Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

The Trump rally extended beyond Wall Street this week to include foreign equity markets, as global investors bought into the promise of faster economic growth under the new GOP administration. The Trump team has promised to deliver a myriad of policy changes designed to boost the economy, including fiscal stimulus, looser regulations and steep tax cuts that could encourage U.S. multinationals to repatriate hundreds of billions of dollars. Trump touched on these points Tuesday evening in his first address to a joint Congress.

At home, the equities boom has also inspired more planning around retirement, with 401(k)s preoccupying investors. In individual stocks, a popular beverage maker continues to make headlines for all the wrong reasons.

Compare this week’s Trends report with our February 24 edition, which tackled consumer and technology stocks.

PepsiCo Slashes Jobs Following Sugar Tax

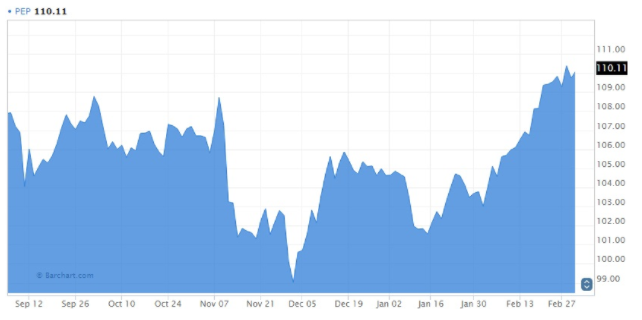

PepsiCo (PEP ) makes our list for the second consecutive week, this time taking the top spot with a 37% rise in viewership. Last week, PEP was in the headlines over a lawsuit that compelled the New York-based beverage maker to change labels on its Naked Juice brand. This time, headlines about job losses at Philadelphia and UK plants piqued investors’ interest.

PEP has already committed to cutting up to 100 jobs in Philadelphia after the city’s new sugar tax weakened demand for soft drinks. The city of Philadelphia has imposed a levy of 1.5% per ounce on sugary drinks to fight rising obesity in the region. The tax came into force January 1.

PEP is also mulling over whether to shut down its Walkers Crisp factory in northern England in an effort to streamline business and boost productivity. PEP executives say the decision has nothing to do with Brexit, although some investors are not convinced. With the United Kingdom set to embark on Article 50, the global financial markets are bracing for a prolonged period of instability as Brussels and Downing Street negotiate a new trade deal. Prime Minister Theresa May is expected to trigger Article 50 – the formal mechanism for exiting the European Union (EU) – by the end of the month. Click here to learn about five U.S. stocks heavily exposed to Brexit.

Despite the negative headlines, PEP shares have held firm this week. The following link provides a complete breakdown of PEP’s dividend history.

PepsiCo operates in the consumer goods sector. For a complete breakdown of dividend stocks by sector, refer to our dedicated page on the subject.

401(k): Retirement Planning Top of Mind for Investors

In the financial markets, investment planning never runs out of style. That’s partly why Michael Flannelly’s 2014 article, A Simple Guide To Understanding 401(k)s, takes the No. 2 spot on our weekly list with a 30% rise in traffic.

Investors making regular contributions to their 401(K)s are keeping close tabs on the latest equities upsurge, now entering its fourth month. Amid the record valuations are growing concerns that the market has entered overbought territory, as eager investors overcompensate on the new administration’s unproven plan to stimulate growth. The Dow Jones Industrial Average spiked above 21,000 this week for the first time ever, while the S&P 500 Index also soared to new highs.

Gains this week were largely driven by financial shares, which have led the Trump rally since the November 8 election. The S&P 500’s financial index has gained more than 40% over the past 12 months.

At this critical stage in the bull market, investors are looking for safe bets to hedge against risk. The article linked above provides important considerations for dividend investors in pursuit of a foolproof retirement plan.

Foreign Dividend Stocks Join in on Wall Street's Rally

The Trump rally has extended far beyond Wall Street. Dividend.com’s Foreign Dividend Stocks take the third and final spot on our weekly list with 22% higher traffic. Click the link above for a complete list of foreign dividend stocks. This dedicated page allows you to navigate company profiles based on dividend yield, annualized payouts and our proprietary DARS rating.

This week, global investors took cues from U.S. President Trump and a parade of Federal Reserve speakers, who indicated that interest rates will rise very soon. Regional Fed Governors William Dudley (New York), John Williams (San Francisco) and Patrick Harker (Philadelphia) all signaled that the central bank has a more compelling case for tightening policy sooner rather than later. Dudley and Harker are also voting members of this year’s Federal Open Market Committee (FOMC), the group responsible for setting U.S. monetary policy. The FOMC will hold its next policy meeting March 14-15. The rate decision will be accompanied by a revised summary of economic projections covering GDP, inflation and the unemployment rate.

European stocks recently traded at their highest level in a year, with gains extending across several individual bourses. In Asia, Japan’s 225-issue Nikkei also climbed to two-month highs.

The Bottom Line

The global financial markets are heading into unchartered waters. As the year progresses, investors will contend with regional politics, uneven economic growth and the potential rise of populist movements vowing to shake up the global political order. This environment could prove volatile for dividend investors in the months ahead.

To keep track of dividend news and analysis from around the world, subscribe to our free newsletter.