Telecommunications stocks are widely held by income investors because of their reliable cash flow and steady dividends. Verizon Communications (VZ ) is consistently one of the highest-yielding stocks in the Dow Jones Industrial Average, thanks largely to its best-in-class wireless business. Verizon paid $130 billion to European telecom giant Vodafone (VOD ) for full ownership of Verizon Wireless. This was a huge sum and Verizon is now carrying a very high amount of long-term debt on its balance sheet.

So much debt is certainly a concern for investors going forward, but there is a reason why Verizon made this deal: Verizon Wireless is a cash-generating powerhouse. According to Verizon’s investor relations department, Verizon Wireless is the largest and most profitable wireless carrier in the country. The wireless business generates a huge amount of cash flow, which will allow Verizon to pay off its debt over time and continue to reward shareholders with regular dividend increases.

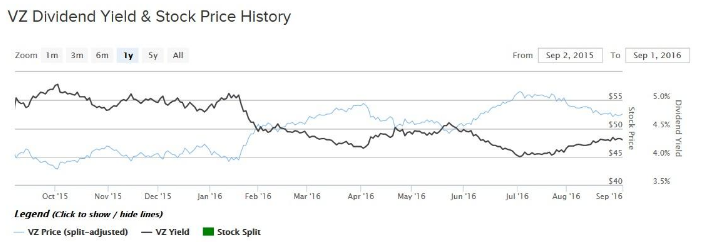

Not only do Verizon shareholders receive a dividend yield roughly twice the average dividend yield in the S&P 500 Index, but Verizon’s share price gains have outperformed the market. Verizon stock has returned 17% in the past one year, which is well above the S&P 500 in that time.

Verizon Rings Up Higher Dividends Thanks to Cash Flow

On Sep. 1, Verizon’s Board of Directors declared a quarterly dividend of $0.5775 per share, which was a 2.2% increase from the previous quarterly dividend. On an annualized basis, the forward dividend rate increases from $2.26 per share to $2.31 per share. Based on Verizon’s most recent closing price of $52.56 per share, the new dividend represents a 4.4% yield. The quarterly dividend is payable on Nov. 1 to Verizon shareholders of record on Oct. 7. Verizon has now raised its dividend for 10 years in a row.

Verizon is a rare example of a stock that combines a high dividend yield with dividend growth each year. The reason why it can accomplish both for its investors is because Verizon generates very high profit margins and cash flow, thanks to what Warren Buffett calls a ‘wide economic moat.’ Verizon provides cable, Internet and phone service across the U.S., which is a very capital-intensive industry. It costs billions of dollars to build a carrier network, which makes it virtually impossible for new competitors to enter the industry. Such high barriers to entry mean the two companies at the top, Verizon and AT&T (T ), enjoy pricing power over the consumer.

For evidence of this, look to Verizon’s free cash flow, a financial metric derived from the statement of cash flows that shows the amount of cash a company generates from its underlying operations, deducting money spent on capital expenditures. Last year, Verizon generated $21 billion of free cash flow, up 57% year over year. In turn, Verizon used its cash flow to pay $8.5 billion of dividends to shareholders and repurchase $5.1 billion of its own shares, and it still had plenty of cash flow left over to invest in future growth opportunities.

The biggest driver of Verizon’s cash flow is Verizon Wireless, which generated more than $10 billion of earnings before interest, taxes, depreciation and amortization (EBITDA) in just the first half of this year. Verizon Wireless had a 47% EBITDA margin in the most recent quarter, which was an even higher margin than the same quarter last year.

Verizon Wireless is the industry’s leader and its superior network provides Verizon with a distinct competitive advantage. Its high-quality network not only allows for pricing power, but also compels many consumers to pay up for better service. Verizon’s churn – the percentage of customers who leave the company for a competitor’s service – stood at an industry low of 0.96% last year.

Verizon’s future growth will be pioneered through three key initiatives: the Internet of Things, 5G and digital advertising. The Internet of Things (IoT) brings unprecedented connectivity to the physical realm. With IoT, all sorts of objects can be connected over the Internet – not just smartphones and computers, but also vehicles and even household appliances. Verizon’s emerging IoT business generated $690 million of revenue for the company last year, which was up 18% from the previous year.

In 5G capabilities, Verizon is investing aggressively alongside its technology partners to accelerate deployment of this new technology and, as a result, has taken a significant lead in 5G. Verizon intends to begin trials of 5G rollout this year with full deployment shortly thereafter. Lastly, in digital advertising, Verizon has made multiple acquisitions to take a leadership position in this high-growth area, such as its $4 billion acquisition of AOL and its $4.8 billion purchase of several operating assets from Yahoo!, Inc. (YHOO).

The Bottom Line

Telecom stocks have historically been a haven for income investors and Verizon is a perfect example. The stock has beaten the market soundly over the past year, with the added bonus of a high dividend yield. Verizon generates more than enough cash flow to sustain its hefty dividend, thanks to its gold mine wireless business. And the company should be able to continue growing its dividend each year, thanks to its investments in new growth industries.