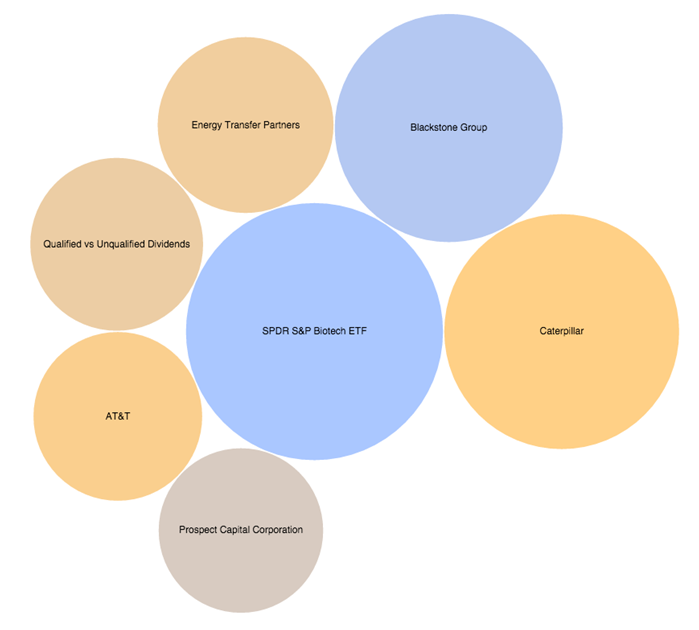

The analysts here at Dividend.com analyzed the search patterns of visitors to our site during the past week ending October 2, 2015. Below we give an analysis of how intelligently users used Dividend.com to help them in their investment decision-making process.

SPDR S&P Biotech ETF

Biotech was further smashed last week due to fears of a bubble burst in the sector. The decline was compounded by Hillary Clinton’s tweet, and as such, there are now several stocks with attractive valuations. Gilead (GILD ), Amgen (AMGN ), Biogen (BIIB) and Celgene (CELG ) have sold off sharply, making their valuations attractive.

Below are the forward-looking estimates for those four biotech stocks on which analysts and fund managers are bullish in the current sell-off.

Gilead Sciences

| Earnings Estimate | Current Quarter Sept. 2015 | Next Quarter Dec. 2015 | Current Year Dec. 2015 | Next Year Dec. 2016 | |

|---|---|---|---|---|---|

| Average Estimate | 2.81 | 2.82 | 11.65 | 11.6 | |

| Number of Analysts | 18 | 18 | 21 | 21 | |

| Low Estimate | 2.6 | 2.41 | 11.06 | 9.73 | |

| High Estimate | 3.08 | 3.66 | 12.37 | 14.45 | |

| Year-Ago EPS | 1.84 | 2.43 | 8.09 | 11.65 |

Amgen

| Earnings Estimate | Current Quarter Sept. 2015 | Next Quarter Dec. 2015 | Current Year Dec. 2015 | Next Year Dec. 2016 |

|---|---|---|---|---|

| Average Estimate | 2.38 | 2.33 | 9.76 | 10.74 |

| Number of Analysts | 17 | 17 | 20 | 20 |

| Low Estimate | 2.29 | 2.22 | 9.62 | 10.12 |

| High Estimate | 2.49 | 2.46 | 10 | 11.75 |

| Year-Ago EPS | 2.3 | 2.16 | 8.7 | 9.76 |

Biogen

| Earnings Estimate | Current Quarter Sept. 2015 | Next Quarter Dec. 2015 | Current Year Dec. 2015 | Next Year Dec. 2016 |

|---|---|---|---|---|

| Average Estimate | 3.88 | 4.03 | 15.9 | 17.83 |

| Number of Analysts | 20 | 20 | 22 | 22 |

| Low Estimate | 3.62 | 3.8 | 15.53 | 16.41 |

| High Estimate | 4.61 | 4.54 | 16.86 | 21.48 |

| Year-Ago EPS | 3.8 | 4.09 | 13.83 | 15.9 |

Celgene

| Earnings Estimate | Current Quarter Sept. 2015 | Next Quarter Dec. 2015 | Current Year Dec. 2015 | Next Year Dec. 2016 |

|---|---|---|---|---|

| Average Estimate | 1.21 | 1.28 | 4.8 | 5.96 |

| Number of Analysts | 19 | 19 | 21 | 21 |

| Low Estimate | 1.11 | 1.13 | 4.59 | 5.19 |

| High Estimate | 1.34 | 1.39 | 4.9 | 6.72 |

| Year-Ago EPS | 0-97 | 1.01 | 3.71 | 4.8 |

Caterpillar May Cut 10,000 Jobs through 2018

Caterpillar (CAT ) was trending this week as the stock hit a 52-week low of $62.99 on September 29. For 2016, the company expects sales to be 5% below 2015 levels, with declines across all three major segments viz. resource industries, construction industries, and energy and transportation. The reductions are part of a corporate restructuring that the company believes will lower operating costs by about $1.5 billion annually once implemented.

Blackstone Group: World’s Largest Real Estate Investment Fund

Blackstone Group is another stock that has puked in the current sell-off, amidst which they have raised a record $15.8 billion for global real estate investments. Blackstone’s real estate group has a record $92 billion in AUM. The global real estate fund is headed by Jonathan Gray, considered a possible successor to Chief Executive Officer Steve Schwarzman.

Energy Transfer Partners

Energy Transfer Partners is an MLP currently yielding 10%. That being said, it’s important to know that an investor shouldn’t gravitate towards stocks that have high yields as they may turn out to be dividend value traps.

Click here for a complete analysis of how to spot dividend value traps.

Qualified vs. Unqualified Dividends

This week investors were curious about qualified and unqualified dividends.

Some examples of dividends that are unqualified, and thus do not qualify for the tax preference, are those paid out by:

- Real estate investment trusts (REITs).

- Master limited partnerships (MLPs).

- Dividends paid on employee stock options.

- Dividends paid by tax-exempt companies.

- Dividends paid on savings or money market accounts.

Those that do qualify for the tax preference have this structure:

| Ordinary Income Tax Rate | Ordinary Dividend Tax Rate | Qualified Dividend Tax Rate |

|---|---|---|

| 10% | 10% | 0% |

| 15% | 15% | 0% |

| 25% | 25% | 15% |

| 28% | 28% | 15% |

| 33% | 33% | 15% |

| 35% | 35% | 15% |

| 39.60% | 39.60% | 20% |

To find out if you’re eligible for a qualified dividend, click here.

AT&T

With a beta of 0.38, AT&T (T ) is a classic dividend stock. The 52-week range for this stock has been 30.97 – 36.45, yielding close to 6%. No wonder it passes Kevin O Leary’s OUSA stock screening methodology and features in OUSA’s top ten holdings.

Prospect Capital Corporation

Prospect Capital Corporation was trending as the monthly dividend stock announced that it will begin trading ex-dividend on September 28, 2015. A cash dividend payment of $0.08333 per share is scheduled to be paid on October 22, 2015. This is the ninth consecutive time that PSEC has paid the same dividend. The stock currently yields 12.71%.

Here are 754 stocks that are all monthly dividend payers.

The Bottom Line

We at Dividend.com know how technology is interwoven in our daily lives. Dividend.com has become a central source of information for all things dividends on Wall Street. By analyzing how you, our valued readers, search our property, we hope to uncover important trends that help forecast stock market performance. Every Friday, we’ll share these search patterns for the week that went by in order to assist you in making insightful decisions for your portfolio.