Sometimes it takes a pretty big wake-up call for a management team to get their act together. For chip and semiconductor maker Intel (INTC ) that wake-up call was a major crash in its core businesses and a missed opportunity to cash in on the next wave of growth: the death of the personal computer and the rise of mobile computing and smartphone adoption.

But management has vowed to never make that same mistake again.

New ventures will allow INTC to get in on the next big thing and potentially regain its status as a supplier to the next tech revolution. For investors, it shows that some old tech dogs can learn tricks. More importantly, those tricks can pay some pretty big dividends down the line.

In the end, the death of the PC might really be meaningless for INTC and its juicy dividend.

Intel increased their dividend in late 2015. Check out our analysis here.

Intel Inside

“Intel Inside” ruled the dot-com boom. Almost every PC that was worth using ran on Intel’s processors and memory chips. And while that is still relatively true today, the problem is that PC sales are falling off a cliff.

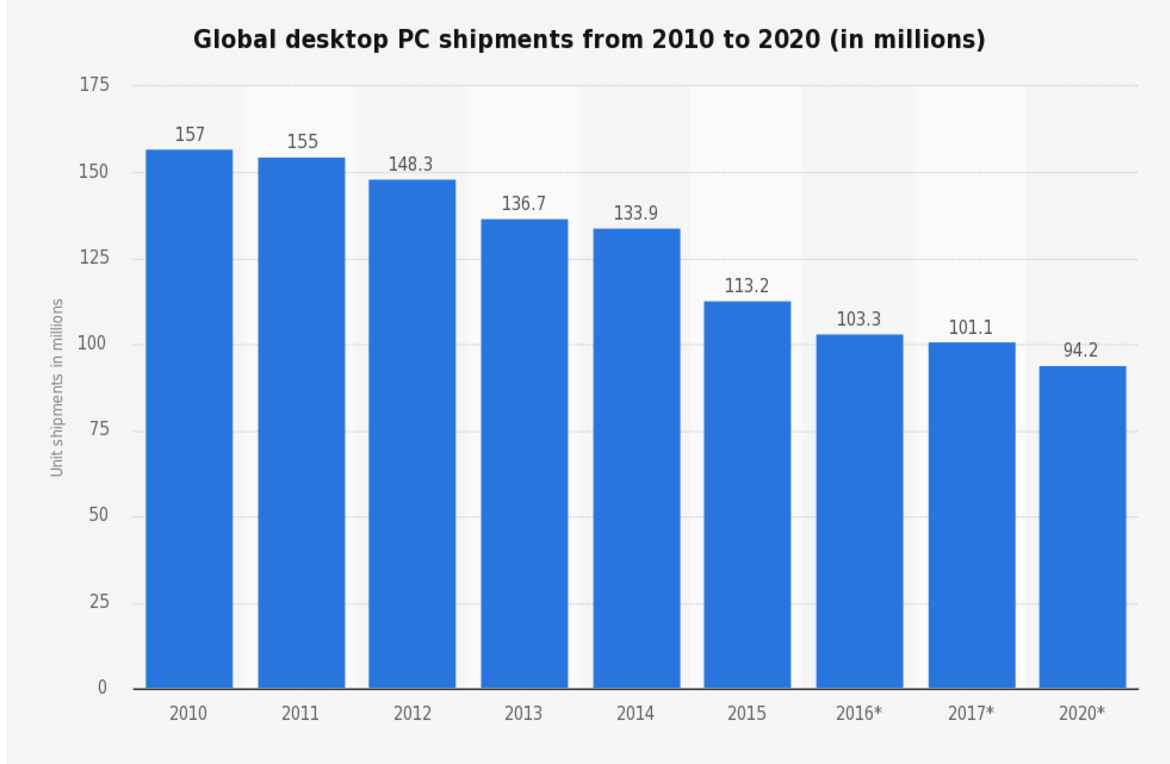

As consumers have adopted smartphones, tablets and other mobile devices, the lonely PC has been regulated to the scrap heap. Homes, which once potentially could have one PC for every member of the family, now tend to have just one, and a series of other devices like tablets and smartphones. Everything most people use a computer for – web surfing, shopping, banking, social media, and so on – can be done on smaller and increasingly mobile devices. As a result, consumers do not need as many PCs as before. In fact, PC sales have fallen for the last eight straight quarters according to tech researcher Garner. This chart from Statista shows how bad the decline has been and how bad it is getting.

That’s a problem if you’ve made a name for yourself selling PC chips. It’s also a problem if you completely missed the shift coming, as Intel did.

Intel had the opportunity to plug-in early when it came to mobile processors. However, viewing the opportunity as a fad with a very low margin – especially when compared to its PC chips – INTC actually sold its RISC-based chips division to Marvell (MRVL ) for a song and dance back in 2006. That was just as the iPhone was really taking off and consumers fell in love with smartphones. ARM-designed chip makers came in and established major market share positions and Intel was forced to play catch-up in the mobile segment. Ultimately, those catch-up efforts proved futile and INTC recently killed off its mobile segment.

Check out other semiconductor dividend stocks on our dedicated page. You can track the latest average dividend yield of that sector, along with the ex-dividend dates of all the stocks in that industry.

Never Again at INTC

It was a very expensive lesson that could have killed the company. And the current brass at the chip maker isn’t going to make that mistake again. Intel went on a cost-cutting bonanza and redshifted its focus. PC chips are still a major portion of its businesses, but a continued rise in R&D spending is showing exactly where the growth at INTC will come from in the future.

For Intel, that means getting in on the ground floor with regards to server/cloud computing chipsets and Internet of Things (IoT) increased connectivity. These are the two hottest trends in tech that actually have some real staying power behind them. As users shift more applications to the cloud and run software as a service (SaaS) operations, it’ll take some serious muscle to run all the computers needed in these server farms. These higher-tech processors are quickly becoming Intel’s domain and the firm continues to develop potentially disrupting technologies for server farms. Its silicon photonics chips are just one example.

At the same time, as we connect more devices to the internet, from our thermostats to our coffee makers, it’s going to take a lot of semiconductors to continue to make that happen. Intel is already making a big bet that IHS Markit’s prediction of 75.4 billion worth of connected devices by the time the calendar rolls over to 2025 comes true. If it’s right, Intel could have a multi-billion-dollar opportunity on its hands as it wins as an early adopter.

Strong Cash Flows and Earnings

Intel’s transition toward a higher-tech future is already starting to bear fruit. Revenues in IoT and data center divisions have grown year-over-year at 19% and 10%, respectively. Meanwhile, Intel’s computer chip businesses have seen declines, but still have relatively steady cash flows due to cuts made to keep margins high. As a result, INTC has still reported top-of-the-line earnings growth, even in the face of declining PC sales.

That’s awesome news for dividend investors. One of the main appeals of buying Intel is for its strong 3% dividend. Intel generated about $6 billion in cash from operations last quarter. Last year, the total number was north of $19 billion. These strong cash flows are enough to help Intel pay for its lucrative dividend, in addition tos funding accretive buyouts such as its buyout of Altera Corporation. Altera went directly into boosting its data center operations.

In the end, INTC has the goods to keep that dividend going and fund its growth projects. That’s evident by its 39% payout ratio.

Check out Intel’s complete dividend history from 1993 to today here.

The Bottom Line

Intel may have missed the boat in mobile, but it’s not going to miss again. The company is diving headfirst into some of tech’s biggest trends with new chipsets and semiconductors, and the efforts are paying off for Intel. They’ll pay off for investors, as well; INTC will has the goods to keep its lucrative dividend going even before these efforts pan out.

Follow all the latest news regarding dividend stocks in Dividend.com’s News section.