In a world of scarce resources, there is perhaps no resource more vital to human life than water. And, since water is a basic need, companies that engage in water distribution are about as safe a business model as one can find. The water utility industry is a niche industry within the broader utilities sector—but water utilities have all the qualities investors look for from utility stocks: specifically, resilient product demand, steady profits, and secure dividends.

As a result, investors interested in a reliable stock with a rock-solid business model should consider the publicly traded water utilities. After all, demand for water is not going to decline. And, due to a combination of population growth, economic growth, and periodic rate increases, there’s plenty of room for these stocks to continue rewarding investors for many years to come.

This article will discuss why American States Water (AWR ) could be an attractive dividend stock for income investors.

Resilient Business Model

Perhaps the biggest reason why American States Water has raised its dividend for more than 60 years in a row is because of its recession-resistant business model. Founded in 1886, American Water Works is the largest publicly traded U.S. water and wastewater utility company. It provides water service to approximately 260,000 customers across 10 counties in California. It also distributes electricity to approximately 24,000 customers.

Like electricity, water is a virtual necessity to sustain society. American States Water operates in a highly recession-resistant industry, which also enjoys a wide economic moat, a popular term coined by legendary investor Warren Buffett. A strong economic moat refers to a business model that has sustainable competitive advantages which limit the risk of competitors taking away market share.

The business is also not very volatile. Since the economics of water usage are stable from year to year, American States Water is not a volatile stock. Its beta value is just 0.8, meaning the stock moves only 0.8% for every 1% move in the S&P 500 Index. American States Water is less volatile than the overall stock market, which is a positive feature for risk-averse investors. Those who need stable income without a volatile stock price, such as retirees, may find American States Water to be an attractive stock pick.

Plus, regulated utilities have another operating advantage—they can pass through modest rate hikes each year, which all but ensures steady earnings growth. Approximately 79% of American States Water’s revenue comes from its regulated business. This allows for steady dividend growth each year. American States Water recently increased its dividend by 5%.

Fundamentals Support Dividend Growth

American States Water generates stable profit and modest, reliable earnings growth from year to year. It projects $2.55 to $2.65 per share in operating earnings this year, which would be right in line with management’s long-term objective of 7%-10% annual operating earnings growth.

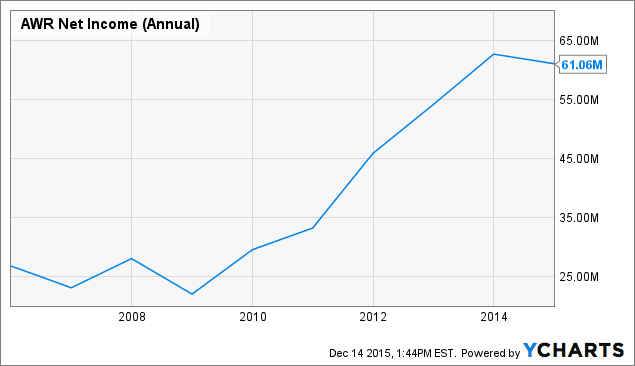

From the following chart, it is clear that American States Water has successfully grown its profitability for many years.

This allows the company to pay dividends each year like clockwork. American States Water provided investors with dividend payments every year since 1931 and has increased its payout each year since 1954.

The Company has provided investors with more than 300 consecutive quarterly dividend payments without interruption, and it has increased its payout for an amazing 61 years in a row. American States Water’s current annualized dividend of $0.90 per share represents a 2.25% yield. This yield level is approximately 12% above the S&P 500 average dividend yield.

American States Water grew earnings per share by 5% through the first three quarters of 2015, year-over-year, thanks to favorable rate increases and the effects of a higher customer base. Its earnings also benefited from lower expenses, and fewer shares outstanding due to the company’s stock buyback program.

Going forward, there should be plenty of room for continued dividend growth on an annual basis. Analysts, on average, expect the company’s earnings per share to rise 6% next year. American States Water’s current annualized dividend represents 55% of the company’s trailing 12-month earnings per share. That is a comfortable payout ratio, which describes how much a company distributes in dividends to shareholders, as a percentage of earnings. A 55% payout ratio leaves enough room to continue reinvesting back into the business to produce future growth.

In addition, American States Water has a strong balance sheet. The company’s current ratio is 1.33 times, which implies satisfactory near-term liquidity. Moreover, its long-term debt to equity ratio is 69%, which is in-line with its industry peer group. As a result, investors should view American States Water’s financial position positively.

The Bottom Line

Water is a finite resource and one that the human race needs to survive. As a result, water utilities provide an excellent alternative within the utility sector. Like electric utilities, water is something that consumers will utilize in a good economy or bad. And, also like electric utilities, water utilities are able to pass on gradual rate increases to their customers. If you’re weary of the same old electric utilities, water utilities could be a great way to diversify your holdings, while still enjoying the reliable results that utility investors count on.

One of the most popular sectors of the stock market for dividends is the utility sector. Within utilities, one group that does not get much attention is the water utility industry. But investors should not overlook water utilities. Thanks to modest population growth, economic growth, and annual rate increases, American States Water’s earnings should rise gradually over time, which should then lead to mid-single digit dividend growth as well. As a result, income investors looking for secure, above-average dividend yields should consider water utilities like American States Water.

Click here to find out everything about another Water Utilities Company that has 200 consecutive years of dividend payment.