When it comes to the major financial stocks, a particular set of firms comes to everyone’s minds. We’re talking about the Wells Fargos (WFC ), and J.P. Morgans (JPM ) of the world. But they aren’t the only bank stocks to buy. In fact, some of the best banks happen to come from our often-ignored neighbor to the north.

And when it comes to Canada’s vast banking system, Toronto-Dominion Bank (TD) could very well be the best one.

While not a household name here in the U.S., TD offers a blend of regulated and new growth businesses that should help power it through the next decades. When it comes to adding a financial stock to their portfolio, Toronto-Dominion could be the pick for investors looking for a hefty dose of both income and growth.

The Power Forward of the ‘Big Five’

Canada’s Big Five banks are considered some of the soundest and most conservatively run banks in the world. Over their long histories, the group – which includes stalwarts like the Royal Bank of Canada (RY) – has managed to deliver impressive returns, dividend growth, and relatively low-risk profiles for decades. But when it comes to finding growth among the Big Five, TD is the only game in town.

The reason is its focus on retail banking rather than wholesale and institutional accounts.

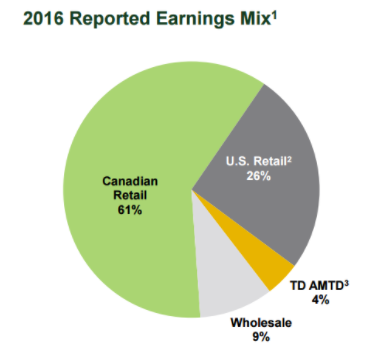

Since its 1955 formation, Toronto-Dominion has focused more on the average Joe than big-time business banking. More than 87% of its total revenues stem from retail customers. Just take a look at the chart below and you can see wholesale banking is barely a blip on its radar.

At first blush that may seem like a bad idea. After all, big firms equal significant sums of money and can be quite profitable. But the reality is that being a retail banking operation offers plenty of benefits for a financial firm.

For starters, there are huge barriers to entry when creating a vast retail banking network. Building branches and working with local/state regulators take plenty of effort. Once this system is established, it’s harder for smaller entrants to muscle their way into a neighborhood. The benefit for TD is that margins on retail accounts are sometimes much higher than wholesale banking.

Competition for bigger clients has brought down many of the lucrative fees that banks charge large businesses for using their services. That’s not entirely so with retail customers. ATM fees, monthly checking charges and other service fees still dominate the average retail bank account. Retail banking also involves plenty of mortgage and small business loan origination fees. What’s even better for TD is that most customers will stay on with their bank for years before even thinking about switching, as the hassles of doing so often outweigh the service fees.

Setting up a vast retail network also provides TD with plenty of diversification benefits. All it takes is one bad economic downturn for a major wholesale banking client to have problems. The odds that every one of its thousands of retail customers run into issues is much smaller. Retail banking is simply more recession-proof than wholesale.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. You can even screen stocks with DARS ratings above a certain threshold. Stocks with the highest DARS ratings are dividend.com’s current recommendations to investors.

Still Plenty of Avenues for Growth

With its stable of local banking operations, TD has an excellent base for its operations but it isn’t just focusing on gathering deposits and making loans. The bank has plenty of expansion and growth plans as well.

Both before and during the recession, TD expanded heavily into the United States through buyouts of smaller regional players. Today, Toronto-Dominion has about 2,400 locations in the U.S. However, almost all of those branches are on the East Coast. With two-thirds of the country still up for grabs, including the lucrative West Coast, there are plenty of expansion opportunities for taking on new branches and delivering on its “America’s Most Convenient Bank” promise.

Secondly, an offshoot of that focus on retail customers comes down to offering other financial services. Back in the dot-com days, TD was one of the first firms to offer an online brokerage account for trading and investing. Its buyout of Ameritrade made the company one of the biggest providers of retail brokerage and retirement services in the country. Fees for margin trading, transaction costs and being an IRA custodian are incredibly lucrative. Even better is that TD gets these charges no matter how the market is doing or what investments a customer chooses.

Growth here is being buoyed by its recent decision to buy smaller online brokerage firm, Scottrade. By adding Scottrade, TD will instantly add more clients – to whom it can cross-sell accounts – and boost its brokerage fee income.

Finally, TD has gotten into the Fintech game. New mobile apps for trading and budgeting, such as its TD MySpend app, are designed to help customers save and earn more money in their accounts. They are also designed to attract younger customers to their banking system. And as we said before, once a customer, always a customer.

Check out how robo advisors will impact the future of investing.

It All Adds up to Earnings and Dividend Growth

For Toronto-Dominion, the combination of safety and stability plus faster investment growth adds up to impressive earnings and dividend increases throughout its history.

During its latest reported quarter, TD’s profits grew an impressive 25% year-over-year on the back of stronger retail operations. For the full year, net income jumped a whopping 11%. That’s excellent considering the “boringness” of two-thirds of its business. But this earnings growth also shows how the higher margined growth engines of the bank can help boost profits.

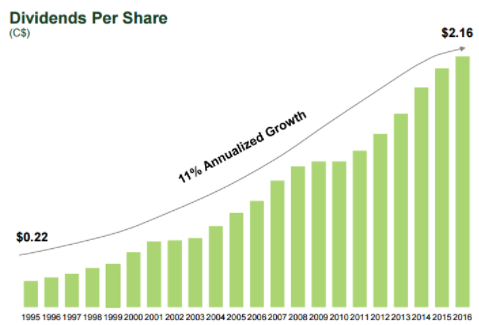

It also raises dividends as well. TD has managed to increase its dividend by a compound annual growth rate (CAGR) of 11% over the last ten years. Its payout has jumped from just 22 cents per share to over $2.16 per share in that time. The graph below illustrates just how powerful the increase has been. Given its low payout ratio and high earnings growth, the bank should have no trouble growing that yield further down the road.

Find out the payout history of TD from 1993 till present here.

The Bottom Line

When it comes to the big banks, investors may want break out their passports and head north. Canada’s Toronto-Dominion offers some for the most impressive growth prospects of any bank. But the firm’s profits are grounded in the stability of a vast retail banking network. In the end, TD stock offers the best of both worlds, and it’s a perfect “growth & income” pick.

Check out dividend.com’s News section for the latest on dividend investing.