Costco Wholesale Corporation (COST ) revolutionized its industry. The company completely disrupted the discount retail space, carving out significant market share thanks largely to its highly popular, and lucrative, membership program. In addition, the company has differentiated itself from major competitor Wal-Mart Stores (WMT ) with a much more positive public image for its better employee relations and cleaner stores.

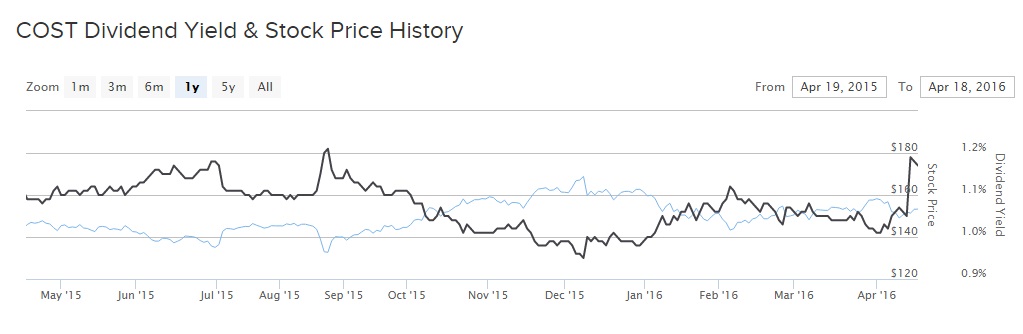

These factors have provided Costco with industry-leading sales and earnings growth over the past several years, which have translated into very high returns for shareholders. Costco has been one of the best growth stocks in the retail industry over a prolonged period of time. Reflecting its financial success and its commitment to rewarding shareholders, Costco recently raised its dividend from 40 cents to 45 cents per share. On an annualized basis, the new dividend rate is $1.80 per share, which results in a 1.1% dividend yield. The declared distribution is payable May 13, for shareholders of record April 29; the ex-dividend date is April 27.

Costco stock performed well over the past one year. Shares returned 6% in that time. Costco significantly outperformed the S&P 500, which was down 1%. While the company still has a relatively low dividend yield, making it less attractive for retirees as an income stock, it is an excellent dividend growth stock.

The Secrets of Costco's Success

This fiscal year has been a difficult one for Costco. Its growth is being negatively impacted by the strong U.S. dollar, which erodes revenue generated in the international markets, as well as lower gas prices. Costco sells gas at many of its stores. When oil prices declined, it was initially assumed that retailers like Costco would benefit, as consumers have more discretionary income. But U.S. consumers have used their gas savings primarily to increase their own savings and pay down debt, not spend more on retail items.

As a result, Costco’s comparable sales, a crucial metric for retailers that analyzes sales at locations open at least one year, was flat over the first half of fiscal 2016. However, Costco’s sales and earnings look much better when excluding the rising U.S. dollar and the impact of gasoline price deflation. Stripping out these cyclical factors, Costco’s total comparable sales would have increased 6%.

One of the most positive factors working in Costco’s favor is the continued success of its membership program. Costco enjoys extremely high customer loyalty (membership renewal rates stood at 91% in the U.S. and Canada and 88% worldwide). And the company increased new membership sign-ups by 4% last quarter, driven in part by its increasing penetration in the Executive Member offering. Executive Members account for two-thirds of membership-related sales. Overall membership revenue rose 4%, or 7% growth excluding the effects of foreign exchange.

These initiatives are particularly positive in the U.S., where Costco’s comparable sales excluding gas and currency rose 4% last quarter. This compares very favorably to the results of Costco’s major competitors, such as Wal-Mart. Wal-Mart’s Sam’s Club is a direct competitor to Costco, but Sam’s Club reported a 0.5% comparable store sales decline last quarter.

Why Investors Can Expect Strong Dividend Growth for Years

Despite the headwinds of a strong U.S. dollar and currency translations, Costco is still strongly profitable. The company earned $2.32 per share over the first half of the fiscal year. Its profits easily cover its dividend. Its new $1.80 per share dividend rate represents just 34% of its trailing 12-month earnings per share.

In addition, Costco has a strong balance sheet. It has a current ratio, a measure of current assets divided by current liabilities, of 1 times. That is a healthy level for a retailer. In addition, the company has ample liquidity with $4.8 billion in cash and short-term investments. Further, it has a manageable level of debt; its long-term debt to equity ratio is 43%.

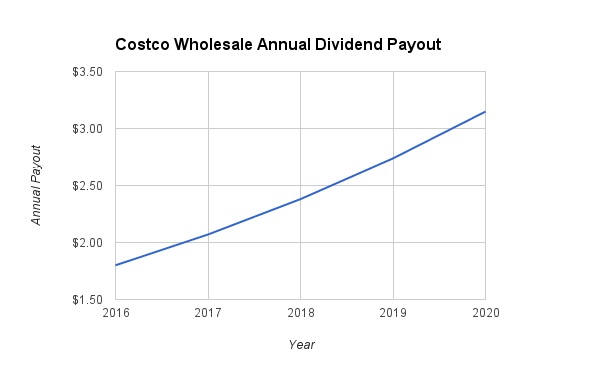

Costco has a highly profitable and growing business model, a strong balance sheet, as well as a low payout ratio. As a result, investors can expect Costco’s pace of high dividend growth to continue for many years. Over the past five years, the company increased its dividend by 13% per year, compounded annually. Going forward, its dividend growth should mimic this growth rate. Dividend.com is projecting that Costco will raise its dividend by 15% per year through 2020. Costco’s annual dividend will reach $3.15 per share under this scenario.

The Bottom Line

Costco is a very strong choice for dividend growth, although it is not a strong pick for high yield. In other words, the type of investor that should own Costco stock depends on the investor’s specific circumstances. Those with a longer time horizon, such as dividend growth investors, should be very bullish on Costco for its double-digit dividend growth potential. That being said, investors who desire current income, such as retirees, may want to buy different stocks with higher dividend yields.