Over the course of 2015, precious metals prices declined significantly—as did several other types of commodities, including prices of oil, silver, copper, steel and others. As a global commodity powerhouse, this has significantly affected BHP Billiton Limited (BHP ). BHP is one of the world’s biggest commodity producers. It has a global reach and operates across several areas of commodities, including iron ore, petroleum, coal and copper.

BHP is in an extremely difficult financial position. Shares of BHP have declined 38% this year, a far worse performance than the S&P 500.

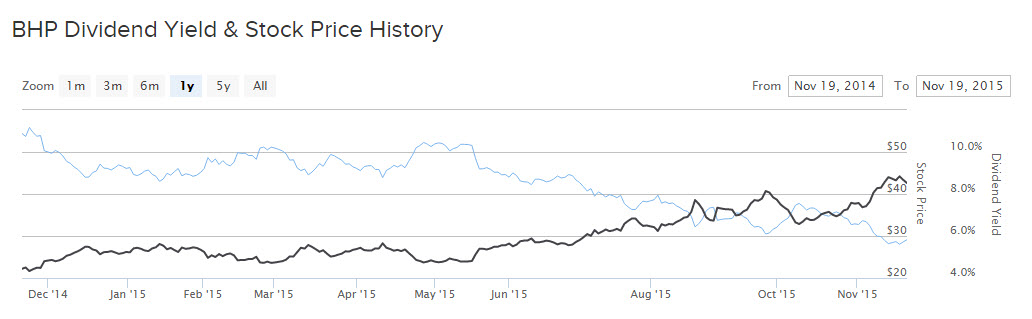

And yet, the company continues to raise its dividend, even though the yield is already very high given its steep decline in stock price and earnings. This raises the question whether BHP’s dividend policy is in the best interest of the company and its shareholders.

Year in Review: 2015

BHP pays a semiannual dividend. For the full year 2015, BHP will distribute $2.48 per share which equates to an 8.5% yield based on its current stock price. BHP took the unusual step of raising its dividend by 2.5% this year, at a time when virtually all other mining stocks have cut their own dividends.

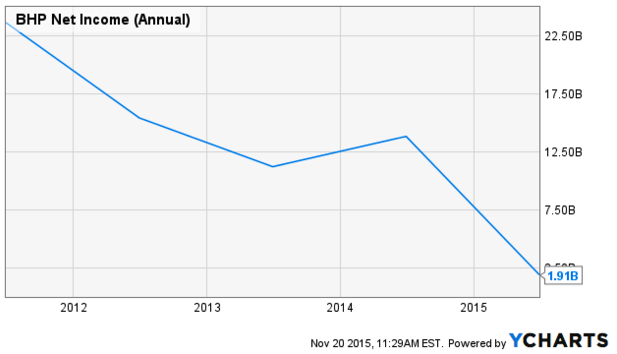

As 2015 draws to a close, it is useful to analyze BHP Billiton’s dividend in the context of its broader financial performance. This is the perspective through which investors can see why continuing to raise its dividend may not be in the best interest of the company or its shareholders. The crash in commodity prices has been a great strain on BHP’s financial health. For the full fiscal year, BHP’s revenue declined 22%, and earnings declined 86%, year-over-year.

This has placed a great strain on the company’s balance sheet. BHP now carries $27 billion in long-term debt and just $6 billion in cash on the balance sheet. The deterioration in BHP’s earnings and balance sheet is entirely due to falling commodity prices. During 2015, BHP’s realized price of oil, natural gas, copper and iron ore declined 33%, 13%, 14% and 41% respectively, versus the previous year. This has had a disastrous effect on profitability, made worse by the decision to keep production ramping up.

One of the biggest headwinds facing BHP is its decision to increase production while commodity prices are falling. For example, BHP has increased production of iron ore by 7% so far this year. This practice has helped boost revenue, but as prices decline, it is hurting margins. Producing at a loss is not a prosperous economic decision. At some point, BHP should consider reducing production. A supply response from the precious metals and natural resource industries may be the only catalyst to get commodity prices rising once again.

To be sure, BHP is being proactive in reducing capital expenditures. This is a very important step to ensure future dividends will be covered with underlying cash flow. BHP’s capital expenditures were cut 24% in fiscal 2015. Going forward, management plans another 23% reduction in the current fiscal year to $8.5 billion in capital spending. This is a positive development, but further action may be necessary since BHP’s dividend is still not likely to be covered by sufficient profitability.

Conclusion: BHP Billiton Should Review its Dividend Policy

BHP Billiton management is trying to soothe investors’ fears that the company is in distress, by continuing to raise its dividend during this difficult climate for natural resource companies. But the market has clearly not been convinced, as BHP’s share price continues to decline at a concerning rate. A better way to convince the market of its sound financial position would be to freeze its dividend, or perhaps lower the dividend, to improve its financial condition.

BHP should consider lowering the dividend to a rate that is in-line with earnings. As earnings have deteriorated this year, BHP is diluting its existing shareholders by issuing capital to finance its dividend. BHP carries a 310% dividend payout ratio, as a percentage of earnings, according to Dividend.com (note: Dividend.com payout’s are forward looking in nature). This is an unsustainable scenario.

Investors are not as pleased with BHP’s 8.5% yield as they are concerned about the state of the company’s finances. If commodity prices remain low, BHP is at significant risk. This is why the stock price continues to decline, even though the company keeps raising its dividend. BHP should consider reducing its dividend, perhaps by 25%-50%, to protect the long-term health of the business. The market is sending BHP a clear signal that the dividend is less important than the ongoing viability of the business and management needs to listen.