General Mills (GIS ) is a legendary dividend stock. The company has paid uninterrupted dividends for 117 years. Its history as a company traces back all the way to 1880. Over the course of more than a century, General Mills has steadily built itself into a consumer goods conglomerate, with brands such as Pillsbury, Cascadian Farms, Betty Crocker, and Cheerios.

General Mills has maintained its long dividend streak because it is a highly profitable company operating in a defensive industry. Everyone needs to eat, even when the economy goes into recession. This keeps General Mills’ profits flowing like clockwork year after year, and it allows the company to raise its dividend over time. On June 29, General Mills raised its quarterly dividend by 4%, from $0.46 to $0.48 per share. This is the eighth dividend increase since 2010, and the second 4% increase in the past two quarters.

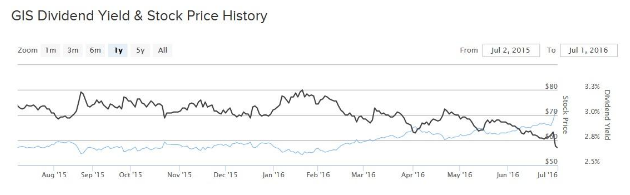

On an annualized basis, General Mills’ new dividend rate is $1.92 per share. The stock now yields 2.67%. Because they are such reliable dividend payers, consumer stocks have become favored by investors this year. General Mills’ stock has increased 26% in the past year, not including dividends, and it has significantly outperformed the market in that time.

Fundamental Analysis

General Mills’ business is split into three core segments: U.S. retail, international, and convenience stores/food service.

In fiscal 2016, the U.S. retail segment posted a 5% decline in net sales, but operating profit grew 1%. The U.S. retail segment is where the company has achieved the bulk of its cost savings. In the international markets, General Mills’ net sales declined 10%, but this was due to unfavorable foreign exchange fluctuations. On an organic basis, international sales actually increased 3% last fiscal year. The convenience stores/food service segment posted a 4% year-over-year sales decline.

Due to the mixed performance across its business segments, General Mills is focusing future investment on the highest-growth areas. In the U.S. retail business, the company will steer investment toward cereal, snack bars, and the natural and organic brands. It does not have significant capital expenditure plans in the international markets, but it does see potential to grow in convenience stores/food service by expanding on frozen snacks, yogurt, baking mixes, and frozen meals.

The company will need to streamline investment and focus capital expenditures on only the most attractive areas, because General Mills has suffered with declining revenue over a prolonged period. Sales have declined in the past two fiscal years, due to the strong U.S. dollar and falling sales of some of General Mills’ shelf-stable and frozen brands. In fiscal 2015 and fiscal 2016, net sales fell 2% and 6%, respectively. Even after excluding the effects of currency translations, General Mills’ organic revenue fell 2% year-over-year. This indicates falling demand for the company’s products.

In response, General Mills has pursued growth through acquisitions. It bought Annie’s, which makes all-natural foods and snacks, for $820 million. This acquisition has added some growth to General Mills, as the all-natural segment is growing at high rates due to the shift in consumer purchasing habits. In the U.S., consumers are increasingly demanding healthier foods. The problem is that General Mills’ core businesses, which are slowing down, are much larger than its growth segments.

Despite the challenge posed by declining revenue, General Mills has achieved significant cost-cutting, which has helped keep earnings growing each year. Operating profit margin increased 450 basis points in the last fiscal year as a percentage of total revenue. This helped adjusted earnings per share to rise 5% on a constant-currency basis to $2.92 per share in fiscal 2016.

Going forward, General Mills expects to continue generating earnings growth through cost cuts. Its cost-savings efforts are projected to produce $600 million in fiscal 2018. Even though organic revenue is forecast to be flat to down 2% in the current fiscal year, General Mills intends to increase its operating profit margin by another 150 basis points. This is expected to result in 6%-8% growth in adjusted earnings per share this fiscal year. Moreover, the company expects fiscal 2018 adjusted earnings per share to increase again into the low-double digit range.

The Bottom Line

General Mills is having difficulty growing revenue, but it remains highly profitable and generates significant cash flow. Last fiscal year, operating cash flow increased 3% to $2.6 billion. This is what allows the company to continue regularly raising its dividend. In fiscal 2016, the company spent $1.1 billion on shareholder dividends and another $607 million on share buybacks. As long as the company can continue increasing earnings over the long term, it should have little trouble increasing its dividends each year.