Performance

Lockheed Martin (LMT) is the largest defense contractor in the United States. It has a balanced portfolio that services the Army, Navy, Air Force, and IT programs. LMT’s most important project is the F-35 program, which by itself accounted for 17% of total revenue last year. It is a highly successful program and one of the reasons Lockheed Martin stock has performed so well in recent years. Shares of LMT have risen 5% year-to-date, outperforming its peer group in that time. As a comparison, the iShares U.S. Aerospace and Defense ETF (ITA) is down 5% since the beginning of 2015.

Earnings

Lockheed Martin stock has outperformed because its fundamentals have improved over the past year. Specifically, LMT’s earnings and cash flow have risen year over year, and it’s second-quarter results beat average analyst expectations on both revenue and EPS. Revenue of $11.6 billion exceeded estimates that called for $10.9 billion, and EPS of $2.94 represented 7% year-over-year growth, significantly beating expectations of $2.67 per share. Over the first half of the year, EPS rose 1% as compared to the same period last year.

Another reason the stock is performing well is due to the fact that its positive earnings momentum is accelerating. After reporting results last quarter, Lockheed Martin management raised its full-year earnings forecast. The company now expects $11-$11.30 per share in fiscal 2015 earnings. This compares favorably to the previous outlook of $10.85-$11.15 in earnings per share.

However, going forward LMT’s earnings per share are expected to decline slightly year over year. At the midpoint of this forecast investors can expect the company to earn $11 per share this year, representing a 2% decline in earnings, due primarily to continued cuts in defense spending in the United States. This may impact Lockheed Martin’s future dividend growth. Another factor that could limit Lockheed Martin’s dividend growth is its $9 billion acquisition of the Sikorsky Aircraft business from United Technologies.

Dividend

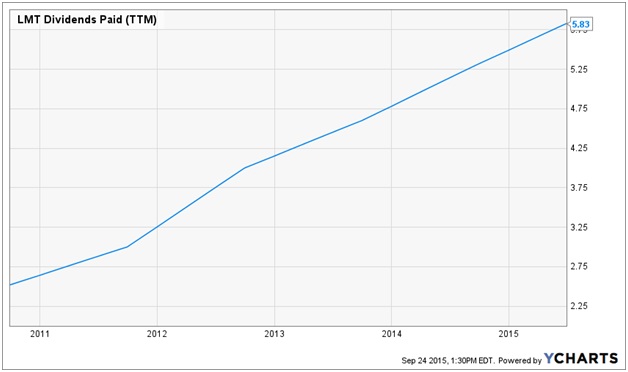

Lockheed Martin has paid and increased its dividend for many years. Last year, the company increased its dividend by 13% to its current annualized rate of $6 per share. That was the twelfth consecutive year of a double-digit dividend increase in percentage terms for the company.

At its September 23 closing price of $202 per share, the stock currently provides a 2.97% yield. That is a higher yield than the S&P 500 Index, which yields approximately 2% on average.

Valuation

A common method for analysts to determine whether a dividend stock is currently overvalued or undervalued is the Dividend Discount Model. This valuation tool incorporates a company’s current dividend and an estimate of its future dividend growth that is then discounted back to the present using the firm’s cost of equity capital. The discount rate and future dividend growth estimates are somewhat subjective, so it is critical for an investor to use fair assumptions in order to derive a reasonable conclusion.

In the past five years, Lockheed Martin increased its dividend by 18.9% compounded annually. However, due to the likelihood that LMT’s earnings will decline this year as a result of stricter defense budgets, investors may want to be more conservative when estimating future dividend growth. As a result, it seems prudent to expect 8% in dividend growth next year and 5% in dividend growth in perpetuity.

For the cost of equity, the analysis will incorporate the Capital Asset Pricing Model. This is a common method used to calculate a firm’s cost of equity in discounted cash flow analysis. Using the 10-Year U.S. Treasury Bond’s current 2.1% yield as the risk-free rate, an 11% expected market rate of return, and Lockheed Martin’s listed beta of 0.64, the firm’s cost of equity is 7.8%.

As a result, fair value for Lockheed Martin using the Dividend Discount Model is calculated to be $231 per share. That represents a 14% premium to Lockheed Martin’s recent closing price and is an indication that the stock is currently undervalued.

You can find LMT’s dividend history here.