Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

The week hasn’t been heavy on company news, but given our readers’ focus on firms returning cash to shareholders, it comes as no surprise that Target has been the most popular stock due to its recently announced share-buyback program. Elsewhere on the list, McDonald’s has drawn scrutiny for the abrupt departure of a long-time executive, while Cisco Systems’ internet of things (IoT) partnership delighted investors. Finally, Lockheed Martin increased its dividend and renewed its share repurchases.

Target: Losing Appeal

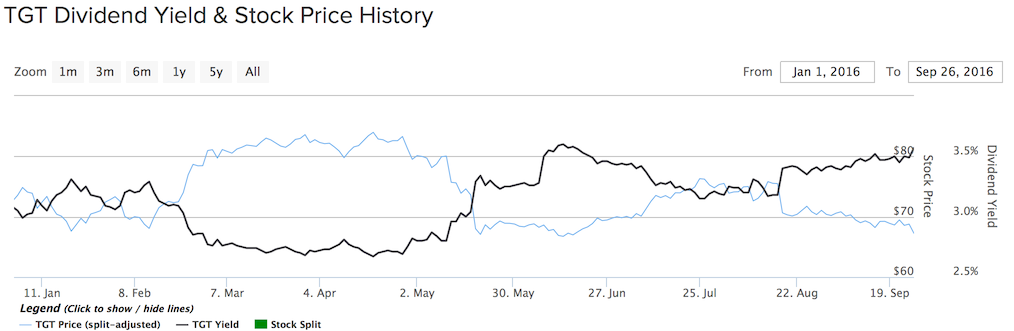

Target (TGT ) has been losing appeal with its customers, according to recent research, but has been popular with our readers, at least this week. About 51% more visitors landed on Target compared to the same period a year ago, as a recently announced share buyback pleased investors. However, shares in the group have still dropped 1% over the past five days, extending year-to-date losses to 5%.

On September 21, the company announced it will repurchase another $5 billion worth of stock after it completes the current $10 billion program. The news prompted a rally in the stock on Wednesday that was completely reversed the following day. The move is part of the company’s commitment to return cash to shareholders through both dividends and buybacks. Target intends to continue the tradition of increasing its dividend every year, which started in 1971. The retailer currently pays an annual dividend of 3.5%.

However, despite the shareholder-friendly initiative, Target has raised concerned lately, because of its decreasing customer traffic. The company recently revealed it is losing customers to rivals, such as Wal-Mart Stores (WMT ) and Amazon (AMZN). A possible reason could be the recent controversial policy of allowing transgender customers to use any bathroom they wanted. Traffic started dwindling around the period of the announcement. However, other analysts argue the retailer has become less attractive because of pricing and convenience reasons.

McDonald’s: Hungry for growth

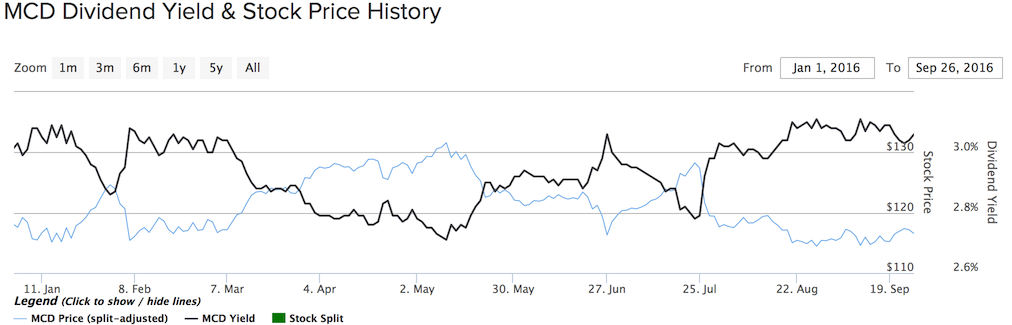

McDonald’s (MCD ) has seen its traffic increase as much as 30% week-over-week, as the company attracted attention for an attempt aimed at resuming growth that may just work this time around. However, the ‘Golden Arches’ experienced a setback as well after long-time executive David Hoffmann decided to exit the firm for a new position at rival Dunkin’ Brands Group (DNKN ). Hoffmann reportedly left because he stood a better chance of becoming CEO at Dunkin’ than at McDonald’s. Market reaction was muted on the news, but the stock rose 1.80% over the past five days amid a broad market recovery.

McDonald’s’ latest move to open a new kind of restaurant in Paris – similar to a Starbucks shop – raised eyebrows in the investment community. The firm is apparently toying with the idea of separating its coffee and pastries business from the usual burger operations, in a move that could allow the firm to tap into a new market. The shop in Paris was named McCafé, and offered pastries that go well with the hot beverage. The experiment was first launched in Toronto in December, with Canadian CEO John Betts saying at the time that customers were asking for a separate coffee shop.

The action could give the Golden Arches renewed impetus given the coffee industry has been growing relentlessly over the past years, although lately it has shown signs of sluggishness.

Cisco Systems: Joining Efforts

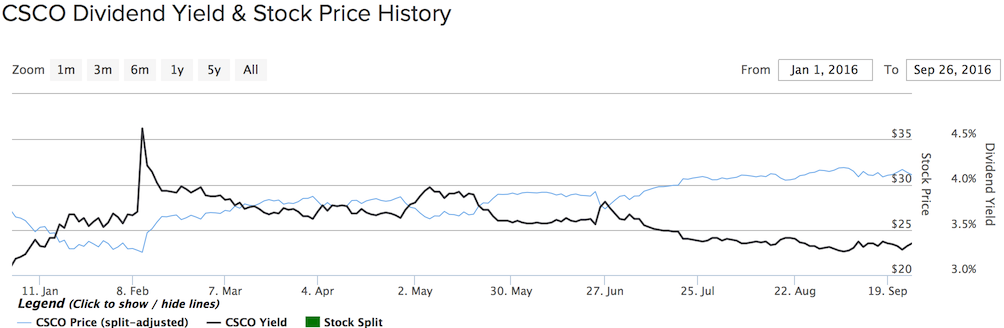

Cisco’s traffic increased 27% this week, not far off from McDonald’s. Shares in Cisco Systems (CSCO ) rose about 1% on Thursday, after the company announced it will team up with Salesforce.com to develop cloud and internet-of-things offerings together. On Friday, however, the stock fell – but remained up 1.6% for the week and 15% year-to-date.

Cisco’s new partnership is viewed as an effort to remain competitive in an increasingly crowded, but lucrative, cloud business that is dominated by giants such as Microsoft (MSFT ), Alphabet (GOOG) and Amazon (AMZN). The emerging internet-of-things industry is a promising field that could bring future benefits to both actors. Cisco said the collaboration would “eliminate the friction users experience today” and provide for a better customer experience. As a result, clients will be able to use the offerings of the two firms more seamlessly.

Lockheed Martin

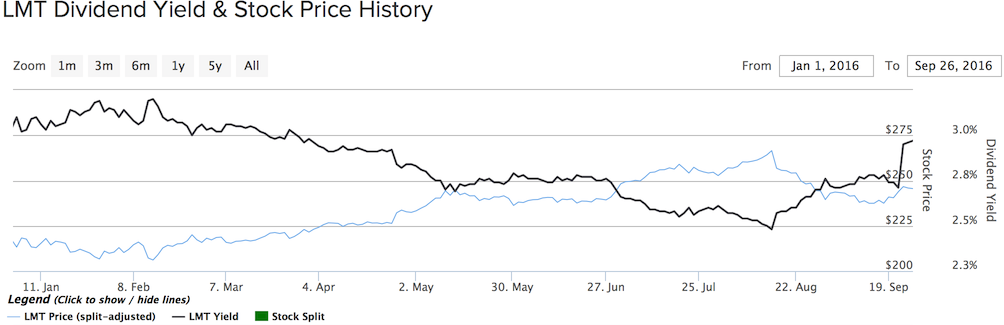

Defense giant Lockheed Martin (LMT ) is in the news whenever Republican presidential candidate Donald Trump is trending, but this time there are more fundamental reasons for the company’s presence on the list. Lockheed Martin has seen its traffic rise 19% week-over-week, as the firm announced shareholder-friendly initiatives recently, such as a larger dividend and a new share repurchase program. Shares have jumped more than 3% over the past five days, extending year-to-date gains to as much as 13%.

Lockheed Martin announced on September 22 that it had increased its quarterly dividend by 10%, to $1.82 per share or $7.28 annualized. With the increase, the defense company now yields 2.34% annually, above the industrial goods average of 1.34%. The firm also said it will repurchase another $2 billion shares, in addition to the $2.3 billion remaining from the previous program.

The Bottom Line

This week, Target has been in the spotlight for its losing appeal, taking first place on our list. The retailer is followed by another struggling legend, McDonald’s; however, MCD could resume its growth with its newly announced coffee shop initiative. In the meantime, Cisco edged up this week on news of a cloud collaboration with Salesforce, while Lockheed Martin delighted investors with a dividend increase and a new share buyback.

By analyzing how you, our valued readers, search our property each week, we hope to uncover important trends that will help you understand how the market is behaving so you can fine-tune your investment strategy. At the end of the week, we’ll share these trends, giving you better insight into the relevant market events that will allow you to make more valuable decisions for your portfolio.