Defense stocks have been among the market’s best performers over the last several years: the industry has enjoyed a prolonged rally based on rising profitability. Global defense budgets continue to rise at a healthy pace. Expanding defense spending across the world provides a strong tailwind for the entire industry. One of the US defense stocks that has generated impressive returns for shareholders is Northrop Grumman (NOC), one of the biggest defense contractors in the world. Based on its June 5 closing price, shares of Northrop Grumman have gained 36% over the past one year, not even including dividends. This has far outperformed the S&P 500 Index.

Other highly rated dividend stocks include Lockheed Martin (LMT ), a Best Dividend Stock, Raytheon Liquid error: internal, and General Dynamics (GD ). All three generate significant amounts of free cash flow and do an excellent job returning a great deal of cash to shareholders through share buybacks and dividend increases.

Aerospace and defense stocks are a haven for growth and dividend investors: reflecting its accelerating momentum, Northrop Grumman recently raised its dividend by 12%.

Profits Take Flight

The US aerospace and defense industry is a source of high free cash flow levels and excellent shareholder cash returns. Lockheed Martin raised its dividend by 10% last September, and it offers a very attractive 2.7% dividend yield. In addition, Lockheed Martin simultaneously unveiled a $3 billion share repurchase authorization. Lockheed Martin generates huge amounts of cash. The company produced $4.1 billion of free cash flow last year, which was a 35% year over year increase. Meanwhile, Raytheon grew revenue by 2% last year, and the company’s growth allowed it to announce a $2 billion share repurchase program in November. Earlier this year, Raytheon raised its dividend by 9%, and the stock has a 2.2% dividend yield. Raytheon has increased its dividend twelve years in a row. Lastly, General Dynamics also grew revenue by 2% last year. The company generated $1.9 billion of free cash flow for the year and provides shareholders with a 2.1% dividend yield.

The common theme throughout the industry is that companies generate high level of cash flow and use it to raise dividends. Northrop Grumman has benefited from the same tailwinds. Last year, its revenue fell 1% from the prior year, but Northrop Grumman still increased its earnings per share by 7% thanks to organic growth, and share repurchases, as well as strict cost controls. Northrop Grumman generated $2 billion of adjusted free cash flow in 2015. The company has generated at least $2 billion in annual free cash flow each year since 2011. This fuels its dividends and steadily rising earnings per share.

EPS & DPS - Last 5 Years

Northrop Grumman is off to a good start this year: first-quarter earnings increased 26% year over year, which was thanks in part to a $80 million tax benefit. Share buybacks once again boosted EPS—the share count at the end of the first quarter was down 8.5% from the same point last year. Share repurchases are likely to continue providing a tailwind to earnings growth, since Northrop Grumman still has $4 billion remaining in its stock buyback authorization. This represents 10% of the company’s current market capitalization.

The future outlook for the company is very promising; analysts expect Northrop Grumman’s earnings to continue rising at a healthy pace moving forward. The company is projected to earn $10.14 per share in 2016 and $11.66 per share next year. This would represent 15% year over year EPS growth, which would provide more than enough room to continue growing the dividend.

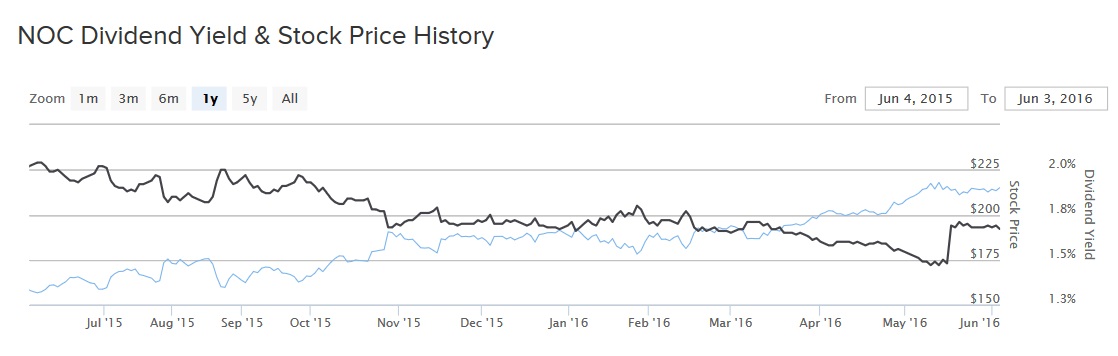

On May 17, Northrop Grumman’s board of directors approved a $0.90 per share quarterly dividend, which is a 12% increase from the previous dividend rate. The dividend is payable June 22. Northrop Grumman has now raised its dividend for thirteen years in a row. On an annualized basis, Northrop Grumman’s new dividend rate is $3.60 per share, which amounts to a 1.7% dividend yield. Over the past five years, the company has raised its dividend by 12% compounded annually.

Investors should expect Northrop Grumman’s dividend growth to continue at a strong pace for many years. This is due to the company’s improving fundamentals as well as its low payout ratio. Based on analyst forecasts for earnings, Northrop Grumman is projected to distribute just 35% of its earnings this year. This is a very modest payout ratio. The company could easily grow dividends by 10% per year over the next five years and still maintain a manageable payout ratio.

The Bottom Line

Northrop Grumman, like many of its peers in the aerospace and defense industry, generates a high level of free cash flow. This allows it to repurchase a significant amount of shares each quarter, which fuels its impressive earnings growth. Through earnings growth, the company is able to raise its shareholder dividend each year at a high rate. For income investors, this results in a very attractive growing stream of income. Northrop Grumman is a promising dividend growth stock.