There are few stocks with as impressive a dividend track record as consumer staples giant Procter & Gamble (PG ). On April 8, the company raised its dividend by 1%. The new annualized dividend rate is now 66.95 cents quarterly, or $2.678 annualized. This is the 60th consecutive annual dividend raise for P&G, which is a tremendous streak of dividend growth.

Only a few publicly traded companies have raised their dividends for 60 years or more. P&G’s amazing dividend record is the result of its fundamental business strength. The company has been in business for 178 years, sells its products in more than 180 countries around the world, and generates annual sales in excess of $70 billion.

However, P&G has seen its growth slow dramatically in recent years. Its huge portfolio of brands, which consists of flagship products such as Tide, Bounty and Gillette, is being weighed down by underperformers. This has compelled the company to enter a turnaround, characterized by a portfolio restructuring and the divestment of several low-growth brands deemed noncritical to the company’s future.

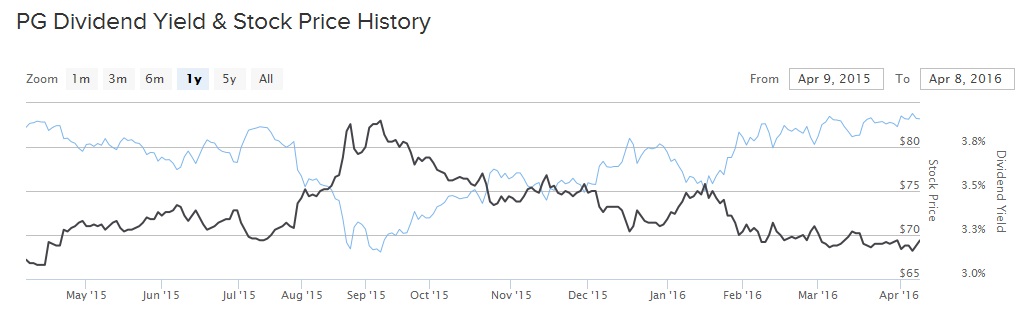

P&G’s turnaround has been a challenging one. Its revenue and earnings growth have suffered as a result, and its stock price was flat over the past year.

Get all the latest dividend increases in our payout tool available for premium members.

Storied Past, Uncertain Future

There is no doubting P&G’s credentials as one of the strongest dividend stocks in history. The company expects total dividend payments to shareholders of approximately $7.5 billion in fiscal year 2016. Assuming it meets this forecast, P&G’s total dividends paid over the past decade would come to nearly $60 billion. P&G has been paying a dividend for 126 consecutive years since its incorporation in 1890. But the past is no guarantee of future results, and in recent years, P&G has been hit by a number of headwinds, including slowing growth in several brands and the strengthening U.S. dollar, which has eroded growth for multinational companies.

As a result, the company’s total revenue declined 5% in fiscal 2015 to $76.3 billion, and diluted GAAP earnings per share from continuing operations fell 21% year over year. These problems lingered into fiscal 2016. Net sales and gross profit declined 10% and 6%, respectively, over the first half of the current fiscal year. In response, P&G decided to slim down in a massive way. It has sold off several well-known brands over the past year, including its Duracell battery brand, which it sold for $4.7 billion to Warren Buffett’s Berkshire Hathaway (BRK-B). In addition, P&G has sold 43 other brands, including Dolce & Gabbana, Gucci, Hugo Boss, Cover Girl, Max Factor, and Wella, to Coty (COTY) for $12.5 billion.

These divestments are the right strategy to take. Many brands, particularly Duracell, simply are not growing. Just consider that consumers are not buying batteries anymore to the extent they used to as an increasing share of consumer electronics do not require batteries. Another key aspect of the turnaround is cost cuts. P&G is planning to cut costs by $10 billion over the next five years. Much of this will be through job cuts. P&G has already cut more than 20,000 jobs since 2012.

But for a company as large as P&G, a turnaround of such significance will take more time to materialize. P&G expects to divest itself of a total of 100 brands when all is said and done. Going forward, investors should not expect P&G to resume double-digit dividend increases. It already maintains a 75% payout ratio and its turnaround is not yet complete.

Divestments Free Up Excess Cash

Many investors will probably be disappointed with P&G’s 1% raise. This came in well below its previous five-year compounded annual dividend growth rate of 6%; moreover, a 1% dividend raise is not enough to protect investor purchasing power against inflation. As P&G’s earnings stagnate, there is a tight ceiling on its ability to raise dividends.

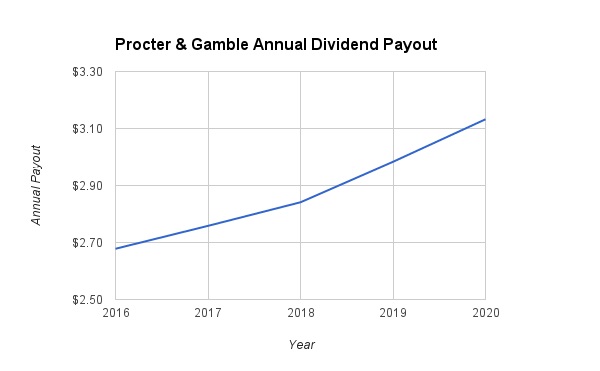

There is hope that future earnings will rise. With the proceeds of its product divestments, P&G expects to return $8-$9 billion in fiscal 2016 through share buybacks. That will help boost future earnings growth as fewer shares outstanding means each remaining share captures a higher percentage of earnings. With higher earnings, P&G’s payout ratio will decline to more reasonable levels, allowing more flexibility to raise the dividend. Since P&G has cut costs so significantly, and because of its billions of dollars in additional excess cash as a result of its divestments, it is likely the company will be able to accelerate dividend growth in the coming years. As a result, Dividend.com is forecasting 3% dividend growth in 2017 and 2018, followed by 5% dividend growth beyond through 2020. With that projection, P&G’s annual dividend will reach $3.13 per share by 2020.

The Bottom Line

P&G may not be a top stock pick for dividend growth investors, but it is still a very good choice for investors looking for high yield. It remains highly profitable, and its current dividend yield is approximately 50% above the average S&P 500 Index dividend yield. Furthermore, as interest rates remain near historic lows, bonds pay relatively little in yield. As a result, investors who desire current income, such as retirees, should still view P&G stock very favorably.