Bargain hunting is a common strategy used by long-term investors seeking to make an allocation at an attractive entry point in a security. While this methodology can lead to stellar gains over the long term, it can also go the other way on a position, leaving you on the wrong side of what appeared to be a bargain purchase. Nothing better exemplifies this than crude oil and related stocks over the previous months.

When Bargain Buying Goes Wrong

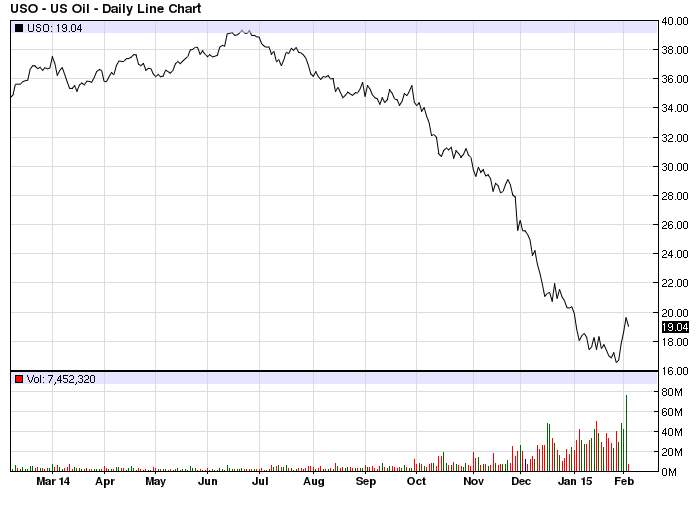

The chart below outlines the performance of crude oil over the trailing year as shown by the United States Oil Fund (USO):

Since making highs in June of last year, crude oil collapsed more than 50%. All the way down, investors and speculators tried to call the bottom, saying there was no way it would break below $70 per barrel, then $60 per barrel, and even $50 per barrel. Instead, the commodity fell below the $50 per barrel threshold and continued to thrash anyone who had bought in on its collapse.

A similar move occurred in energy stocks, which are popular in the dividend world as they tend to have stable and often attractive yields. The majority of these stocks have seen increased interest from those trying to time a bottom in the last few months, only to fall even further, burning anyone who established a position along the way. The following table shows five major energy stocks and their returns over the last six months:

| Stock | 6 Month Return |

|---|---|

| ExxonMobil (XOM ) | -8.94% |

| Phillips 66 (PSX ) | -10.11% |

| Chevron (CVX ) | -15.77% |

| BP (BP ) | -17.87% |

| ConocoPhillips (COP ) | -19.71% |

This is a tough but important lesson to learn; bargain hunting can be a powerful strategy but it also carries a fair amount of risk. Sure, stocks like XOM or BP looked attractive three months ago, but they are even lower now. Trying to time the bottom is a dangerous game, and it often does not work out in favor of the investor. Granted, bargain hunting in crude oil stocks over the last few months has been a unique scenario, but it is still one that investors can learn from.

The Bottom Line

Bargain hunting should never be about trying to time the bottom in an asset, but rather finding a stock that is undervalued relative to its peers and/or the broad market. Approach bargain buying with a sense of caution, as there is no guarantee that it will move in a profitable direction. The best way to defend yourself from a losing bargain buy is to do your homework and due diligence prior to making any kind of investment.

Be sure to follow us on Twitter @Dividenddotcom