Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

Toyota Motor (TM ) has topped our trends list this week, perhaps as a reminiscence of last week’s heavy interest in the car industry following reports of falling sales across the board. Railroad companies are second in our top four as recovering commodity prices fueled optimism for higher cargo revenues at these stable dividend companies. At the bottom of our list are two technology companies: Microsoft (MSFT ) and Google (GOOG).

Toyota Motor: Green Falling Out of Fashion

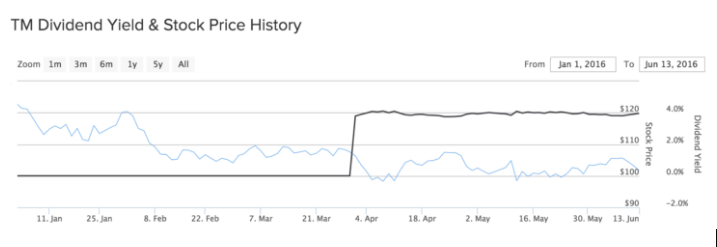

The presence of Japanese car maker Toyota Motor in our list this week is hardly surprising, given the bad sales numbers for all relevant automobile manufacturers in May. Our page covering Toyota saw its traffic rise 9% compared with the previous week, as the company’s stock continued its downward slide. Shares in Toyota have fallen nearly 5% over the past five days, extending year-to-date losses to as much as 28%.

Toyota saw its US car sales fall 9% in May compared with the same period a year ago, finding itself among the car companies posting the worst performance and missing analysts’ estimates of an 8% slide. Like almost any car company out there, Toyota’s sales of sedan models were down significantly, with its once-in-vogue hybrid Prius model falling 36% last month and 54% compared with the same periods in 2015 and 2014, respectively. On the bright side, the firm’s RAV4 crossover sales edged up 12%. The shift in consumer tastes from energy-efficient models toward high fuel consumption alternatives is not at all surprising, given the collapse of oil prices.

Despite the stock price losing one-third of its value since the beginning of the year, the company is wasting no time in investing in the future. Over the past few weeks, it emerged that Toyota made a strategic investment in ride-hailing app Uber, in a bid to capture a part of what could become a huge business. The partnership is expected to benefit Toyota in many ways, including by giving it insight into the ride-sharing market and providing it with income from potentially selling cars to the drivers.

Toyota pays a 4% annual dividend, nearly double the consumer goods average.

Railroads: Looking for Cargo Demand

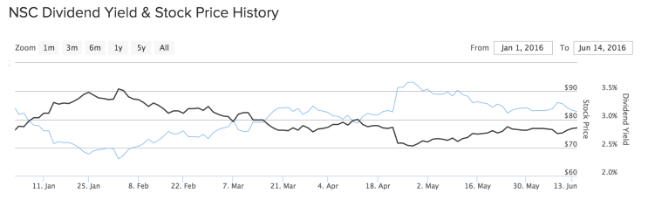

Our page covering a suite of dividend railroad companies has seen its traffic rise by 3% in the past week. This coincides with increasing optimism that the sector will resume its growth and with rising commodity prices, particularly agricultural ones. Most railroad firms have yet to recover from a decline in commodity prices. Norfolk Southern (NSC ), which was subjected to a hostile takeover approach earlier this year from Canadian Pacific Railway (CP ), has seen its shares drop about 10% over the past 12 months, and 2% since the beginning of the year.

But there are signs the industry is about to turn a corner. With grain and oil prices starting to rise, demand for cargo shipments will increase. Indeed, the Association of American Railroads, a trade group, said grain shipments were up 2.3% in the week ending on June 4 compared with the same period last year. Coal traffic, however, continues to slump, but this is probably a secular trend rather than a cyclical one.

On average, the railroad companies tracked by Dividend.com pay an annual dividend of 3%.

Microsoft: Going Social

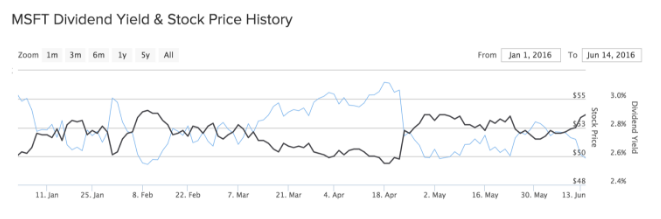

Our page tracking software giant Microsoft has seen its viewership rise about 1% in the past week compared with the week-ago period, as the technology behemoth hit the headlines with its acquisition of social network LinkedIn (LNKD). The company’s shares have dropped about 4% on the announcement, extending year-to-date losses to more than 10%.

The $27 billion acquisition financed with debt has raised eyebrows in the investment community for its high price, particularly considering Microsoft’s poor track record at integrating acquisitions. For instance, Skype has not met expectations, while Nokia’s phone unit was a total flop. Moreover, a $6 billion splash on advertising company aQuantive ended with Microsoft writing down its value almost entirely. However, there are reasons to believe this time will be different. Both LinkedIn and Microsoft cater to professionals, providing an opportunity to integrate the social network website with the company’s office suite—a move that could drive additional revenue.

Google: No Change

A page containing an article about why Google did not pay a dividend has taken the last position in our top four, with a 1% increase in traffic. The story was written in 2014, but it is just as relevant today. Google still pays no dividend to its investors, committed to allocating its cash to futuristic projects—many of which are abandoned before showing any results. The only thing that has changed since then is the name of the company; it is now known as Alphabet.

Despite the lack of dividend, the company has continued to reward its investors. Since the article was written less than two years ago, the company’s stock has jumped nearly 25%.

The Bottom Line

This last week, Japanese car manufacturer Toyota topped our trends list, largely on the back of broad worries surrounding the car industry, while railroad companies attracted viewers at signs of recovery in cargo demand. Meanwhile, technology company Microsoft garnered interest for its big purchase of LinkedIn, and Google made readers wonder again why it does not pay a dividend.

By analyzing how you, our valued readers, search our property each week, we hope to uncover important trends that will help you understand how the market is behaving so you can fine-tune your investment strategy. At the end of the week, we’ll share these trends, giving you better insight into the relevant market events that will allow you to make more valuable decisions for your portfolio.