When oil prices collapsed from over $100 per barrel at their peak 2014 levels, to as low as $27 per barrel at their 2016 lows, many Master Limited Partnerships had to cut or suspend their distributions. But for the most part, the damage was contained to the exploration and production MLPs. This has caused investors to widely shun even strong midstream MLPs like Enterprise Products Partners (EPD ).

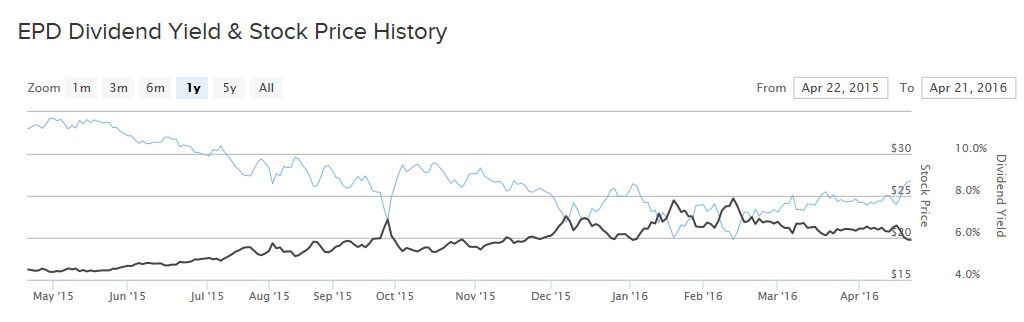

Enterprise Products’ unit price has declined significantly over the past year, along with the drop in commodity prices. But its fundamentals have held up relatively well when compared to many other stocks within the energy sector. Not only has Enterprise Products’ distribution survived the oil downturn, but the company has continued to raise its payout without interruption. On Apr. 11, Enterprise Products raised its quarterly distribution by 5% from the same quarterly payout last year.

Going forward, the new distribution rate will be $1.58 per unit on an annualized basis. This amounts to a nearly 6% yield based on the current unit price. That’s almost three times the average dividend yield in the S&P 500. As a result, Enterprise Products Partners is a very attractive income stock.

Fee-Based Model Fuels Steady Growth

Enterprise Products is engaged in the storage and transportation of oil, natural gas, and other refined products. Its first operating advantage is its huge network of high-quality assets. Enterprise Products is a giant in the midstream business. It owns and operates 49,000 miles of pipelines and 24 natural gas processing plants. It has the storage capacity for 250 million barrels of crude oil and natural gas liquids, as well as 14 billion cubic feet of natural gas storage capacity. This provides significant scale benefits.

Enterprise Products’ other key operating advantage is its fee-based business model. As a midstream firm, the company collects fees based on volumes of products being transported. As such, it is not highly reliant on the underlying commodity price to sustain its cash flow. As long as demand remains steady, as it has in the United States, the company can still generate enough cash flow to grow its distribution. Exports will also help keep demand steady. Last year, Enterprise Products generated $4 billion of distributable cash flow, which was a record for the company. Distributable cash flow is a non-GAAP metric often utilized by MLPs instead of traditional earnings per share. It describes how much cash an MLP generates above its capital expenditures, which can be distributed to unit holders. Enterprise Products’ underlying distributable cash flow covered its distribution by 1.3 times in 2015. This is what separates Enterprise Products from many of the upstream MLPs that have cut or suspended distributions in the past year.

A critical consideration to keep in mind is debt. Too high levels of debt are systemic throughout the MLP asset class. Overly leveraged balance sheets are largely why many MLPs like Kinder Morgan (KMI ) were forced to cut their dividends. Fortunately, Enterprise Products maintains a total debt-to-EBITDA ratio of 4.3—that is well below the midstream industry average. It appears the company’s debt is under control.

Dividend Growth Expectations

Enterprise Products has an amazing track record of uninterrupted distributions. The most recent raise marks the 47th consecutive quarterly increase—meaning the company has increased its payout each quarter for almost 12 years in a row. Looking back further, it is the 56th distribution increase since the company’s initial public offering in 1998. The new distribution rate will be $1.58 per unit on an annualized basis. This amounts to a nearly 6% yield based on the current unit price, which is almost three times the average dividend yield in the S&P 500.

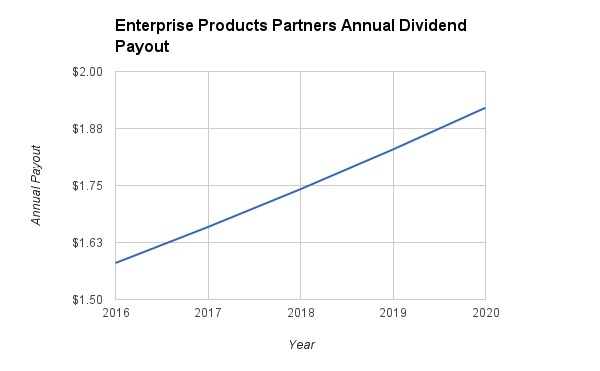

Going forward, investors should expect mid-single digit distribution growth to continue for many years, even if commodity prices remain at current levels. Enterprise Products has a large backlog of future expansion projects, which will add to cash flow growth once completed. For example, last year the company successfully completed $2.7 billion of organic growth projects that began commercial operations and generated new sources of cash flow during 2015. In 2016, it has another four major growth projects on schedule for completion in 2016, which will add to distributable cash flow next year and beyond.

This should provide Enterprise Products more than enough cash flow to sustain its current distribution and grow its payout each year in the near future. I am forecasting 5% distribution growth to continue on an annual basis. Under this scenario, Enterprise Products’ distribution will grow to $1.92 per unit by 2020.

The Bottom Line

Investors are very negative on the MLP asset class, as unit prices and valuations have come down significantly along with oil prices. But midstream MLPs are not like upstream MLPs. The critical difference is their business model. Enterprise Products has a much steadier stream of cash flow than E&P firms. This allows Enterprise Products to reward its shareholders with a high yield and a growing distribution each year. Investing in the energy sector these days requires a high-risk tolerance, but Enterprise Products could be worth the risk for its high-income potential.