On the surface it’s a simple idea: work, earn money, save, invest and retire. However, we all know getting from point A to point B can be quite tricky. Utilizing plain old savings and government-provided Social Security just does not cut it anymore. A savvy investor knows that taking advantage of retirement accounts, like IRAs, or employer-sponsored plans, like 401(k)s, are the only ways to build substantial wealth for retirement in today’s economic climate. But the problem is that many individuals do not fully understand the potential that these plans have for establishing a comfortable retirement. Here is a simple outline to help you understand a well known employer-sponsored retirement plan, the 401(k).

What Is a 401(K)?

Here is how a 401(k) works: a 401(k) is a type of retirement savings plan that is sponsored by an employer. The plan has tax deferred benefits, allowing you to contribute to the account with pre-tax dollars. Employers often match a certain percentage of contributions. Investors have control over how their money is invested and are typically given a choice of a handful of stocks, funds, and bonds. The plans often have strict requirements concerning when money is withdrawn, including a 401(k) withdrawal tax, so it is important that investors understand when and how they can take their money out.

Benefits of 401(k)s

There are two big benefits that 401(k)s have over other investing and retirement vehicles. First, the money you contribute to your plan is made with pre-tax dollars from your paycheck, meaning you have yet to pay taxes on that income. This is unlike most investment vehicles where you typically contribute money after taxes. The difference here can be huge [see also A Guide to Tax-Advantaged Savings Accounts].

For instance, if you were to add $1,000 dollars to your 401(k), you are actually investing that $1,000 because it is taken from your paycheck before taxes. However, in another type of investment account, that same $1,000 earned could be invested at a substantially lower amount because of the taxes paid to the government. The difference between the pre-tax and after-tax contributions is especially significant when considering the potential that money has to compound and appreciate over the years until you are ready to retire.

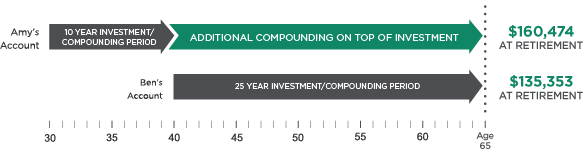

The following chart, courtesy of Nationwide, shows how big of an impact compounding can have on a portfolio. The chart looks at two hypothetical accounts: Amy contributes $2,000 each year from age 30 to age 40, Ben contributes $2,000 each year from age 40 to age 65, making far more contributions than Amy. But because Amy started earlier, her account is still bigger upon retirement despite contributing far less money (the chart assumes an annual return of 7%).

Another big benefit that 401(k) plans have is the potential for basically free money from your employer. This is because most employers offer 401(k) matching plans. What this means is that your employer will match the amount you contribute to a certain degree. Some employers will match up to a certain percentage of contributions while others will match the entirety of employee contributions. Matching plans are often quoted in terms of percentage of salary; so the employer will match contributions up to a certain percentage of your salary. Let’s take a hypothetical example of someone who makes $50,000 each year and contributes 10% of their salary ($5,000) to their 401(k). Here is the employer contribution for various matching plans:

| Matching Plan | 2% | 3% | 5% | 10% |

|---|---|---|---|---|

| Employer Contribution | $1,000 | $1,500 | $2,500 | $5,000 |

In the case of a 100% match, the employee could theoretically put as much money as they wanted into their 401(k) and the employer would match it.

There is really no reason investors should not take advantage of this plan, but still many are unaware of the benefits that the employer-sponsored 401(k) have for their potential retirement finances.

Investment and Dividend Considerations

Because you are investing with pre-tax dollars, plus an added contribution from your employer, you can easily take advantage of compounding interest with dividends to build up your wealth over time. For more on compounding interest, check out The Pros and Cons of Compound Interest.

The investments within the 401(k) grow tax-deferred, meaning that all the transactions within the account grow without being taxed. Any capital gains or dividends earned from the investments are not taxed at their respective rates. This allows you to grow your investment over time to a substantially higher amount than if these same investments were made in another investment vehicle or account. For more on dividend taxes, check out A Brief History of Dividend Tax Rates.

Something else to consider is that sometimes within a 401(k) plan you may be heavily invested in the stock of the company that employs you. However, be wary of being too overexposed to your company’s stock; just because you feel like you are putting in hard work and expect the company to benefit from your input, this does not mean the company is sound financially (just ask the former employees of Enron). You want to make sure to diversify your investments so your savings will not take a hit if any one securities goes down the tubes.

While there are some 401(k) plans that allow you to actively manage your own investments, there are certain plans that mandate that you choose from a variety of investing goals that are managed by a professional investing company. Nevertheless, by outlining a strategy using compounding dividends and diversified assets as a way to appreciate, funds can still result in substantial nest egg growth for the future.

Common Pitfalls and Misconceptions

Though you are making your contributions with pre-tax income, it does not mean that these savings will never be taxed; your investment is tax-deferred, not tax-free. When you are in retirement and ready to withdraw from your 401(k), this money will then be taxed at a rate as normal income. But don’t fret, the long-term benefit of your investment appreciating over time from that initial pre-tax income should outweigh the normal income tax on distributions during retirement (which will most likely be a lower tax rate anyway). Curious about retirement account tax rates? Check out Retirement Account Withdrawal Tax Rates.

The money withdrawn from your 401(k) must be made after the age of 59.5, or else you will be hit with a 10% penalty fee (plus state and federal taxes). There are exceptions to this, though. Many 401(k) plans allow for a penalty-free withdrawal if the money is used for certain transactions like buying a house. All plans are different, however, so check your respective 401(k) if you have any questions about any stipulations or restrictions.

Another restriction that your 401(k) will have is the amount of money that you can contribute to your 401(k) plan annually. Again, this restriction differs depending on your respective plan, so your best recourse is to check your own 401(k) plan to reaffirm how much you can contribute to your account annually.

Keep in mind that your 401(k) plan is not permanent. If you were to lose or leave your job, then your 401(k) retirement plan is more or less over. However, you do have the opportunity to roll your 401(k) into another retirement account like an IRA. The best bet for you is to contact a financial advisor to outline a retirement plan that makes the most sense for your specific retirement goals.

5 Things to Consider Before Borrowing from Your 401(k)

Sometimes you may find yourself in a financial pinch and look for a loan–or any type of borrowed money–to help alleviate the monetary problems that have arisen. Even though there are better options out there, you may look to tap into your retirement account, like a 401(k), and borrow from it to solve your short-term financial issues. Though it is not recommended by most, if the situation does arise and you need to borrow from your 401(k), keep in mind the following considerations.

1. You’re Defeating the Purpose of Your 401(k)

The idea of a 401(k), or any retirement plan for that matter, is to invest money into a tax-advantaged plan and let it grow over time. The fundamental goal is to build a significant nest egg that will aid in supporting a comfortable lifestyle well into your retirement years. By borrowing from your 401(k), you are ultimately impeding your overall progress towards the path to a successful retirement.

This is because in most 401(k) plans you are prohibited from making additional contributions until the loan is paid back. So, if you borrow money from your 401(k), you are halting a significant portion of possible retirement contributions just to take out a loan. In the short-term, this may pay off as you finance some bills or some other cost, but the long-term losses most likely outweigh these short-term gains [see also 7 Retirement-Planning Musts for Young Investors].

Even if your 401(k) plan allows for continued contributions when you borrow money from it, most likely you are not in a position to add funds to this retirement account while you are paying back the loan. So, regardless, you are defeating the purpose of your 401(k) when you borrow from it because you don’t let your money work for you and compound over time. It is tough for some individuals to have a long-term vision that outweighs short-term needs, but you need to realize that borrowing from your 401(k) will ultimately lose you money as time works against you.

2. It May Be Low Cost, But at What Cost?

Sometimes borrowing from a 401(k) allows you to get a better interest rate than a commercial loan rate. This may be especially beneficial for individuals who have a tough time finding affordable rates because of less-than-ideal credit. However, even though you may be getting an affordable rate versus a bank loan, this short-term benefit may not make up for the money you end up losing out on in the long-term by not letting the investment appreciate in the 401(k).

Furthermore, in the event you are not able to pay back your loan, you would then have to pay a 10% penalty fee on the money borrowed, if you are under 59.5 years old. In addition to this hefty fee, you would have to pay full federal and state taxes on the money, as if it were a normal distribution. Keep this in mind, especially if you are considering borrowing from your 401(k) but may be in a position where you are unable to repay the loan.

In the end, a seemingly modest plan to borrow from your 401(k) may end up costing much more than originally anticipated, both in terms of the actual price paid for the borrowed money and the wealth missed out on by removing it from your investment.

3. How’s Your Job Security?

Before ever borrowing from a 401(k), assess your current job situation. You want to make sure that you are happy at your current place of work and that they are happy with you. This is because if you were to lose or leave your job, then you’d have to pay back your loan within 60 days. It is probably safe to say that not many people are in the position to pay back a loan that quickly after just losing a job.

Moreover, if you were to lose or leave your job, then the money borrowed from the 401(k) gets tagged as a withdrawal, not a loan, and you would have to pay the early withdrawal fees and taxes outlined above. This factor may trap you in a current job if a better opportunity arises, because the penalties attributed to the loan may not be worth the career move.

4. Is It for a Smart Investment?

Though most of the time individuals should be advised against borrowing from a 401(k), there are times when a solid, smart investment may be a reason to consider borrowing from the account. However, to make up for the potential loss of retirement wealth, you must make sure that the investment will be worth it in the end. Buying a new home, financing a business or advancing your education may all be adequate investments that can have a greater return than the investments in the 401(k) realize. But, before going through with the loan and investment, you must make sure the risk is worth the reward. If you are concerned with your investments and financial path, see How to Create An Effective Financial Plan.

5. Is This Your Last Resort?

Sometimes it is just flat out necessary to borrow from your 401(k). You may have exhausted all other options, like looking for affordable commercial loans, a home equity line of credit, or borrowing from a family member. Keep in mind, even if you feel like you are being pressured to borrow to pay for credit cards or other debts, there are ways to deal with these creditors. But maybe you have exhausted that path as well, so you bite the bullet and decide to borrow for your 401(k). Don’t worry, it is not the end of the world.

Going forward though, you should assess how you are living. Make an effort not to spread yourself out too thin or live beyond your means. Borrowing from a 401(k), though not the end of the world, is a red flag that your lifestyle may be draining money from your future. In tough financial times, this is all easier said than done, but know that if borrowing from a retirement account is your last recourse, you are ultimately paying a heavy price.

The Bottom Line

The benefits of a 401(k) may seem obvious, but many employees do not take advantage of these plans offered by their employers. By making a simple call to your Human Resources department you can set up your 401(k) immediately and start seeing the benefits of a tax-advantaged, employer-sponsored retirement account. By using smart investment strategies, plus diversifying retirement plans between 401(k)s, IRAs and other investment vehicles, you may be on your way to a substantial retirement nest egg. Soon, you will be able to enjoy peace and comfort well into your golden years.

Be sure to follow us on Twitter @Dividenddotcom.