In this weeks trends, we weigh the conundrum between the payout of “boring” stocks with attractive dividends versus attractive stocks with “boring” dividends.

Introduction

The analysts here at Dividend.com analyzed the search patterns of visitors to our site during the past week ending September 25. Below, we give an analysis of how intelligently users used Dividend.com to help them in their investment decision-making process.

Short the story on page A1 and go long the story on page C16, making its way onto page A1 goes the old Wall Street saying.

In this week’s dividend trends, we saw two “page C16” utility companies trending and two high profile “Page A1 stocks”, along with a dividend stalwart whose cost cutting worked as it increased its dividend.

McDonald’s: I’m Lovin’ its Dividend

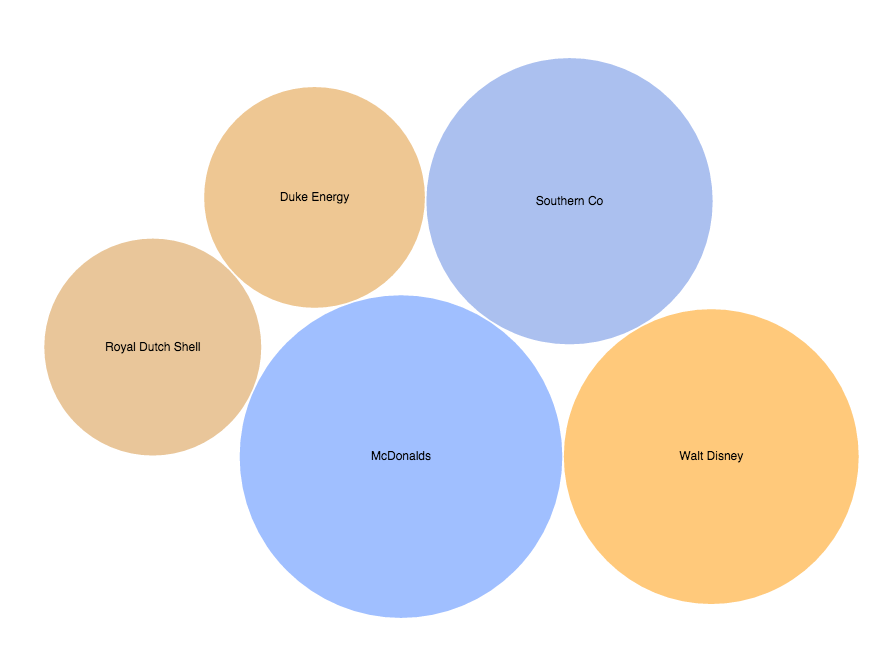

McDonald’s increased its dividend by 5% as the stock finally broke out over $100. Cost cutting, closing underperforming restaurants and launching new restaurants has strategically worked well for the company.

In this article, we have analyzed their turnaround and why it remains a top dividend pick.

Check out all the Best Restaurant Dividend stocks here.

Walt Disney and “The New Age Economy”

Walt Disney—the high-flying media company with business segments such as media networks, parks and resorts, studio entertainment, consumer products and interactive media—was trending this week as we saw a 36% jump in traffic to its ticker page.

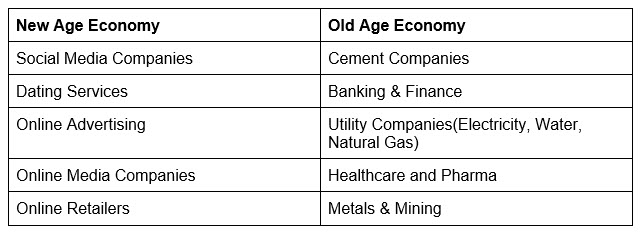

Most “New Economy” businesses are fancy and are revolutionizing the way a product or service is delivered. Take the disruptive streaming service providers Netflix and Amazon who have almost doubled their revenue in the past five years, but are still struggling to maintain a consistent profit. What’s common between them and Walt Disney? They all have attractive businesses, are in the news a lot more than “old economy businesses” but—the most important commonality for dividend investors—their dividends are very boring. Walt Disney has a yield of 1.14% while Netflix and Amazon don’t pay dividends at all.

Most of the “New Age” Economy businesses are “Story Stocks”. The world can still survive without their services, at least at present.

Here is an extract from our “Why Doesn’t Social Media Pay Dividends” where we found the time period it took for today’s dividend stalwarts to finally start paying one after they went public.

Microsoft (MSFT )

IPO’d in 1986 and paid its first dividend in 2004. It took 18 years before investors began receiving dividends on their capital investments.

IBM (IBM )

Listed in 1913 and paid its first dividend that year. IBM has been paying a dividend ever since, making it one of the strongest dividend performers of all time.

Apple (AAPL )

IPO’d during 1980 and paid its first dividend in 2012, making it 32 years before investors began receiving dividends.

Oracle (ORCL )

IPO’d during 1986 and paid its first dividend in 2009, making it 23 years before investors received dividends.

They were new age back then. NOW? Not so much.

Southern Company & Duke Energy

Classic examples of “Old Economy businesses”. Southern Co is a utility company that sells electricity through their four traditional operating companies, including Alabama Power, Georgia Power, Gulf Power and Mississippi Power in the southeastern states.

Duke Energy is classified as its competitor and has business in 3 major segments: Regulated Utilities, International Energy and Commercial Power. Southern and Duke are companies that are in the 17-20 PE range, have market caps between $40 Billion to $50 Billion, have exactly the same dividend yield of 4.90% and have bottom lines of $2 Billion and $2.4 Billion respectively.

Both are consistent dividend payers (more than 15 years). After all these positives, why don’t we hear their name in the media as much as Facebook or Amazon or Netflix? Because selling and managing electricity is not a fancy news item that would drive clicks. One doesn’t particularly get excited about selling electricity, but they have a pretty exciting dividend. This is a page C16 company that might never make it on page A1.

Savvy dividend investors using dividend.com however, have always shown interest in both these ticker pages as traffic jumped more than 30% for these two ticker pages last month.

Defensive Companies, Old Age Economy Business, Boring Businesses, never in the news, very very low beta’s make a perfect recipe for smart dividend investors.

Royal Dutch Shell

There may be many reasons why this could be trending.

- Out of fear: Investors in Royal Dutch Shell might be querying it to find out how dismally low its share price is going (almost near its 2008 lows now!)

- Dividend Trap: This ADR currently yields 7.77% and could be a dividend trap as the yield looks high due to a drop in share price and not due to a rise in dividend.

- Bargain: 2008 lows could be a BUY signal for the contrarian who feels that oil might rebound.

If you have a hunch why this ticker page is trending then give us a shout at Twitter (at)dividenddotcom or email us at contact(at)dividend.com.

The Bottom Line

We at Dividend.com know how technology is interwoven in our daily lives. Dividend.com has become a central source of information for all things dividends on Wall Street. By analyzing how you, our valued readers, search our property, we hope to uncover important trends that help forecast stock market performance. Every Friday, we’ll share these search patterns for the week that went by in order to assist you in making insightful decisions for your portfolio.