Before the opening bell on Friday morning, MasterCard (MA ) reported its fourth quarter results, posting higher revenues and earnings than last year.

MA's Earnings in Brief

- MasterCard reported fourth quarter revenues of $2.42 billion, up from last year’s Q4 revenues of $2.13 billion.

- Net income for the quarter came in at $801 million, or 69 cents per diluted share, up from last year’s $623 million, or 52 cents per share.

- MA beat analysts’ estimates of 67 cents EPS on revenues of $2.4 billion.

CEO Commentary

MasterCard CEO and president Ajay Banga had the following comments: “Despite a mixed global economy, we delivered solid results for the quarter and for the full year in 2014. This year is off to a good start with several new wins, as well as renewals of some important customer agreements, with more in the pipeline. Looking ahead, we will continue to be at the forefront of our industry by driving payment innovation with solutions such as MasterPass, and by increasing electronic payments usage globally as demonstrated by our significant expanded acceptance footprint across Africa.”

Stock Performance

MasterCard stock was up $2.38, or 2.92%, in pre-market trading. YTD, the stock is down 5.55%.

The Bottom Line

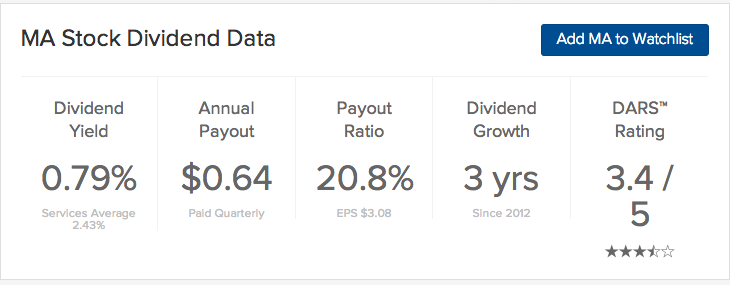

MasterCard (MA ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.4 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.