This year has been very difficult for Wal-Mart Stores, Inc. (WMT ) and its stock price.

Wal-Mart’s earnings throughout the year have failed to meet analyst forecasts. Sales growth is slowing due to multiple challenges, including the strengthening U.S. dollar and intense competition in retail. And the company’s annual investor meeting presentation failed to please investors.

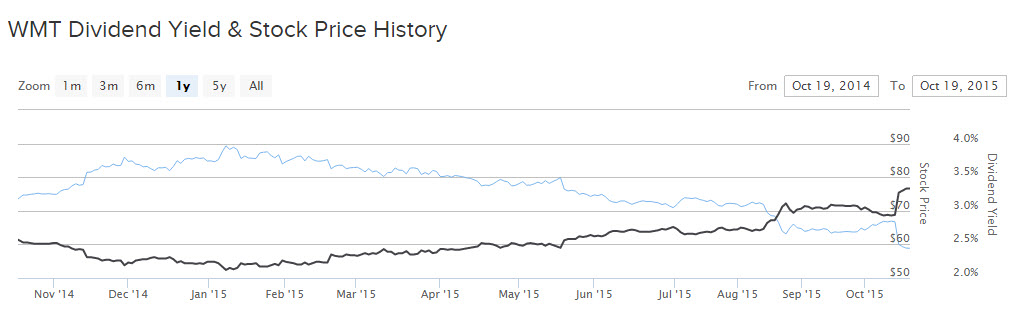

Wal-Mart told investors it will spend billions on renovating stores, raising employee wages, and new avenues for growth such as e-commerce. The announcement is expected to cause the company’s earnings to decline for several more years. It’s also likely to have an impact on its dividend growth, which has slowed down in tandem with its earnings growth. Still, Wal-Mart’s 3.3% dividend remains attractive, and there is still room for dividends to grow going forward.

Elevated Spending, Slowing Sales Cause Earnings to Decline

Wal-Mart does not expect to grow sales this year, which is a meaningful reduction from the company’s prior forecasts for 1-2% growth in net sales. In addition, management expects earnings to decline this year and not grow until 2019. This is a direct result of Wal-Mart’s higher investments in raising employee wages and new growth opportunities. For example, the company expects to spend $1.2 billion on increasing employee wages and another $1.1 billion in costs related to building its e-commerce and mobile businesses. As a result, WMT expects earnings to fall 6-12% next fiscal year, and does not expect earnings to recover until fiscal 2019, when it projects 5-10% growth. But these investments are necessary for long-term growth, and the preliminary results indicate the strategy is viable.

Wal-Mart’s investments are already paying off in its small-store format and its e-commerce business. E-commerce revenue grew 16% last quarter, year-over-year, on a constant-currency basis. Separately, the small-store banner Neighborhood Markets grew comparable sales, which measures sales at locations open at least one year, by 7% last quarter. Wal-Mart has opened more than 350 Neighborhood Markets in the past two years and will continue to see a boost as it plans to open another 160-170 smaller stores this fiscal year.

As a result, it makes sense for Wal-Mart to continue investing aggressively in the strategic imperatives that will produce long-term growth, even though that spending will negatively impact earnings in the short-term.

Dividends Should Continue to Grow

In the trailing 12-month period, Wal-Mart generated $4.79 per share of earnings. Its dividend represents $1.96 per share. Consequently, the company maintains a 40% dividend payout ratio, a modest multiple. The fact that Wal-Mart distributes less than half of its earnings per share is a testament to the company’s earnings power as well as its conservative financial management practices as they pertain to the dividend. With a 40% payout ratio, Wal-Mart should be able to continue increasing the dividend. Wal-Mart is also a member of the Dividend Aristocrat list, having increased its dividend for 42 years in a row.

Over the past five years, Wal-Mart’s annualized dividend has increased from $1.21 per share to $1.96 per share. That represents a 10% compound annual growth rate in that time. Even if WMT’s earnings decline by 10% in fiscal 2016, remain flat in fiscal 2017 and 2018, and grow by 7% in fiscal 2019, which is roughly at the midpoint of management’s forecast, the company could still grow its dividend by 5% per year and maintain a healthy 50% payout ratio by 2019. Here is a projection of dividends with those assumptions:

| Projections | FY 2016 | FY 2017 | FY 2018 | FY 2019 |

|---|---|---|---|---|

| Projected Earnings per Share | $4.31 | $4.31 | $4.31 | $4.74 |

| Projected Dividends | $2.05 | $2.16 | $2.27 | $2.38 |

| Projected Payout Ratio | 47% | 50% | 52% | 50% |

The Bottom Line: Dividend Is Secure, Long-Term Growth Catalysts Remain Intact

Wal-Mart’s plan to spend more on its employees, stores, and new growth avenues are necessary investments. The retail industry is intensely competitive and the company has lost ground in recent years to rivals such as Amazon (AMZN), which dominates online retail. Within its core discount retail business, close rival Costco (COST ) has taken market share as it enjoys a better reputation among consumers for the quality of its goods and for the perception of better treatment of its employees.

Wal-Mart is highly profitable and generates more than enough cash flow to accomplish all of its goals. It can easily afford to invest more in its e-commerce business and higher employee wages and also continue to raise its dividend each year. Wal-Mart is simply doing what needs to be done to compete in the new age of retail. Its investments may pave the way for stronger earnings growth over the long term, which will of course be positive for dividend growth. As a result, long-term income investors should continue to view Wal-Mart as an attractive dividend stock.