Before the opening bell on Thursday morning, ConocoPhillips (COP ) reported its fourth quarter results, posting lower earnings compared to last year’s Q4.

COP's Earnings in Brief

- ConocoPhillips reported a net loss of $39 million, or 3 cents per share, for the fourth quarter, compared to last year’s Q4 earnings of $2.5 billion, or $2 per share.

- On an adjusted basis, COP reported EPS of 60 cents, which is down significantly from last year’s $1.40.

- The energy company was able to beat analysts’ EPs estimates of 59 cents.

- Due to anticipated lower commodity prices in 2015, COP is cutting its capital expenditures by $2 billion, from $13.5 billion to $11.5 billion.

CEO Commentary

COP chairman and CEO Ryan Lance had the following comments: “We are responding decisively to a weak price outlook in 2015 by exercising our capital and balance sheet flexibility. In this environment our priorities are to protect our dividend and base production, stay on track for cash flow neutrality in 2017, and preserve future opportunities.”

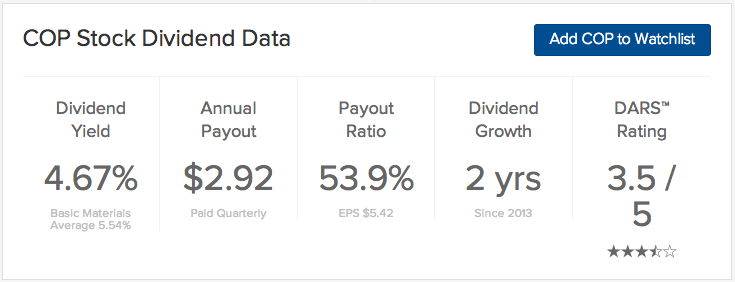

COP's Dividend

ConocoPhillips paid its most recent dividend of 73 cents on January 1. We expect the company to declare its next dividend in the coming days.

Stock Performance

COP stock was up 42 cents, or 0.67%, in pre-market trading. YTD, the stock is down 9.38%.

The Bottom Line

ConocoPhillips (COP ) is recommended at this time, holding a Dividend.com DARS™ Rating of 3.5 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.