When it comes to particular segments of the market, bigger isn’t always better. That’s certainly the case with financial stocks. While deregulation in the 1990s made a case for getting bigger, the current environment has put some big pressures on the larger financial stocks. Case in point: mega-insurer MetLife (MET ).

The last few years at MetLife haven’t run too smoothly. The combination of lower interest rates and being branded as a “too big to fail” institution have caused shares to flounder since the end of the Great Recession. Earnings have been less than ideal, and MET has reported some bigger-than-expected losses in recent quarters.

But things are happening at MetLife. A transition is underway that should yield some very positive results for investors. Even better is that the firm’s cash flows – and dividends – have stayed ever-present throughout the recent struggles.

For investors, MetLife could represent one of the best and underappreciated financial stocks out there.

Dueling Problems for MET

Insurance companies are supposed to viewed as the rocks of the financial sector. But lately, some of the larger firms haven’t been that solid. MET fits into this category, as does rival AIG (AIG ). And their tales are very similar.

For MetLife, the problems come down to size. As one of the largest life insurers on the planet, MET has grown into a powerhouse of a firm. As a result, the firm has plowed plenty of its assets and profits from its float into a variety of side businesses. Before the recession, these businesses provided plenty of boost to profits. Unfortunately, all good things must come to an end.

For MET, that end was brought by Uncle Sam. Thanks to the Dodd–Frank Wall Street Reform and Consumer Protection Act, MET was branded a "systemically important financial institution,” or SIFI. As the name implies, MetLife is one of the most import financial firms in the U.S., and its failure could bring major catastrophic consequences to the economy. The term “SIFI” basically gave a name to the “too big to fail” banks and other financial firms in the nation.

As a result, MET is subject to increased regulatory scrutiny and higher capital requirements on its balance sheet.

Find out everything about the top 75 property and casualty insurance stocks here.

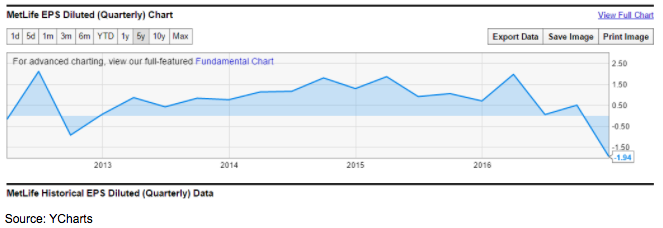

The problem for MetLife is that as an insurance firm, it already needs to have a high percentage of “safe” assets on its balance sheet; the firm was forced to hold even more cash and bonds. With interest rates in the proverbial toilet over the last nine years, MET was earning even less money on its reserves and float. And as you can see by the below chart, MetLife’s total earnings have been all over the place and generally trending downward on lower rates.

Kicking Snoopy to the Curb

With MET’s earnings being flat to lower over time – this quarter saw a loss of $1.94 per share – why would any investor want to own the firm? It comes down to reversing the two major factors hurting its bottom line.

For starters, MET is trying very hard to lose its SIFI label. Taking a page out of fellow SIFI-labeled General Electric’s (GE ) playbook, MetLife has started to shed assets to lose the moniker. In total, MetLife has announced plans to divest businesses that represent upwards of 20% of its operating earnings. Some examples of that include the $300 million sale of its U.S. retail advisor group to MassMutual.

The biggest part of this divestiture/transition plan is MET’s pending spin-off of its life insurance unit as a separate company. Dubbed Brighthouse Financial, the new company would house U.S. life-insurance and annuity assets – about 25% of MetLife’s total asset pie. The spin-off would remove the most volatile piece of the insurer’s earnings and would almost guarantee the removal of its SIFI label.

Moreover, the spin-off is coming at just the right time for MetLife. The Federal Reserve has finally started to meaningfully raise rates. As rates rise, MET will finally be able to make some serious coin from its underlying bond reserves.

Putting it together, MetLife will be able to invest in other items and return more cash to shareholders, while earning more on its core portfolio of bonds.

Find out how you can use options to play dividend stocks here.

MetLife has also decided to drop Snoopy as the face of their company.

Video by The Wall Street Journal

Translating to Bigger Dividends

The real end result of all of this is that MET will be able to continue its pace of growing its dividends even higher.

Like most SIFI stocks, MET was forced to cut its dividend in the wake of the recession. This wasn’t because of problems, but because regulators wanted the higher cash reserves. Since being approved for dividend hikes, MetLife has delivered. Over the past four years, its dividend has seen a growth of 44%, while the firm’s payout ratio remains low at just 31%. Find out the complete dividend history of MetLife here.

With such a low payout ratio, any boosts to its net income via higher rates or the spin-off could translate into bigger dividends for investors down the road. And those dividends and buybacks really could get a shot in the arm as the Brighthouse spin-off pays MET planned special dividends worth $3.3 billion to $3.8 billion. Meanwhile, the loss of its SIFI label would free up plenty of capital that MET could use to boost payouts. MetLife has already said it would use the extra money for rewarding shareholders.

MetLife is classified as a life insurance stock. We have a dedicated page tracking all life insurance dividend yields here.

The Bottom Line

MetLife has suffered right along with the rest of the SIFI-designated firms – with the two biggest hurdles being low-interest rates and the higher reserve ratios. With moves to eliminate those items and the Fed cooperating, MET stock could be an interesting dividend growth story in the years ahead. Even better when you consider its rock-bottom price-to-book and price-to-earnings ratios.

Dividend.com recently launched a new tool called the Most Watched Stocks. It’s a list of all the stocks that are being watched by our premium members currently in their watch list, ranked by the highest number of watchers. Find out if MetLife is on the list here.