Specialty coffee retailer Starbucks Corporation (SBUX ) has enjoyed tremendous returns for shareholders this year. The stock is up 52% year-to-date, while the S&P 500 Index is up just 1% in the same period.

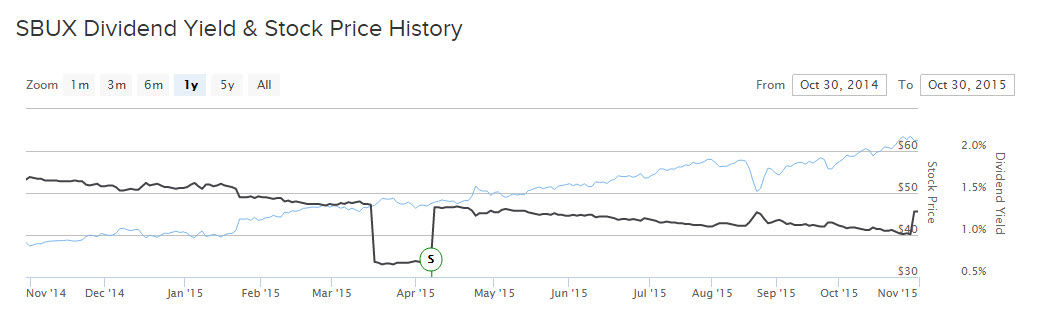

Starbucks recently concluded fiscal 2015 and reported record financial results for the full year. Along with its earnings report, the company announced a huge 25% dividend increase. Still, Starbucks’ dividend yields just 1%, which blunts the impact of even a large dividend increase. And, the stock trades for 34 times trailing earnings, a signal that the stock could be overvalued. Below, Dividend.com has applied the Dividend Discount Model analysis to Starbucks to help determine fair value for the stock.

Record Financial Results Fuel Dividend Increases

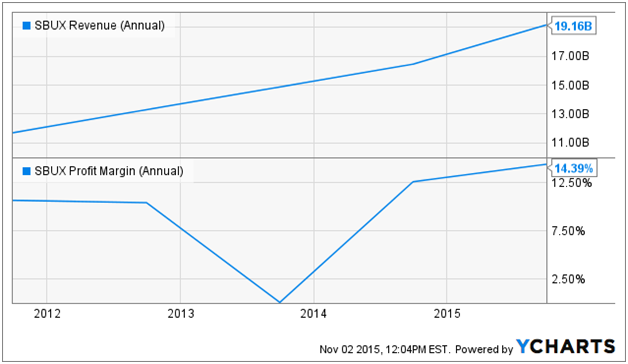

In order for a company to raise its dividend, it needs a corresponding increase in revenue and profits to sustain higher dividend payouts. In Starbucks’ case, the company enjoyed a record financial performance last year. The key drivers for Starbucks are growth in customer traffic and price increases. This helped comparable sales, a measure of sales at store locations open at least one year, rise 7% in fiscal 2015. Comparable growth in the Americas reached 7% last year, driven by 3% growth in customer traffic. Comparable sales rose 9% in China/Asia Pacific, due to an 8% increase in traffic.

For the full year, earnings per share reached $1.82, representing 35% growth year over year. Starbucks opened 1,677 new stores in the recently concluded fiscal year, ending the year with more than 23,000 stores spread across 68 countries. Starbucks enjoys tremendous pricing power, which allows the company to charge more for its products each year. This flows directly to the bottom line and explains why the company can manage increases in both sales and margins.

This gave Starbucks more than enough financial flexibility to increase its dividend.

Using the Dividend Discount Model for Valuation

One frequent method for performing valuation on a stock is the Dividend Discount Model. This model is popular for determining fair value of dividend stocks. The model incorporates future dividend growth estimates and discounts those future dividends back to the present in order to gauge whether a stock is undervalued or overvalued. Since estimates rely on assumptions, it is critical for investors to use realistic assumptions to come up with a reasonable result.

The first necessary calculation is the cost of equity capital. This is how much it costs a company to issue equity, and is determined by the Capital Asset Pricing Model, or CAPM. This calculation takes into account the risk-free rate, a stock’s beta value, and a market risk premium. Using the 10-Year U.S. Treasury bond’s 2.1% yield as the risk-free rate, Starbucks’ 0.82 beta value, and an 8% market risk premium, the cost of equity for Starbucks is 8.8%.

The next step is to estimate a firm’s future dividend growth. Including the 25% increase, Starbucks has raised its dividend by 25% compounded annually. This is a very aggressive rate of dividend growth, which may not be sustainable into perpetuity. That being said, Starbucks maintains a fairly conservative dividend policy. Including the new annualized dividend rate of 80 cents per share, Starbucks still distributes just 43% of its trailing 12-month earnings per share. This is a low payout ratio, and Starbucks earnings are likely to grow in future years.

As a result, we see the potential for 10% earnings growth over the next five years. On the dividend, we see potential for 20% dividend growth next year, and dividend growth leveling off to 10% over the following four years, which will keep the payout ratio below 50%. Into perpetuity, we are taking a modest assumption of 7% perpetual dividend growth.

Consequently, here is what the next five years of earnings and dividends would look like.

| 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|

| EPS (GAAP) | $2.00 | $2.20 | $2.42 | $2.66 | $2.92 |

| Dividend per share | $0.96 | $1.05 | $1.16 | $1.27 | $1.40 |

| Payout Ratio | 48% | 47% | 47% | 47% | 47% |

The Bottom Line

Incorporating all of the inputs listed above, the Dividend Discount Model provides a fair value estimate of $53.30 per share. Starbucks stock currently trades for $62 per share. This implies the stock is currently overvalued by approximately 16%. The view that Starbucks could be overvalued is supported by peer analysis.

As previously mentioned, the stock trades for 34 times earnings, while the S&P 500 Index trades for 19 times earnings. Within Starbucks’ peer group, competitor Dunkin’ Brands (DNKN ) trades for 25 times earnings. Therefore, there is reason to think Starbucks’ stock may be overvalued, and the dividend discount model backs this up.