Biotech and healthcare have largely been out of favor post allegations by Hillary Clinton on price gouging by biotech firms and the ongoing Valeant Pharmaceutical saga. We analyzed 187 healthcare stocks that we track and found that there are a few green shoots in terms of excellent price performance and acceptable yields, payout ratios and earnings growth expectations.

Healthcare, largely viewed as a sector that’s generally insulated from economic turmoil, wasn’t considered ‘defensive’ by investors at the start of 2016 when the markets fell. In fact, healthcare is the 3rd worst performing sector as of today, as on average all stocks in the sector are down -20.62% after adjusting for outliers as highlighted in the chart below. The worst performing sector remains basic materials largely constituting oil & gas stocks followed by industrial goods which constitutes a lot of oil & gas refineries.

Below, we analyze 4 healthcare stocks that are near their 52 week highs.

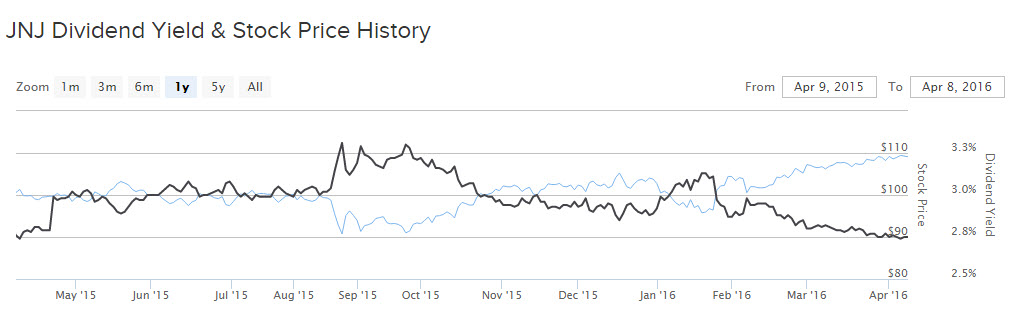

Johnson & Johnson

JNJ (JNJ ), a household name with a market cap of more than $300B, is leading the healthcare pack with outstanding stock price performance. A solid dividend payer yielding 2.75% is off just -0.67% from its 52 week high. JNJ has an EPS estimate of $6.51 for the current calendar year and is estimated to clock a 5.68% growth rate for next calendar year. Trading at a PE of 16.76 is above the industry average. However, the premium that JNJ commands can be accepted given its brand value and a history of having increased its dividend for 53 consecutive years. The stock has a payout ratio of 46% which is within the range of 35%-55%, which we consider as healthy.

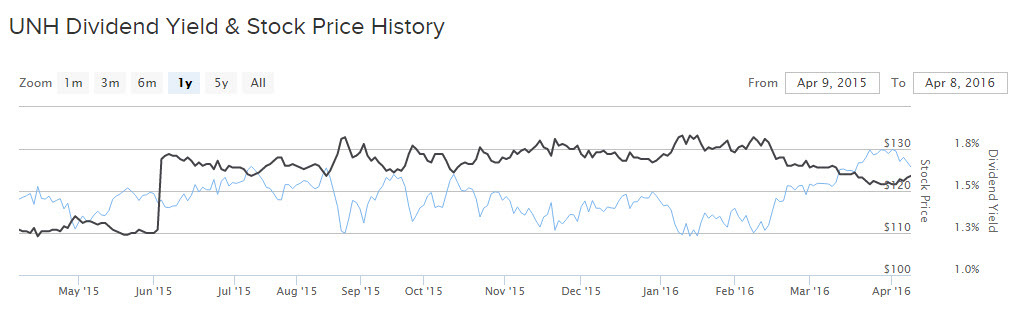

UnitedHealth Group

UNH (UNH ), with a market cap of $118B, is scorching the stock price performance charts as it’s up 6.8% YTD. The stock is off 4.14% of its 52 week high. The stock is expected to clock double digit earnings growth for next year. Current calendar year EPS estimates are $7.74, while next year’s estimates are $8.82, which results in a 13.95% growth. At a PE of 16.24, the company has an annual dividend of $2, which results in a 1.59% yield. The payout ratio is 25.82%, which is lower than our healthy range of 35%-55%.

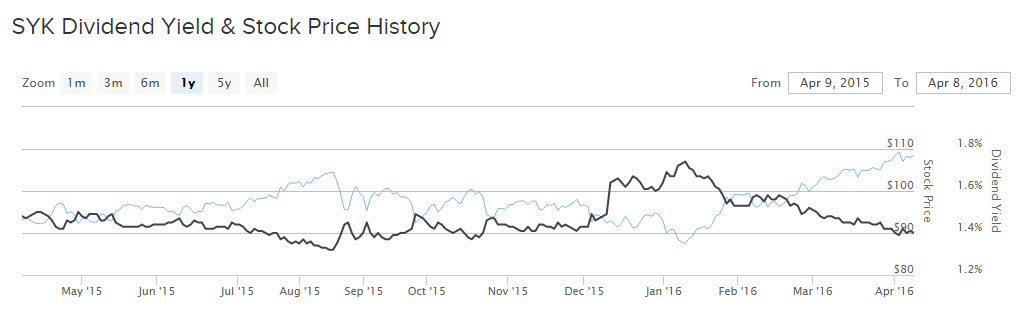

Stryker Corporation

SYK (SYK ), with a market cap of $40B, is another outperformer, as it’s off by only -1.14%. With an EPS estimate of $5.61 for the year and a growth estimate of 10% for the next year (2017 EPS estimate of $6.17), the company is on track to grow. The stock pays a dividend of $1.52 on an annualized basis and has a PE of 19.29 and a payout ratio of 27%. Its 1.40% yield is considerably lower than both the average in the sector and the other 4 stocks mentioned in this analysis.

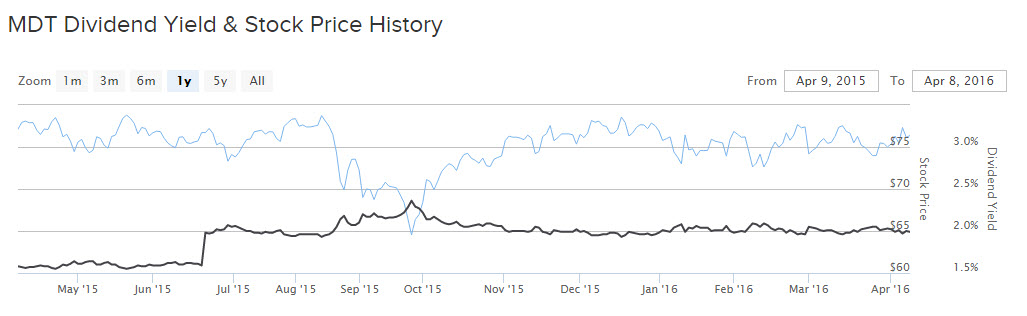

Medtronic PLC

Medtronic (MDT ), with a market cap of $107B, is off just 3.43% from its 52 week high. The stock has a basic EPS estimate for 2016 of $4.37 and an estimate of $4.69 for the next year. Yielding 2%, the company has consistently grown its dividend for 38 consecutive years. With a payout ratio of 35%, there is ample room for the company to grow its dividend

In this article, we go deep into Medtronic’s dividend; however, note that we say: MDT is overvalued in that analysis on a diluted EPS basis and not on a basic EPS basis.

The Bottom Line

Healthcare and biotech—currently overshadowed by political rhetoric and accounting irregularities—have thrown up a lot of buying opportunities. ‘Dumb Money’ ensured that those stocks which were perfect ‘buys’ also participated in the blood bath. The stocks mentioned above are rare outperformers in the sector and may be in a strong position when dumb money again starts viewing the sector positively.

Click here to read about 5 Technology Stocks near Their 52 Week Highs.