There’s nothing too exciting about diapers, toilet paper and tissues. But for Kimberly-Clark (KMB ) these essential items have translated into a century of profits and growth. And for dividend-focused investors, they’ve meant big things as well. KMB has been paying dividends for more than 82 years and it’s managed to increase them for the last 44 years. (Find all the Dividend Aristocrats currently on our list on our 25-year Dividend Increasing page.)

But for that unassuming nature and big time dividend-paying ability, investors are currently paying a premium for KMB shares – even when compared to other dividend stocks.

The question for those looking to buy Kimberly-Clark today is whether or not the stock is worth paying the premium.

Turning to Page 10

While Kimberly-Clark may not be a household name, its brands certainly are. There’s a good chance that you have Kleenex tissues, Huggies diapers or Scott toilet paper in your house. According to KMB’s own numbers, nearly one in four people globally uses its essential brands every day. That’s a pretty powerful statistic. But what’s also pretty powerful is what KMB is selling to get that sort of demand. We’re talking about boring old paper products. It’s the stuff that ends up being on page 10 of the Wall Street Journal, rather than the front page or main headline.

There’s basically no headline risk here. No real possibility that a news story will adversely affect KMB’s stock price or ability to pay a dividend. Demand for these sorts of consumer staples is pretty steady, and that translates into slow-and-steady earnings growth. It’s exactly what dividend investors need and want.

The problem is that they are paying a lot of that in the current market.

As interest rates have kept low, demand for dividend stocks like KMB have been driven to levels not seen in a long time. Price-to-earnings ratios for major dividend indexes and income-heavy sectors are actually above broader market indexes. KMB alone can be had for a current P/E of nearly 21. That’s pretty expensive for a firm that sells paper towels. (Is “Dividend Aristocrats” just another clever marketing term like BRICS or Smart Beta or are they really worth following? Find out the answer to this in our analysis here.)

KMB Does Have Unique Advantages

But in terms of KMB, that high P/E and relative expensive nature may be worth it for investors. Kimberly-Clark does have a few advantages over some of its consumer staples rivals like Procter & Gamble (PG ). A big one is its low cost of innovation.

The real basics behind toilet paper and paper towels haven’t changed in what seems like decades. There’s no sort of “disruptive” technology here, waiting to make diapers obsolete. That provides KMB with a very unique position versus other consumer products companies. It simply doesn’t have to shell out much money to design new products. For example, Colgate-Palmolive (CL ) has to constantly redesign its soaps, deodorants and other personal health goods to bend to the changes in consumer tastes. That’s not so much the case with paper products.

Secondly, any dollars spent on advertising have incredible staying power because of the slow changing nature of paper products. CL will need to advertise its new formulas, changes and other advances multiple times to get consumer knowledge and attraction up. Again, not so with toilet paper. All of this helps reduce the outlay that KMB needs to spend and, ultimately, boost profits and margins at the firm.

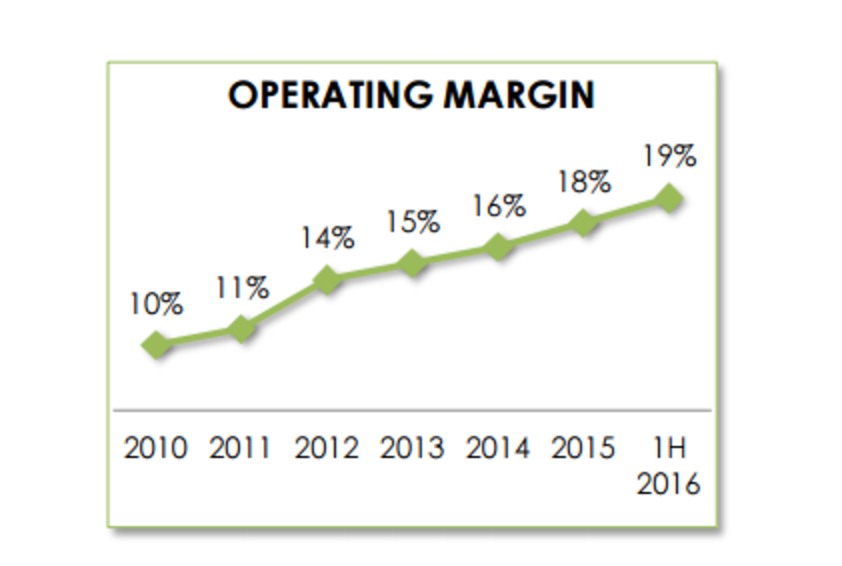

Even better is that many of its brands – including Kleenex, Huggies and Viva – are considered “premium” brands in their respective categories. As a result, they command higher prices than similar products. By going with premium consumer brands and sticking to boring, non-changing paper products, KMB is able to realize huge margins for its products. Take a look at the following chart. 19% from a commodity like toilet paper is quite an achievement.

The downside to all this is that boring paper products are, well… boring. KMB’s earnings-per-share growth and revenue aren’t exactly tech stock-like numbers. Between 2004 and 2015, KMB’s sales grew at a compound annual growth rate (CAGR) of just 3% per year. Earnings grew at just 6% annually in that time. However, growing at a snail’s pace isn’t necessarily bad as that steady nature has afforded the firm plenty of years’ worth of dividend growth.

As for kicking that future growth into high gear, KMB has some advantages as well.

For starters, “slimming down” was key. Part of that slow growth was due to its hospital and healthcare businesses. While KMB can charge premium prices for its consumer products, that simply isn’t the case for surgical masks, disposable gowns and other paper-related hospital products. Margins for these items remained depressed. As a result, Kimberly-Clark spun the business out as Halyard Health, Inc. (HYH) at the end of 2014. By kicking out the slower moving pieces, KMB should be able to improve its overall margins and earnings.

At the same time, KMB is big, but not too big. What that means is that small- to mid-sized acquisitions could actually move the needle at the firm. At a market cap of over $227 billion and $65 billion in sales, it takes a big buyout for Procter & Gamble to realize higher EPS and real benefits. Not so with KMB. And considering it’s a global player, that M&A can come from smaller local brands in emerging markets or other international hot spots. The other beauty to this is that these sorts of smaller, accretive acquisitions can be made via KMB’s ample free cash flows.

So Is KMB Really Worth It?

The real question is whether or not KMB stock is a good buy for investors. The answer may be yes with a big asterisk.

On one hand, the firm is slow going and offers plenty of dividend bang for your buck. Its yield of 3.24% is pretty juicy in the current environment and its history of growing that payout is also very well documented. Its payout ratio of 60% is a tad on the high side, but not insanely high and does offer some wiggle room for rising payout potential. Especially if KMB is able to grow its profits faster due to M&A or rising sales. (Check out our analysis on Kimberly’s latest payout increase, which marked its 44th consecutive year of dividend increases.)

On the other hand, KMB is still quite expensive. Even after an 18% drop from its 52-week high, shares of the stock can be had for a forward P/E of 18 – that’s still much higher than the broader market. And while it does have avenues for higher growth, those amounts aren’t going to shoot the moon, even in the low double digits. Kimberly-Clark is a low-beta stock that thrives on slow-moving growth.

With that said, for those investors looking for a steady 5 to 7% a year in total returns, KMB stock may not be a bad choice. However, given just how pricey it is, they may want to wait before getting their hands on shares.

Dividend.com regularly analyzes payouts of dividend aristocrats like Kimberly-Clark. Be sure to check out our news section for the latest in the dividend world.