For dividend investors, there can be something said for safe investments. After all, slowly increasing revenues and cash flows lend themselves to steadily rising dividends. So, it’s no wonder that many of the best dividend stocks happen to operate in very boring and mundane industries. And you can’t get much more boring than a water utility.

But for American Water Works (AWK ), boring happens to also be pretty exciting.

The nation’s largest investor-owned water and wastewater utility has built a strong earnings and dividend profile on the back of that sector. However, unlike many water utilities, AWK has plenty of growth potential as well.

In the end, American Water Works could offer the best combination for great long-term returns and dividend growth.

Follow other retirement news in our How to Retire section.

A Massive Portfolio

When it comes to water utilities, American Water Works is at the top of the pile. And that’s been its competitive advantage over the years. Since its founding in 1886, AWK has expanded and now serves more than 15 million customers across 47 states and Ontario. Its asset base is huge with over 100 wastewater treatment facilities, 1,200 treated water storage facilities, 1,400 pumping stations, 81 dams and 49,000 miles of mains and collection pipes.

That immense size provides AWK with one heck of a competitive advantage and a massive moat. The reason being that you can’t pick your water utility; it’s solely based on where you live. That means that those 15 million people have to use American Water Works for their needs or else they’d have to try to shower using bottled water – and we know that’s not going to happen.

Now, because we’re stuck using whatever water utility is located in our geographical area, they are heavily regulated. Rates are set by public commissions and the underlying utilities have to abide by those rates. For AWK, that’s actually not so bad. It provides a steady source of revenues and cash flows.

The problem is that water treatment is a very CAPEX-heavy business, and margins are very small. AWK’s size provides an advantage again. Since it covers such a vast area, the firm is able to clip more revenues – no matter how small – across its entire system. Think of it like Wal-Mart (WMT ), which is making only a few cents per item, but making that up on volume.

Check out the best water utilities dividend stocks and track their latest dividend yields on our dedicated industry page tracking the same.

The Growing Side of ‘Boring’

The regulated and boring side of AWK’s business provides the bulk of its revenues and cash flows. However, American Water Works has some growth potential in its tank. And that’s because it also operates plenty of non-regulated and market-based operations.

For starters, AWK is a defense contractor. While it doesn’t build missiles, it does provide water and treatment services for various U.S. military bases. Military bases aren’t allowed to tap into public systems and they often operate their own treatment facilities on site. AWK will run these facilities for a fee. And since the military has different needs and tolerances than the general public, the fees are pretty hefty. With 12 bases under contract, including some of the nation’s largest, margins remain very fat for this business line.

Secondly, American Water Works is a big provider of water and waste treatment services for the energy industry in the Appalachian Basin. It takes a lot of water to frack a well, and those millions of gallons of water need to be brought in from the outside. AWK’s Keystone Clearwater subsidiary provides all sorts of water-based equipment to the region. And considering how fast production in the natural gas-heavy Marcellus Shale is growing, AWK has been able to grow its market share pretty handily over the last year or so since buying the unit. Again, as a non-regulated asset, American Water Works can charge pretty much whatever it wants for this business.

Finally, AWK has the potential to keep finding growth in its core business of regulated water utilities. Many cash-strapped municipalities have begun outsourcing operations of their wastewater treatment plans or outright selling them. With their huge asset base, many of these sales can be considered bolt-on acquisitions that instantly add value and cash flows to AWK’s bottom line. With more than 84% of all water utilities being of municipal ownership, there’s plenty of growth potential for AWK to pick up assets over the long haul.

AWK has also looked into desalination assets and residual waste management as well as offering “insurance” to homeowners for their sewer lines.

DRIP, DRIP, DRIP With AWK

So on one hand, you have a very stable business that has steady demand and cash flows. And on the other, you have plenty of growth elements that offer higher margins and potential revenues. The combination provides AWK with strong dividend potential and growth.

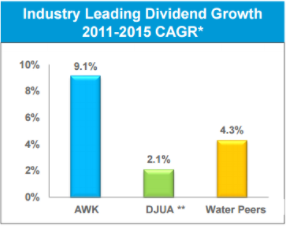

Despite being founded in the 1800s, AWK is a newish stock. The firm only had their IPO in 2008. However, since that time, American Water Works has been a dividend champion. The water utility has raised its dividend every year since it went public in 2008. More importantly, the 9% compound annual growth rate (CAGR) of that dividend has been better than its peers and the Dow Jones Industrial Average.

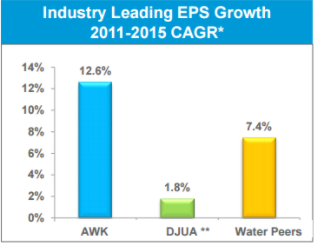

The combination of regulated and unregulated assets has resulted in average earnings per share growth of roughly 13% over the last few years, as illustrated below. That’s pretty darn good for a utility, let alone a water one.

It’s also kept its payout ratio rather low. Currently, AWK features a payout ratio of just 54%. That means there is still plenty of room to grow its dividend further, without seeing any earnings growth. But with its initiatives to keep growing, there’s no reason that dividend can’t move even higher over the long term.

Looking for income? Find out why “Realty Income Is Still a Retirement Income King”.

The Bottom Line

American Water Works is a typical boring water utility. On the other, it’s a fast-moving, non-regulated water provider. Together, this forms a great stock with plenty of dividend growth ahead.

Our Best Dividend Stocks list is comprised of the highest rated stocks which we are currently recommending to investors. Only those stocks that get the highest rating based upon our proprietary DARS rating system make the list.