Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

This week has not offered a central theme, with the exception perhaps of the presence of two energy stocks, DHT Holdings (DHT ) and Duke Energy (DUK ). Elsewhere on the list, Bristol-Myers Squibb (BMY ) took a hit after a drug surprisingly failed an efficiency test, while Wal-Mart Stores (WMT ) grabbed the headlines with an acquisition that may challenge online retail king Amazon (AMZN). Finally, Vodafone Group (VOD ) has taken fourth place on our list.

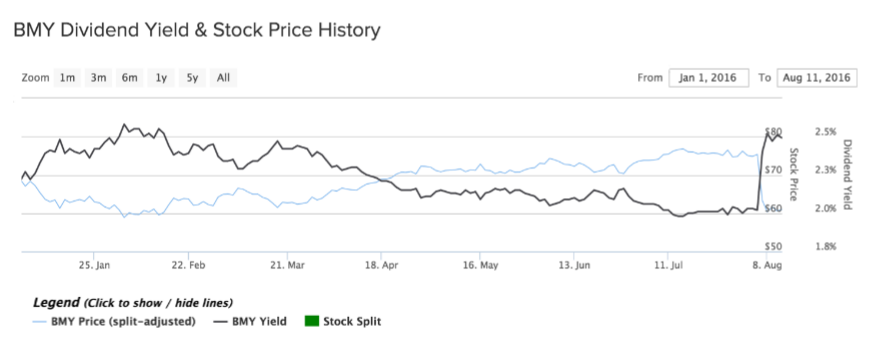

Bristol-Myers has seen its viewership rise as much as 398% week-over-week for obvious reasons. In a recent surprise announcement, the giant biopharmaceutical company said that a key drug treating a specific type of cancer failed an important test, sending the share into a tailspin. Over the past five days, the company’s stock has tumbled more than 18%, bringing year-to-date performance in negative territory at more than 11%.

The company’s drug, Opdivo, failed a clinical trial test, taking the markets by surprise. The drug was believed to be a revolutionary immunotherapy offering treatment for a wide variety of cancer patients. However, the drug did not meet the primary endpoint for a broader population, but the company said it was committed to enhancing the drug’s ability and making new tests.

The bad news effectively increased the dividend paid by the company to an annual payout of nearly 2.5%, and provided long-term bulls with a good entry point. The company’s balance sheet remains healthy, and its second-quarter results were better-than-expected. Not all is lost for Opdivo – the company said it had used a broad patient sample to test the drug, meaning that it may be effective for a smaller sample. Further studies along the road will provide clarity about the revolutionary drug.

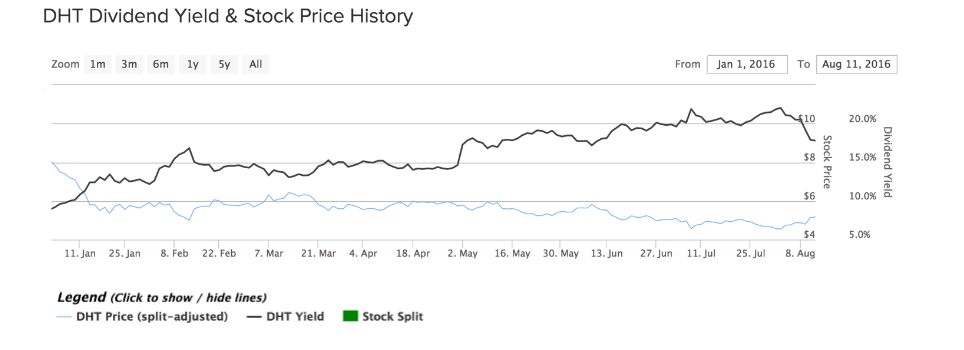

DHT Holdings

Crude oil tanker company DHT Holdings has taken the second spot in the list with a 96% increase in viewership week-over-week. The firm recently posted better-than-expected results for the second quarter, propelling the stock up significantly. Over the past five days, shares have risen more than 8%, limiting year-to-date losses to 36%.

On August 9, the company reported second-quarter net income of $0.38 per share, surprising pundits, which predicted a per-share figure of just $0.30. What made investors even more excited was the news that the firm decided to increase its quarterly dividend to $0.23 per share, from $0.21 previously. This marks the third consecutive quarterly hike, and an impressive 200% increase from just two years ago, when it paid out just $0.02 per share. The dividend hike made DHT one of the best paying dividend stocks in the industry with an annual payout of nearly 18%. The industry average is just 2.3%.

Management expects the third-quarter to be at least as good as this one. Earlier this month, DHT received a new building from Hyundai Heavy Industries and expects to receive two more in the near future, a move management believes will increase the firm’s earnings power.

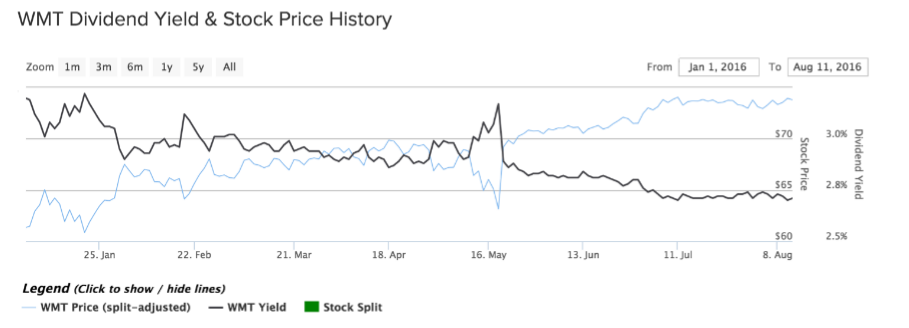

Wal-Mart Stores: Catching up With Amazon

Giant brick-and-mortar retailer Wal-Mart has made headlines this week after announcing the acquisition of online peer Jet.com. The move evidently raised eyebrows, increasing the company’s traffic by 29%. Shares in the company have barely moved following the news, signaling investors’ skepticism about the deal. Still, the stock remains up more than 20% since the beginning of the year.

Wal-Mart forked out $3.3 billion to acquire up-and-running online retail store Jet.com, prompting pundits to wonder about the company’s intentions. Some readily defined the deal as an attempt to challenge Amazon’s dominance in online retail, but others reckoned the deal may simply mean that Wal-Mart wants to fight for second place with other brick retailers, Target and Costco. eBay is currently the second most-visited retail website. Whatever the company’s ambitions, it seems ready to invest heavily in online expansion, having taken on board Jet.com’s management team, which will be responsible for Wal-Mart’s overall online strategy.

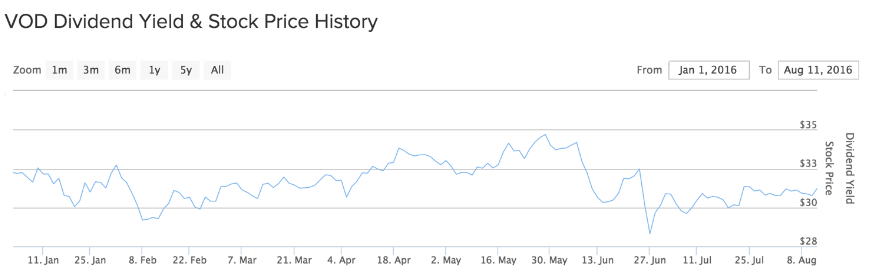

Vodafone Group

Vodafone Group has seen its traffic jump 26% in the past week. Shares in the U.K.-based telecommunications company have risen slightly over the past week, about 1%, but year-to-date the stock is down 2.6% on disappointing earnings.

In this low interest rate environment, the company’s dividend seems very attractive to investors, particularly because the blue-chip firm has stable revenues. Vodafone currently yields about 5% on an annual basis compared to the industry average of just 1.7%. However, the company will need to improve its earnings in the coming years to prove the sustainability of its dividends. Last year’s loss of 449 million pounds raised concerns, but this year, analysts expect a 36% rise in profits for the fiscal year ending in March 2017.

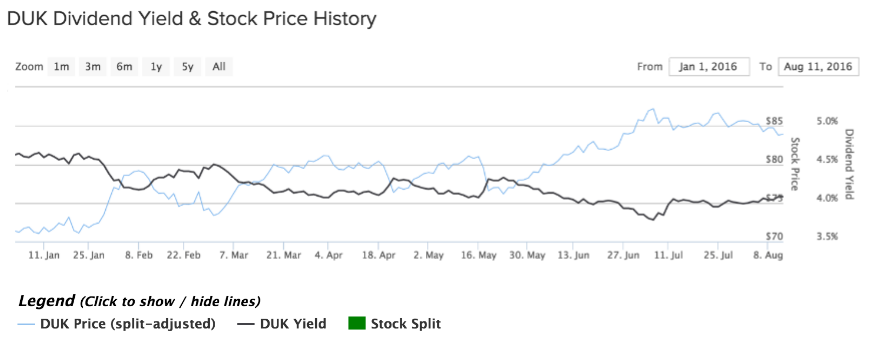

Duke Energy: A Greener Future

Duke Energy has seen its viewership increase 20% week-over-week, as the company released an upbeat earnings report on August 4. Although shares are slightly changed over the past five days, they have edged up nearly 18% since the beginning of the year, an impressive performance considering the utility sector it has been operating in.

The company said revenues rose 13% year-over-year in the second quarter and confirmed its earlier guidance.

The utility firm has been successfully transitioning from fossil fuels to greener alternatives such as solar power and natural gas lately, and has been rewarded handsomely for that move. Its net income and profits have continued to grow over the past five years, while other companies that were reluctant to change their business model have suffered. Duke also pays an attractive 4% annual dividend, higher than the industry average of 2.7%.

The Bottom Line

This week has been full of surprises. Bristol-Myers failed to pass a test for a key drug, prompting a swift slide in the stock. DHT Holdings, meanwhile, surprised investors with strong earnings and a dividend hike. Wal-Mart has grabbed headlines with a future-defining acquisition, and Vodafone Group was noticed for its attractive dividend. Finally, Duke Energy has attracted interest for its healthy dividend and successful transition process.

By analyzing how you, our valued readers, search our property each week, we hope to uncover important trends that will help you understand how the market is behaving so you can fine-tune your investment strategy. At the end of the week, we’ll share these trends, giving you better insight into the relevant market events that will allow you to make more valuable decisions for your portfolio.