This morning, Wall Street woke up to news of eurozone finance ministers approving a Greek bailout extension. While the extension will stave off default for another few months, many believe the deal is far from any kind of solution to the eurozone’s bigger issues.

The Extension

On Tuesday, European officials announced that a four-month extension to Greece’s bailout has been approved. This means that the $273 billion in funding from the eurozone and the International Monetary Fund won’t expire this week and will instead expire at the end of June. The deal, however, will still need to be voted on by parliaments in several eurozone countries. Analysts are expecting approval from all voting parliaments.

In the bailout extension, Greece submitted a list of proposals that should be in-line with the IMF’s and eurozone’s austerity requirements. The list outlines several fiscal structural policies that will be implemented, including changes in tax policies, public finance management, revenue administration, public spending, social security reform, labor market reforms, and privatization and public asset management among others. These proposals are meant to put Greece in a better position to begin repaying its debts, while at the same time attempting to implement poverty alleviation reforms.

The Greek finance minister, Yanis Varoufakis, adamantly upheld Greece’s commitment to avoid receiving a new tranche of the bailout package. Earlier this month, he stated: “It’s not that we don’t need the money, we’re desperate because of certain commitments and liabilities that we have … We have resembled drug addicts craving the next dose. What this government is all about is ending the addiction.”

The Human Impact

While the latest developments seem to put Greece in a better position, the fact is the country is far from improving its economy. Putting aside the Greek balance sheet, what is more worrisome and harder to “solve” is the impact these dire financial woes have had on Greece’s population.

Unemployment remains above 25%, while unemployment among Greece’s youth is at a remarkable 50%. The nation’s pension and social security programs are grossly underfunded, while at the same time healthcare spending continues to be trimmed by the government.

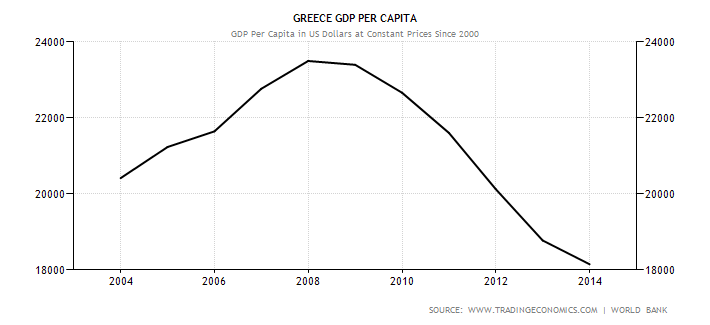

The list of human and material impacts of Greece’s financial troubles is an extensive one, and frankly could go on and on. To put things into perspective a bit, below is a chart of Greece’s GDP per capita (in U.S. dollars) since 2003. (Remember that GDP per capita is obtained by dividing the country’s gross domestic product, adjusted by inflation, by the total population.)

Ending the Tragedy

Greece’s economic hardships are far from being solved. More importantly, without better living and economic conditions for the country’s population, Greece will continue to rely on external funding and even stricter austerity measures, which will ultimately hurt the country even more. Another key idea investors need to keep in mind is that Greece’s troubles are not isolated. How the bailout pans out will ultimately affect the entire eurozone region. These spillover effects could potentially impact certain investments, particularly those with close ties to the region. As always, we encourage everyone to keep on top of important economic trends both in and outside of the U.S..

Be sure to follow us on Twitter @Dividenddotcom.