After the closing bell on Thursday, Starbucks (SBUX ) reported its first quarter results, posting strong gains in both earnings and revenues compared to last year’s Q1.

SBUX's Earnings in Brief

- Starbucks reported first quarter revenues of $4.8 billion, which are up 13% over last year’s Q1 revenues of $4.24 billion.

- Net earnings for the quarter came in at $983.1 million, or $1.30 per share, compared to last year’s Q1 figures of $540.7 million, or 71 cents per share.

- On an adjusted basis, EPS came in at 80 cents, marking a 16% gain over last year’s Q1 non-GAAP EPS.

- Looking ahead, SBUX sees Q2 non-GAAP EPS in the range of 64 cents to 65 cents, while analysts expect 68 cents. For FY2015, SBUX sees non-GAAP EPS in the range of $3.09-$3.13, while analysts expect $3.13.

CEO Commentary

SBUX chairman and CEO Howard Schultz had the following comments: “Starbucks record Q1 fiscal 2015 financial and operating performance was exceptional by every metric and standard. Our reimagined in-store holiday experience that included a vastly expanded assortment of Starbucks Cards, new holiday food, beverage and merchandise offerings and the opportunity to win ‘Starbucks for Life’ resonated powerfully with our customers and drove both increased traffic and tremendous excitement in our stores and around the Starbucks brand.

SBUX Declares Dividend

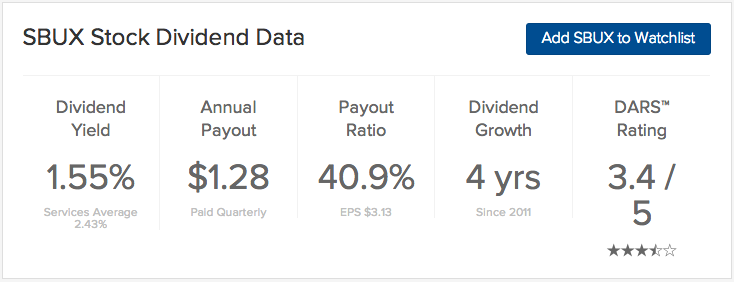

Starbucks’ board of directors declared a 32-cent quarterly dividend that is payable on February 20 to all shareholders on record as of February 5.

Stock Performance

Starbucks stock was up $2.61, or 3.15%, in after hours trading. YTD, the stock is up 0.84%.

The Bottom Line

Strabucks (SBUX ) is not recommended at this time, holding a Dividend.com DARS™ Rating of 3.4 out of 5 stars.

Be sure to visit our complete recommended list of the Best Dividend Stocks, as well as a detailed explanation of our ratings system here.