The first full trading week of 2015 proved to be a volatile one, and the back-and-forth trading mood doesn’t appear to have entirely evaporated from Wall Street judging by the slump seen on Monday morning.

Volatility has been rising due to the Greek elections’ uncertainty spilling over onto the home front and oil’s ongoing meltdown; while it’s hard to say if confidence will return to the markets this week, it’s a certainty that the spotlight will be back on corporate earnings.

Read more about Insuring Your Portfolio.

Earnings Season Kicks Off

The aluminium bellwether Alcoa (AA ), known for kicking off the corporate earnings season, is slated to report after the market closes on Monday. Analysts are expecting for Alcoa to report a profit of 27 cents a share, and it’s safe to say that better-than-expected results from the materials juggernaut are bound to lift investor sentiment, as the company’s performance is often regarded as a barometer for the global economy.

Other must-see earnings releases this week include:

- Tuesday: KB Home (KBH ) reports in the morning and CSX Corp. (CSX ) after the market closes.

- Wednesday: Banking juggernauts JP Morgan Chase (JPM ) and Wells Fargo (WFC ) are reporting after the market closes.

- Thursday: Bank of America (BAC ) and Citigroup(C ) report in the morning and chip-maker Intel Corp (INTC ) after the closing bell.

- Friday: Goldman Sachs (GS ) will report before the opening bell on the last trading day of the week.

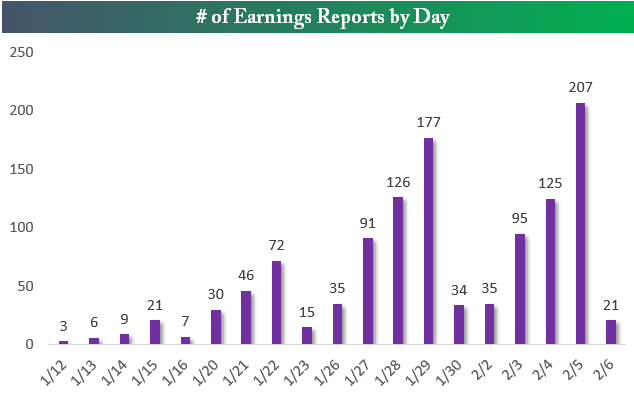

The first week of earnings season is important to watch, but as the chart below from Bespoke Investment Group illustrates, the action doesn’t really pick up steam until the end of the month and into the first week of February:

Though quarterly performance results from leading industry players will dominate the headlines this week, investors will also digest some key economic news.

More specifically, Wednesday’s Retail Sales report will be a must-watch release as investors look to see whether or not decreasing energy prices really translated into increased consumer spending during the month of December. On Thursday, the spotlight will be focused on manufacturing releases, including the Empire State Index and Philly Fed. The week will wrap up with the releases of the consumer price index (CPI) and consumer sentiment data on Friday morning.

Be sure to check us out on Twitter @dividenddotcom.