When it comes to all-time success stories in the market, one of the biggest has to be Starbucks Corporation (SBUX ). Starting from just one small shop in Seattle, the coffeehouse chain has grown into a global giant with revenues in the billions of dollars. Its brand is now synonymous with coffee and has millions of loyal fans around the world. Both brand devotion and continued higher and higher profits have managed to take shares of Starbucks higher as well.

A Long History of Growth

It turns out that selling addictive stimulants is a great business to be in, just ask Altria’s (MO ) investors. And convincing people to spend $4 or more on a single cup of the stuff is even better. As the largest coffee chain in the world, SBUX has managed to turn coffee into something more than, well, just coffee. And over the years, more and more people have continued to get their morning caffeine fix from the giant.

Moving from a single shop in Seattle’s Pike Place Market, Director of Retail Operations Howard Schultz took the idea and ran with it. Schultz hit a nerve when he decided to model the concept after the coffeehouses of Europe. Consumers loved it and the company was able to expand in a big way.

As of 2015, there are now 12,521 Starbucks stores in operation in just the United States alone. That number balloons to more than 23,000 when adding in the rest of the world. Its massive size and economic moat have continued to drive sales for the firm over its history.

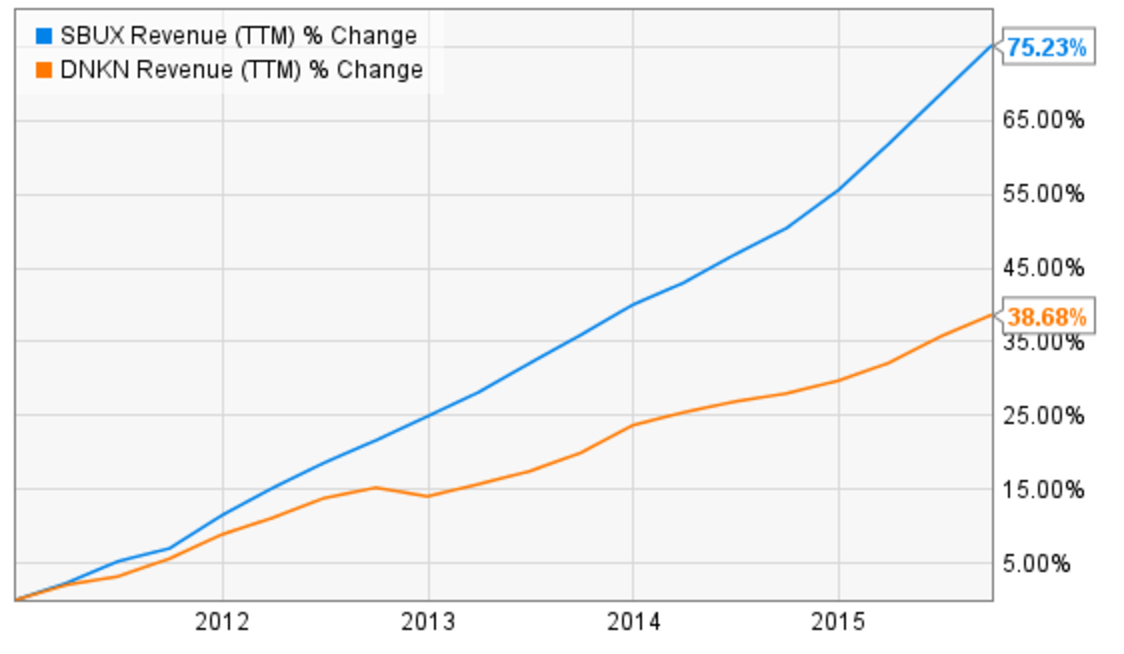

And its major competitors can’t touch its growth profile.

Starbucks has managed to grow its revenue by more than 75% over the last few years. As you can see by the chart below, its chief rival – Dunkin Brands Group Inc (DNKN ) – doesn’t even come close. Those sales for SBUX totaled more than $19 billion in 2015, by the way.

Growth Still Brewing for SBUX

These sorts of revenue and profit gains are very impressive. But what is truly impressive is that Starbucks still has the potential to brew even more growth. That’s because SBUX is embracing technology in a big way.

Through its My Starbucks app and revamped rewards system, SBUX has crafted a so-called ‘digital ecosystem.’ The app and ecosystem allow for the ease in ordering, paying, earning awards and even downloading content via the mobile web. In the end, it keeps more money in house and helps to drive repeat sales over and over again.

Starbucks is part of the specialty eateries industry, which is in the services sector.. You can track the average dividend yield of the industry on its page.

The proof is in the pudding. During the fourth quarter, mobile orders and payments accounted for 20% of all orders during peak times at 600 stores. This last quarter, the number jumped to more than 1,200 stores featuring 20% usage during peak times. In fact, mobile ordering and paying is so successful that it’s caused some congestion at its stores. Too much demand is a great problem to have.

Getting people inside its stores outside of peak times has also become a priority. It’s no secret that Starbucks thrives in the early morning. But increasingly, it’s becoming a mid-day and evening destination. That’s because the chain has launched plenty of food initiatives, specifically for lunchtime. Bonus rewards in its app, as well as sandwiches and snacks, continue to boost traffic during the afternoons. Even better is that margins on food items are higher than they are on some of its beverages. As these plans continue to pay off, SBUX has seen rising profits.

And then there are its international offerings to consider. SBUX is making a bid to be number one in China, and it’s succeeding quite well. Before his retirement, Schultz announced that Starbucks wants to have more than 5,000 stores in China by 2021. It’s about half way there today. And there’s reason to love China. The nation already features the highest number of Starbucks Rewards/App members in Asia Pacific at more than 10 million. And those members shop big-time in its stores. China’s comps were up 6% in the fourth quarter, which is very impressive considering the number of stores.

Why do some stocks have negative payout ratios? Find the answer here.

Driving SBUX’s Dividend

With its torrid pace of profit and sales growth, SBUX has decided to give its investors something else besides mega-share price appreciation. Namely, a fat dividend check and a 1.77% yield.

Starting in 2010, SBUX initiated a quarterly dividend payout. And while the yield may seem small, it’s more of a function of price appreciation than unfriendly management.

Since its first dividend, and as profits/cash flows continue to grow, Starbucks has managed to increase that payout by more than 400%. This past November saw that payout jump by more than 25% alone. And given that Starbucks features a low payout ratio of around 44%, more dividend hikes could come down the road, sooner than later. SBUX is still earning plenty of cash to more than cover increases and other activities. And that doesn’t even take into account its growth avenues.

Speaking of other activities, SBUX has become a buyback champion. Back in mid-2015, SBUX approved a new 50 million share-repurchase program. Since 2001, more than 430 million shares have been bought back by the company.

Get the complete payout history of SBUX here.

Ordering a Cup of SBUX

In the end, SBUX features just what investors are looking for in a dividend stock. It has steady and rising profits and a low payout ratio. The bonus for Starbucks is its continued growth plans, which should help drive revenues and profits further down the road. In turn, that will help drive its already strong dividend growth profile. Investors would be wise to order up some SBUX shares while they buy their morning cup of coffee.

Dividend.com maintains sector pages for all dividend stocks. Here, you can find the company count and the current average sector yield. This yield changes every day as companies announce new payouts. Be sure to track it every time you make an investment decision.