Medtronic (MDT ) is a large and diversified health care products company. It primarily offers medical devices, although it is diversified across therapeutic areas including cardiac, minimally-invasive restorative therapy and diabetes. Medtronic is highly profitable and is a Dividend Aristocrat, a group of S&P 500 companies with at least 25 consecutive annual dividend increases. Income investors, in particular, tend to gravitate towards the health care sector because there are many companies in the sector that are highly profitable, generate healthy levels of free cash flow and use a significant portion of their profits to return cash to shareholders.

On June 24, Medtronic announced a 13% dividend increase to $0.43 per share on a quarterly basis. The dividend will be payable July 27 to shareholders of record on July 8. The new annualized dividend rate of $1.72 per share represents a 2% current yield based on the current share price. This represents the 39th consecutive annual dividend increase for Medtronic. According to the company, its dividend growth rate over these 39 years is 18% compounded annually, and the company has nearly quadrupled its dividend in the past decade alone.

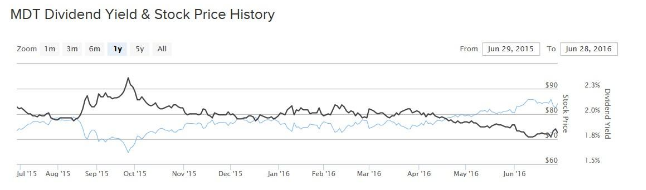

Medtronic stock has performed very well for a prolonged period. It is up 15% in the past one year, not including dividends. The stock has significantly outperformed the S&P 500 Index in that time, which is flat in the same period. Medtronic is an attractive stock for dividends and growth.

Structural Tailwinds to Fuel Long-Term Growth

Fundamentally, Medtronic has an advantage that should provide it with many years of revenue and earnings growth going forward – an aging U.S. population. Based on data from the U.S. Census Bureau, there are 75 million “Baby Boomers”, the group aged 51-69 years. The Baby Boomers are the second-largest generation in the U.S., only slightly behind Millennials. As a result, there are millions of people in or near retirement, and as this generation ages, it will likely create a long-term increase in health care spending in the U.S.

This is an important trend for investors. Higher demand for health care products and services is very likely to be a strong tailwind for the health care sector more broadly. This should include medical devices, where Medtronic is a leading brand. Last year, Medtronic grew its organic revenue, excluding the effects of foreign exchange and acquisitions by 7% from the previous year. Continued revenue growth in the high-single digit range will allow for significant earnings growth over the long term. Medtronic’s future growth will be augmented by its $50 billion acquisition of Covidien. On a pro-forma basis, Medtronic would have generated sales of $28 billion last year, an increase of 3.6% over the prior year. Excluding the acquisition, Medtronic’s revenue increased 7% on a constant-currency basis. Medtronic grew earnings per share by 3% in the last fiscal year.

For now, the diabetes group is Medtronic’s smallest segment, but it is a high-growth area. Medtronic management seeks to increase the number of patients it serves from 1 million to 20 million by 2020. The diabetes business is Medtronic’s fastest-growing area, as it increased revenue by 10% last quarter.

In addition to the tailwind provided by the aging population, Medtronic’s acquisitions will boost earnings. As a result of the Covidien acquisition, Medtronic expects to realize at least $850 million in cost savings by fiscal year 2018. The company is on track to reduce costs by $300-$350 million in fiscal 2016. On June 27, Medtronic acquired HeartWare International (HTWR) for $1.1 billion to expand its heart failure products business. Medtronic management forecasts the ventricular assist device market is currently $800 million worldwide, and will grow in the high single digits through 2017 with double-digit growth thereafter. This acquisition fits in well with Medtronic’s existing less-invasive operating unit, and provides it with exposure to another growth niche within the medical devices industry.

Analysts currently expect Medtronic to grow earnings by 7% in 2017. With future earnings growth expected to continue, given the structural tailwinds of its core business, investors should expect Medtronic’s long track record of dividend growth to continue. The new dividend level of $1.72 represents approximately 40% of the company’s trailing 12 month earnings per share. Along with the dividend raise announcement, the company also stated its intention to raise its level of cash returns. Going forward, the company expects to distribute at least 50% of its free cash flow to shareholders in dividends and share repurchases. Medtronic could easily continue to raise its dividend at double-digit rates over the next several years, given that it is growing earnings and has a modest payout ratio.

The Bottom Line

Investors are sometimes lumped into one of two groups: growth investors or income investors. Growth investors typically invest in companies that are growing revenue and earnings at high rates, while income investors tend to buy dividend stocks. With Medtronic, investors get a great mix of both.