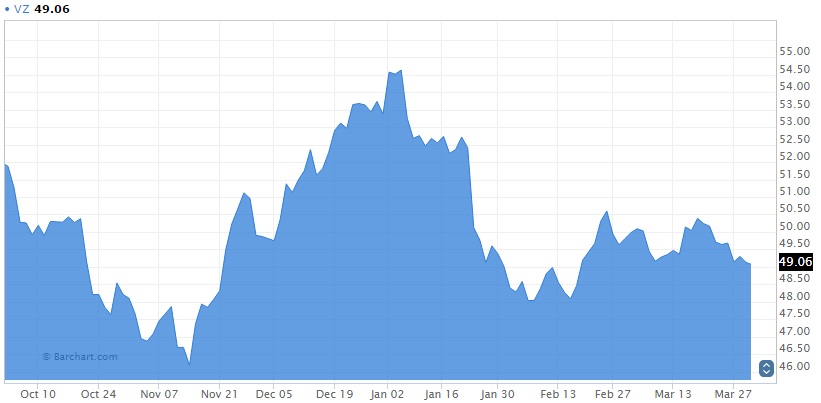

Interest in Verizon Communications Inc. (VZ ) shot up 39% this week after various news outlets reported that the telecom blue-chip was breaking into online TV streaming.

Verizon has been acquiring streaming rights from television owners in preparation for a nationwide launch of online television, according to Bloomberg. While still subject to speculation, VZ is expected to launch the new service in the summer. It will compete against other newcomers to the industry, such as Hulu and YouTube, which are launching similar offerings this year.

TV networks are under growing pressure to provide smaller, more affordable cable packages to a market that is streaming more online content than ever before. In addition to video streaming services like Netflix (NFLX), millions of Americans now subscribe to new television packages streamed over the internet.

Verizon is a member of the Dow Jones Industrial Average. Click here for a complete list of the Dow 30 dividend stocks.

The Bottom Line

The second quarter could test the market’s resolve as investors begin to question the prevailing assumptions of the post-election rally. With earnings season just around the corner, dividend investors will likely be on the hunt for new dividend plays to safeguard against an increasingly uncertain outlook.

For the latest dividend news and analysis, subscribe to our free newsletter.