Carlisle Companies Incorporated (CSL ) may not be a household name, but it is a very well-known and highly regarded stock among dividend growth investors. Carlisle is a mid-cap stock with a market capitalization of $6.7 billion, but it generates steady profits and reliable dividends like a large-cap blue chip. Carlisle generated $3.5 billion of revenue in 2015 and notched a company record for both sales and profits last year.

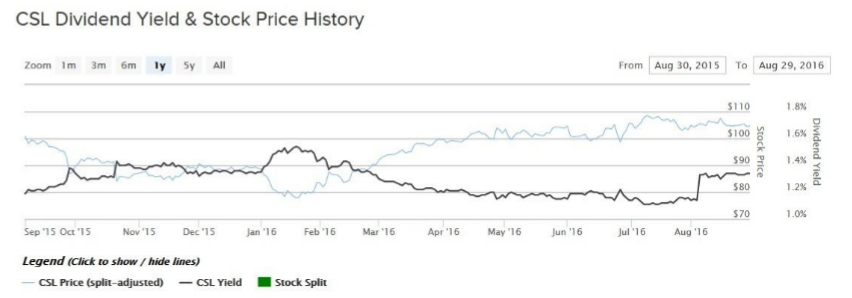

The company is very shareholder friendly. Carlisle returns a significant portion of its annual profits to shareholders as a dividend and management is committed to growing the dividend each year. On Aug. 2 the company announced a quarterly dividend of $0.35 per share. This is a 17% increase from the previous quarterly rate of $0.30 per share. The dividend is payable on Sept. 1 to shareholders of record on Aug. 18. The new annualized payout rises to $1.40 per share, which represents a 1.3% current dividend yield based on Carlisle’s Aug. 29 closing price. This raise is the 40th year in a row in which Carlisle has increased its annual dividend. Carlisle qualifies as a Dividend Aristocrat, a group of companies that have raised their dividends for at least 25 years in a row.

Diversified Business Model Provides Steady Earnings Growth

Carlisle has a diversified business model across product categories and geographic markets. Carlisle operates in the consumer goods sector as a diversified manufacturer of products that serve the energy, agriculture, mining, construction, aerospace, foodservice, healthcare and sanitary maintenance industries. Last year 57% of the company’s revenue came from the construction materials business, 22% was derived from the interconnect technologies segment and the remainder was cumulatively generated from the fluid technologies, brake & friction, and the foodservice products segment. In addition, the company has a significant international focus. It generates approximately 30% of its revenue from outside the United States.

The company has focused heavily on construction materials – and there is good reason for this strategy – because it offers the greatest opportunity for growth and efficiency improvements. For example, last year earnings before interest and taxes in that segment rose 30% from 2014. The reason was because of lower raw materials costs, due in part to the drop in commodity prices, pricing discipline and efficiency improvements. These factors drove a 40% return on invested capital in the construction materials business last year, which is an outstanding performance. Carlisle has performed well to start 2016. Over the first half of the year, sales and earnings per share from continuing operations rose 5.7% and 39%, respectively, versus the same period in 2015. Acquisitions helped drive some of the growth, as did continued margin improvements.

In recent years Carlisle has placed a renewed emphasis on increasing profit margins through efficiency gains. Aggressive cost-cutting resulted in a 15% return on invested capital and 15% operating profit margins last year, which helped generate record earnings in 2015. Carlisle is expected to increase earnings per share by 18% this year, and another 6.9% in 2017. The company has a long track record of generating strong growth in sales and earnings, thanks to these strategies. Carlisle has grown its sales and earnings at a compounded annual growth rate (CAGR) of 6% and 13% respectively over the past five years.

Growth in Sales & Net Operating Profit After Taxes (NOPAT)

Carlisle has a strong balance sheet. It ended last quarter with $1.4 billion in current assets compared with $673 million in current liabilities, for a current ratio of 2.1 times. A current ratio above 1.0 indicates the company has enough liquid short-term assets and investments to pay off its liabilities due within the next year. Moreover, Carlisle has a long-term debt to equity ratio of 40%. A ratio below 50% indicates a company that has not stressed its financial position with too much long-term debt, in relation to its long-term assets.

Going forward, the company should have little trouble maintaining its streak of annual dividend raises. In addition to its strong balance sheet and highly profitable business model, the company has a conservative capital allocation structure. Even after the recent 17% dividend increase, Carlisle’s new annualized dividend represents just 25% of the company’s projected 2016 earnings per share. The company is set to distribute a very low percentage of earnings this year, which provides plenty of room for future dividend increases. Investors should expect double-digit dividend growth over the next five years.

The Bottom Line

Carlisle is a well-run company with a strong brand and a leadership position in its industry. The stock has returned 4% in the past one year including dividends, which is an admirable performance in an uncertain global economy. Carlisle has a plan to continue to drive growth through acquisitions, organic investment and cost cuts – even if the economy remains in a low-growth climate.

Carlisle stock has a below-average dividend yield, but it makes up for this with very high dividend growth. As a result, while investors desiring current income may not view the stock attractively, dividend growth stocks should consider further research of Carlisle stock.