Dividend.com analyzes the search patterns of our visitors each week. By sharing these trends with our readers, we hope to provide insights into what the financial world is concerned about and how to position your portfolio.

The list of trends this week is filled with banking stocks, which perhaps is not surprising given that their shares have risen following hawkish remarks by the Federal Reserve. Two Canadian banks, Toronto-Dominion Bank (TD) and Royal Bank of Canada (RY), have recently released their earnings results, while their peer from the neighboring country, Bank of America (BAC ), is trying to improve its balance sheet through asset divestitures. However, on the top of our list is McDonald’s (MCD ), a food stock that grabbed attention with its successful turnaround and headwinds from workers protesting low wages.

McDonald's: Turning it Around

Traffic to our page covering McDonald’s (MCD ) stock has increased 76% this week compared to last week, largely because the Big Mac seller has been in the spotlight with its annual meeting and protests among its workers, who seek higher wages. The company, which pays an annual dividend of 2.8%, is under pressure to increase minimum workers’ wages to $15 an hour from about $9 currently. In this sense, about 10,000 workers may have protested around the country, in addition to some picketing the company’s annual shareholder meeting several days ago.

The potential wage increases puts pressure on the company’s bottom line at a time when it is in the process of implementing a turnaround. Indeed, facing bleak prospects and fierce competition, the company announced a turnaround plan in mid-2015 under the then newly-appointed CEO Steve Easterbrook. The plan, which is still underway, is a combination of corporate changes and menu amendments that have so far proved to work. Its all-day breakfast menu has been a hit with the US consumers, and has considerably improved earnings. After a bad first half in 2015, the company had a stunning second half, seeing net income grow 23% and 10% in the third and fourth quarter, respectively. McDonald’s reported strong results in the first quarter of this year as well, with same-store sales rising 6.2%, proving once again that its turnaround is working. As expected, the stock has risen about 29% over the past year, beating the S&P 500 considerably, as well as many of its competitors, including Yum Brands (YUM ) and Shake Shack, down 8% and 54%, respectively. Year-to-date, the stock is up more than 4%.

Toronto-Dominion Bank: Prudency Paying Off

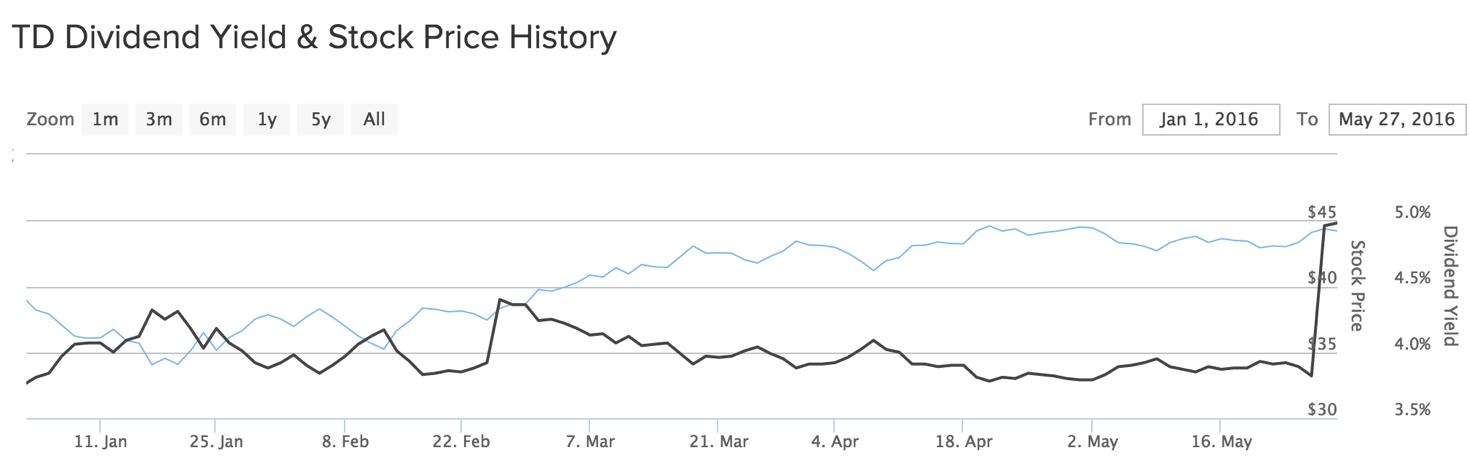

Viewership of our page tracking Toronto-Dominion Bank has risen about 24% week-over-week, since the company posted impressive results for the fiscal second quarter on May 26. The bank’s earnings increased over 10% compared to the same period a year ago, boosted by a significant profit jump from its retail operations in the United States and a stronger US dollar relative to its Canadian counterpart. Shares in the firm have risen more than 2% over the past five days, extending its year-to-date gains to nearly 13%.

The outstanding performance has taken place in a tough environment for banking stocks, with headwinds from low interest rates and struggling oil firms. Many banks have exposure to the energy industry through loans they provided during crude’s heyday. But luckily for Toronto-Dominion, its exposure to the sector is not significant: it has about 1% of total outstanding loans and is below its peers. The company is also benefitting from buoyant demand for credit in the United States and is expected to gain even more from rising interest rates in the neighboring country. The Federal Reserve has hinted that it is ready to raise interest rates for a second time, either in June or over the next months.

Royal Bank of Canada: Oil Drags

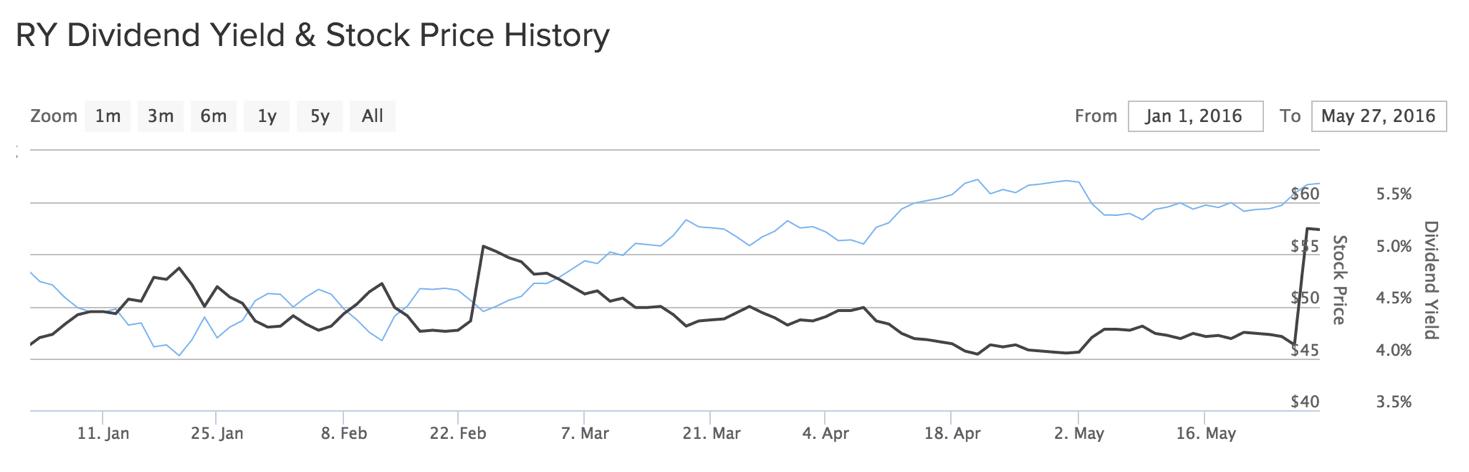

Royal Bank of Canada, a close peer of Toronto-Dominion, has seen its viewership rise over 26% week-over-week. Royal Bank released its financial results on nearly the same day as its competitor, but these results were not as shiny. While the company said earnings had risen about 3% compared to the same period a year earlier, its ratio of bad loans increased to 19% in the second quarter from the last one, largely because of soured credits to the oil firms. The stock has risen about 2% since the bank issued its report on May 26, expanding gains since the start of the year to more than 8%.

Down the line, the company could experience further impairments on its loan book, given its vulnerability stemming from the oil sector’s struggles. Royal Bank is Canada’s largest lender and has the second highest exposure to the oil industry, with about 1.6% of its portfolio consisting of loans to oil and gas firms.

Bank of America: Selling Off

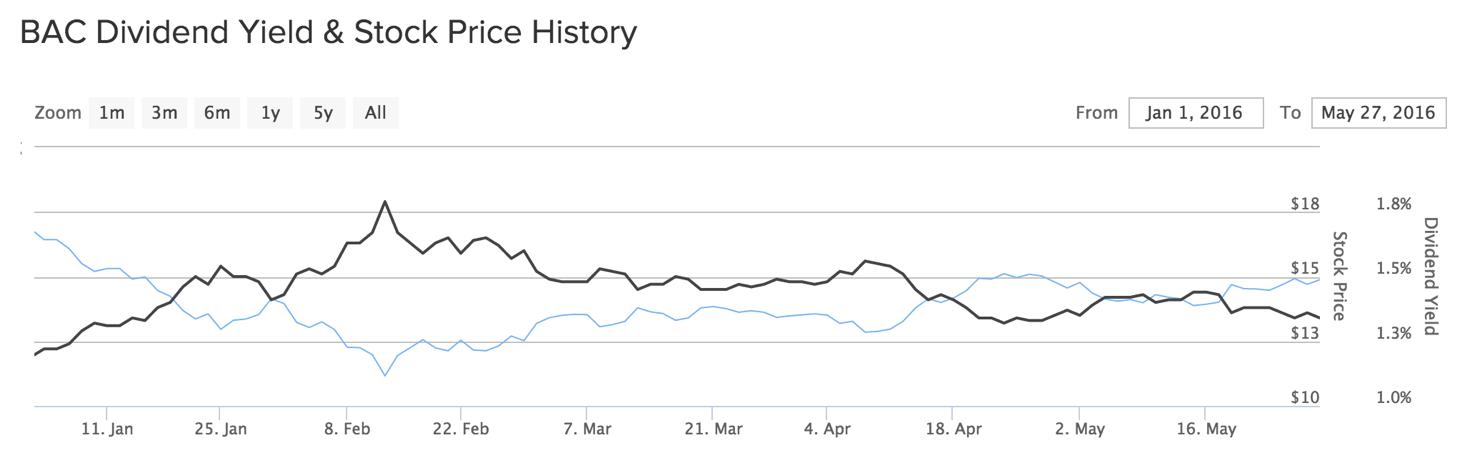

Unlike its Canadian peers, Bank of America (BAC ) has seen its stock drop over 11% since the beginning of this year, making it one of the worst performers among the big five US banks. Traffic to our Bank of America page is up 16% this week compared to the week-ago period, since the firm’s stock has rallied following the Federal Reserve’s minutes, which pointed to an increased possibility of a rate hike in June.

The stock could continue its ascent after investors digest the news that the bank has put MBNA, the UK’s largest credit card lender, for sale again. That would not be the first disposal of an international credit card business by the company in order to improve its balance sheet: in 2011, it sold its Canadian credit card business for $8.6 to Toronto-Dominion.

The Bottom Line

McDonald’s has taken the first spot in our list for its rising share price on the back of a successful turnaround and a 2.7% dividend yield. On the “banking” side of our top, two Canadian lenders are present in the list because of their relatively good performance in a tough environment, while Bank of America has been boosted by Federal Reserve’s hawkish comments.

By analyzing how you, our valued readers, search our property each week, we hope to uncover important trends that will help you understand how the market is behaving so you can fine-tune your investment strategy. We’ll share these trends at the end of the week, giving you better insight into the relevant market events that will allow you to make more valuable decisions for your portfolio.