It pays to be an innovator. For Qualcomm (QCOM ), that has meant a decade of immense profits and revenues. Thanks to its early work on mobile devices, the semiconductor producer became the 800-pound gorilla of the wireless market. Its leading chips still are the preferred choice for many wireless device markers and its rich patent portfolio has driven a steady diet of dividend increases over the last 14 years.

However, QCOM hasn’t been living up to its glory days recently. There have been plenty of issues that have popped up for Qualcomm over the last few years. From declining sales to patent disputes, QCOM has suffered. Investors are starting to wonder if the former wireless kingpin should be regulated to the dustbin of former tech superstars.

But don’t panic just yet. The firm still has plenty of growth opportunities left in its tank. And those opportunities should continue to provide Qualcomm with plenty of cash flow for dividends down the road.

If anything, the recent struggles at QCOM could be used as an excellent buying opportunity.

In our Dividend Stock Screener you can screen stocks by the sector and industry of your choice. You can also screen further by using 15 more parameters as you make your investment decisions.

Being Big Can Be an Issue

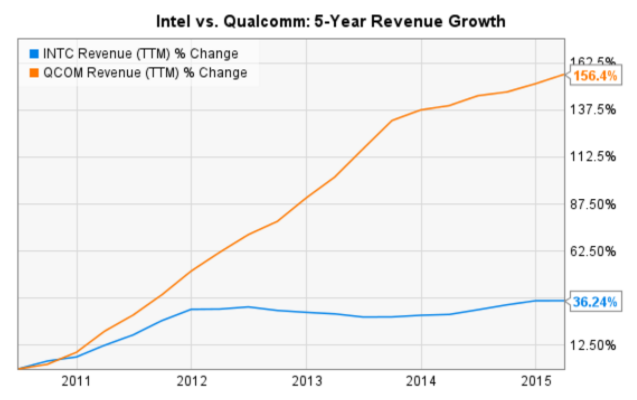

Back when mobile was in its infancy, Qualcomm made one of the most intelligent decisions in its history. As Intel (INTC ) was casting aside its mobile division to focus on PCs, QCOM went the other route. Licensing ARM’s low-power CPU architecture turned out to be a major coup for the firm. Original equipment manufacturers loved the power savings that ARM chips provided and QCOM was able to corner the wireless market. The chart below compares INTC to QCOM’s sales growth.

Its Snapdragon processors are still the No.1 selling semiconductor for high-end Android phones, while its rich wireless patent portfolio steadily clips a piece of every 3G/4G-enabled mobile device sold across the globe.

This continued mobile dominance has helped power QCOM’s cash flows and dividend since the wireless revolution took off just a decade ago.

The problem with being too big is that you often start to catch regulators’ attention. Unfortunately for Qualcomm, it has a huge bullseye on its back.

Those patent royalties have been a monster revenue generator for QCOM. But they are an albatross around the necks of the OEMs dabbling in the mid- and low-end of the market. Profit margins are already next to nothing on most of these low-end phones. Some manufacturers have complained that they can’t break even because of the royalty rate. As a result, QCOM has been taking to court numerous times

Qualcomm was already forced to lower its royalty rate in China and pay a $975 million fine in 2015. More recently, QCOM was hit with a $850 million penalty in South Korea and is currently debating the ruling of a new lower rate. A recent Federal Trade Commission (FTC) investigation has potentially ruled that the stock’s licensing practices may be considered anticompetitive. And let’s not forget that the EU and Taiwan have also opened up their investigations in QCOM’s royalty practices.

As if these legal headaches weren’t enough, the firm has also realized lower revenues for its produced chips. Some OEMs like Apple (AAPL ) have started designing their chips in-house. Smaller rivals like MediaTek have also begun to chip away at the semiconductor market share.

Given these issues, it’s understandable why investors have fled QCOM and had concerns about the company.

Check out Qualcomm’s complete dividend history.

Moving Beyond Wireless

The thing is, QCOM is quickly becoming more than just a wireless giant. Yes, that’s what built the castle. But these days Qualcomm moving beyond mobile.

For starters, it’s becoming one of the largest players in automotive chips. Its $47 billion buyout of NXP Semiconductor (NXP) announced in October 2016 will give it the leading position in a variety of chips used by automotive manufacturers. This includes 14 of the top 15 customers for infotainment systems employed in cars as well as the semiconductors needed for vehicles to communicate with each other. That puts QCOM right at the forefront of driverless cars and new radar stopping systems.

It also preps itself for the Internet of Things (IoT). NXP already designs and holds patents on a variety of IoT chipsets that will be used in a whole host of devices. And speaking of patents, QCOM continues to beef up its portfolio via small bolt-on acquisitions to help defend against that lost revenue.

Finally, QCOM seems to be poking at Intel again. The firm recently unveiled next-gen Snapdragon processors that can be used inside PCs. Partnering with Microsoft (MSFT ), Qualcomm has designed chips that will be 100% fully compatible with Windows 10. That is a major shot at INTC’s long -time dominance inside PCs and data centers and could send billions QCOM’s way. If ARM works for mobile, it can certainly work for a PC.

In the end, Qualcomm is becoming a much more diversified chipmaker and that’ll be a good thing for investors in the long run.

Buying QCOM Stock

With more than $30 billion in cash, a low payout ratio, and a decent 3.30% current yield, QCOM looks like a great buy. Yes, the patent lawsuits and regulation hurt and the potential for it to see lower revenues from this rich portfolio is there. But today’s QCOM isn’t just a wireless-focused firm. It’s seen the light and realized that mobile hardware is not a super growth engine anymore. But its forays into IoT, self-driving cars and data center growth are.

For investors, the short-term picture may be a bit rocky as QCOM goes through its transformation. But when it does, it’ll still have the kind of high cash flows needed to power its dividend for decades to come.

The bottom line is: QCOM is still a supreme tech dividend leader. There’s no reason to dump it.

Learn more about Qualcomm’s 10% dividend increase here.

Dividend.com’s daily newsletter is subscribed by over 100,000 dividend investors. Get dividend specific ideas in your inbox daily by signing up for free. Check out some testimonials written by our users.