Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

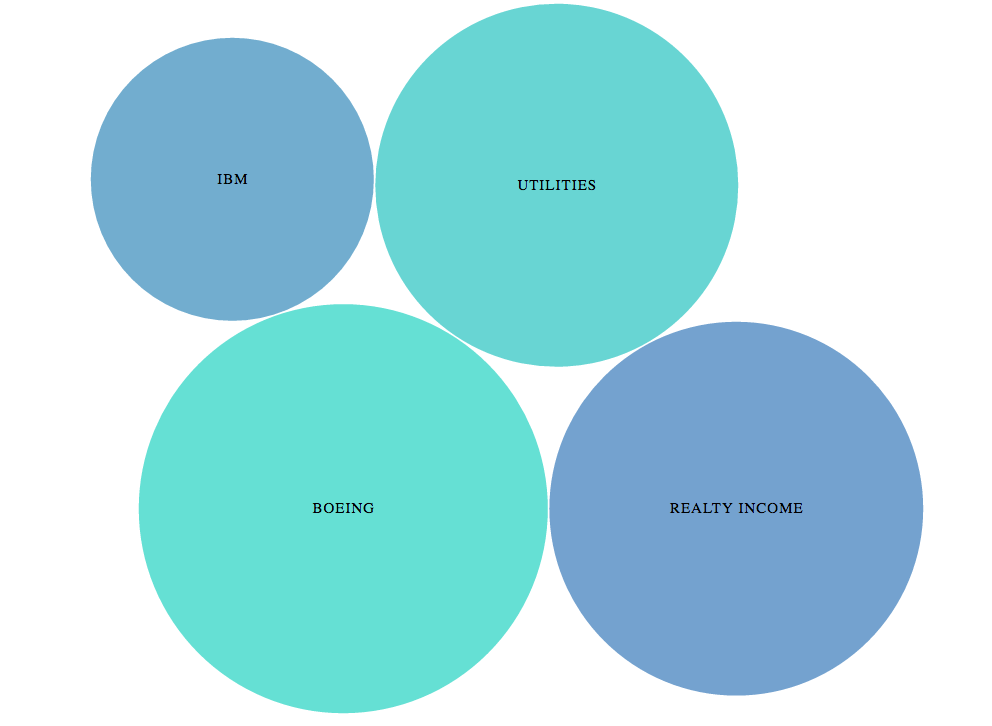

This week, the Fed and its impact on interest rates was on investors’ minds. This was evident by rising site traffic for both dividend stock stalwart Realty Income and the utilities stocks sector. Both realized huge declines this week, as the Fed’s meeting minutes showed that a rate hike will be coming sooner rather than later. Elsewhere on the list, aerospace giant Boeing saw rising site viewership, as the firm reported several bullish prospects in its latest delivery report. Finally, IBM saw rising traffic, as the Dow Jones component is gearing up for its latest earnings report.

Realty Income: Slides With the REITs

Dubbed the “Monthly Dividend Company.” Realty Income (O ) remains a popular portfolio choice for a variety of investors. The company became even more popular with our readers this week. About 18% more visitors searched for Realty Income this week, when compared to the same period a year ago. The culprit was the Federal Reserve’s and Europe’s take on interest rates, as well as the firm’s latest dividend announcement. Shares were pulled back and forth by the different pieces of news, but ended up 1.18% over the week.

At the beginning of the week, Realty Income spent much of its time down, as a broader REIT sell-off occurred. That sell-off was due to liquidity concerns. The Fed, via their latest FOMC meeting minutes, announced that they would be raising rates sooner rather than later. News agency Bloomberg then reported that the European Central Bank is getting ready to wind down its quantitative easing program. Both measures would end the flow of easy money that has popped up in REITs like Realty Income.

Counteracting that was Realty Income’s focus on its dividends. On October 11, O’s board announced its 556th consecutive monthly dividend to shareholders. While the payout did not include an increase this time, the consistency of its payouts is affirmed by our readers and investors.

Utilities: Power Fizzles

Given our readers love of income, it’s no surprise that a sector known for its dividends would see rising traffic. The broad utilities sector saw its viewership grow 18%, week-over-week. However, the cause for the increase wasn’t exactly all bullish. Like Realty Income, utilities suffered under the weight of central bank actions to increase interest rates. The sector proxy, the Utilities Select Sector SPDR, managed to gain about 1.07% this week. However, the index is down more than 10% since the summer.

In the utilities sector, higher interest rates are a double-edged sword. With rates high, investors are able to find “safer” sources of income than utilities. On the other hand, higher interest rates make it harder for utilities to borrow needed funds. It takes an awful lot of cash to build-out a power plant and keep it running. Higher interest make it harder for the sector to roll over debt and cheap rates. This crimps profits and dividend potential.

So with the Fed looking to raise rates, and Europe’s central banks looking to end their bond buying programs, it’s easy to see how the sector could sell-off and face a major problem going forward.

Boeing

Aerospace stalwart Boeing (BA) saw its traffic jump 7% week-over-week, as dividend investors looked to the headlines for clues about the firm’s order book, before it reports earnings this month. The order book and backlog are critical pieces of its business, and help dividend investors gauge future cash flows. Despite the potential for bullishness, Boeing was essentially flat this week – falling just 0.35%.

The reason for the mixed gains was the mixed results from its order book. Defense orders were way up, while commercial aircraft was down. So far, over the last nine months, BA has managed to ship 708 units. This compares with 726 in the corresponding period last year. The lower amount of units shipped has had some analysts questioning whether Boeing is losing major contracts.

In addition to all of this, BA mentioned that it might have to take some charges relating to late orders for its CST-100 Starliner Space Taxi program. The program’s official launch will not be until the end of August 2018.

IBM Gears up for Earnings

Given IBM’s (IBM ) popularity as a dividend holding of the Oracle of Omaha, Warren Buffett, it shouldn’t come as a shock that it’s a favorite stock among our readers. With the venerable tech superstar reporting earnings soon, it saw a 7% week-over-week increase in page views on Dividend.com. However, investors may not have liked what Big Blue might be reporting. For the last 7 days, IBM has fallen roughly 2.55%.

IBM earnings haven’t exactly been all that stellar over the last few quarters. It seems that the tech giant has had a hard time adapting its business model towards services and other higher margined products. While its programs to use data mining and its supercomputers get most of the press, its other cloud offers and money-making endeavors have fallen a bit flat. Profits have been there, but guidance numbers have been poor. Especially since smaller, more nimble rivals have entered many of the same markets. Given its favorite status among Buffett’s holdings and dividend stock investors, this is something to be concerned with.

The Bottom Line

This week, Realty Income was in the spotlight for both good and bad reasons: a rising dividend and the threat of higher interest rates. Higher interest rates were also the reason investors were searching for utilities stocks and their dividends. Earnings drove searches this week for both aerospace star Boeing and tech stalwart IBM. Both saw high activity on the site, thanks to upcoming earnings reports and guidance figures.

By analyzing how you, our valued readers, search our property each week, we hope to uncover important trends that will help you understand how the market is behaving so you can fine-tune your investment strategy. At the end of the week, we’ll share these trends, giving you better insight into the relevant market events that will allow you to make more valuable decisions for your portfolio.