Computer Sciences (CSC) reported its third quarter results after the closing bell on Monday, posting lower sales and higher adjusted earnings compared to last year’s Q3.

CSC's Earnings in Brief

- Computer Sciences reported third quarter revenues of $2.95 billion, which are down from last year’s Q4 revenues of $3.23 billion.

- Adjusted EPS for the quarter came in at $1.18, marking a 9% gain over last year’s Q4 adjusted EPS of $1.08.

- CSC beat analysts’ EPS estimates of $1.12, but revenue missed the $3.19 billion expectation.

CEO Commentary

CSC president and CEO Mike Lawrie had the following comments: “We are delivering solid profitability improvement through our cost takeout initiatives. We returned to top line growth in our public sector business and we expanded the operating margin through tight cost management and good contract performance. We continue to see significant growth from our next-generation offerings. However, these contributions are not yet large enough to offset headwinds in our traditional commercial business. Free cash flow was strong at $498 million due to better working capital management.”

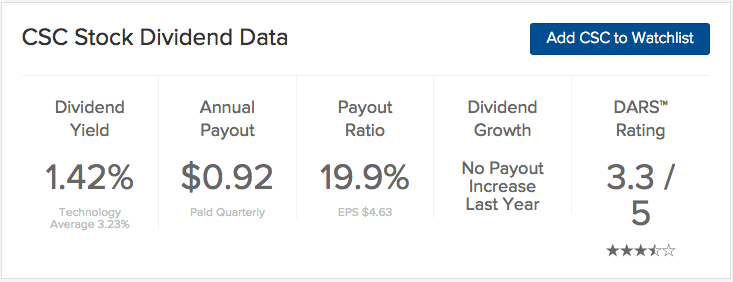

CSC's Dividend

Computer Sciences paid its most recent quarterly dividend of 23 cents on January 26. We expect the company to declare its next dividend in the coming month.

Stock Performance

CSC stock was down $4.29, or 6.62%, in after hours trading. YTD, the stock is up 2.84%.

The Bottom Line

Computer Sciences (CSC) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.3 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.