Over the years, Carnival Corporation (CCL) has seen its fair share of misfortune when it comes to accidents on its cruise ships. The company’s reputation has been significantly damaged, as the media has widely reported on all of the company’s disasters. Below is an overview of some of the Carnival Cruise disasters and how its stock price has reacted.

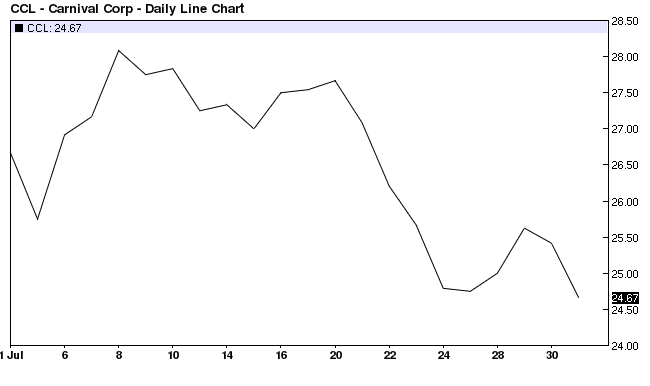

July 20, 1998: Fire Starts on Carnival’s Ecstasy Ship

With 2,500 passengers on board, Carnival’s Ecstasy ship caught on fire off the coast of Florida at the beginning of a trip to Mexico. The fire resulted in injuries to 60 passengers and massive damage to the ship. Six tugboats came to the rescue, extinguishing the fire and towing the ship back to shore. CCL’s share price fell for the five days following the incident, and lost over 10% of its value by the end of the month.

Carnival’s share price continued to fall during the next two months as news reports from the accident continued to be released. The company told shareholders that its earnings would likely be affected by the event. By September, CCL’s share price fell 28% since the day of the incident. Just one year later in 1999, another ship caught on fire. The second incident did not have a significant impact on CCL’s stock price.

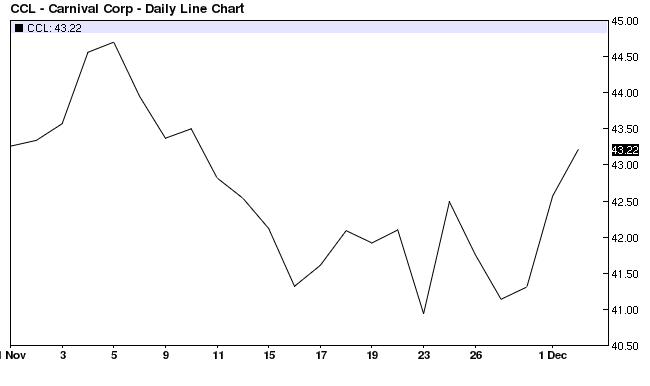

November 8, 2010: Carnival’s Splendor Ship Loses Power

In November 2010, Carnival’s Splendor ship lost power after a fire started in the engine room. With 4,500 passengers and crew on board, the ship was stranded in the Pacific Ocean for several days until it was able to be transported to a port in Mexico. For three days, passengers were left with no electricity and limited food. At the end of the trip, passengers were reimbursed for their trip and given credits for future cruises.

Carnival Cruise stock price dipped about 7% by the end of November, but was able to completely rebound by the following month. Although this was an unfortunate event for CCL, it had no long-term impact on its share price. By the end of December 2010, the company’s share price was higher than it was before the power loss incident.

Be sure to also read The Biggest Dividend Stock Collapses of All Time.

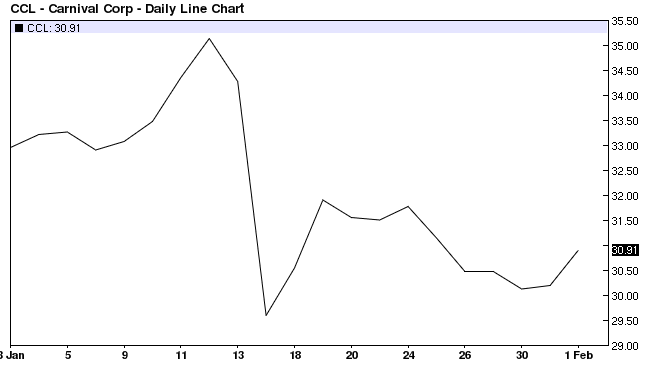

January 13, 2012: The Costa Concordia Disaster

On January 13, 2012, Carnival’s Costa Concordia ship capsized in the Mediterranean Sea with over 4,000 passengers and crew on board. The incident occurred when the ship hit an object on the bottom of the sea while it traveled close to the shoreline to salute the locals on shore. It took six hours for all passengers to evacuate the ship, while some passengers were forced to swim to safety. The accident killed 32 passengers. After this incident, search crews searched for missing passengers for several weeks.

The following market day after the disaster, the Carnival Cruise stock price sunk almost 16%. The following day, CCL’s share price made some recovery, but it ultimately took months for the company to completely rebound.

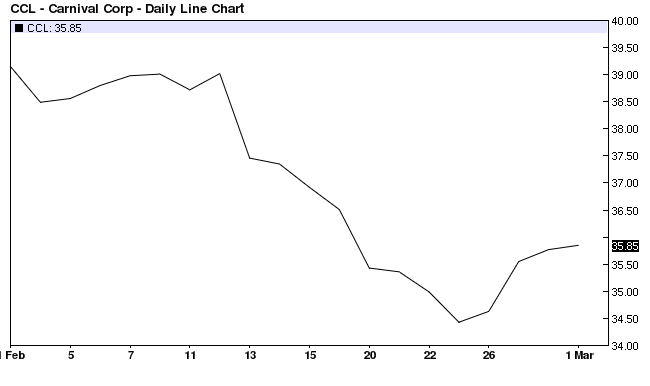

February 10, 2013: Passengers Stranded on Carnival’s Triumph

With over 4,200 passengers and crew members on board, a small fire occurred on Carnival’s Triumph ship on the morning of February 10, 2013. Although the fire was quickly extinguished, the entire ship lost power. Following the power outage, the ship was stranded in the middle of the Gulf of Mexico for several days. Passengers on the ship were forced to wait for hours for food, experienced water shortages, and had to sleep in the hallways of the ship to avoid the heat. This carnival cruise disaster was most known for its disabled toilets, which caused waste to spill throughout the ship.

This incident caused Carnival’s stock price to dip for several days after the news broke. By the end of February, its share price lost 7% of its value. Although this event did not have any major effects on its stock price, it took months for CCL to fully rebound.

Carnival's Worst Trading Days

Although the four events listed above were all terrible incidents for Carnival, only one of the events had a significant long-term effect on the company’s stock price. So, if it’s not disasters related to Carnival’s cruise ships, what events have the largest effect on CCL’s stock? While two of the worst days for CCL’s share price were caused by events that had direct impacts on the travel industries, the other two non-disaster related events could happen to any company. Below are the company’s five worst trading days.

Be sure to also check out these Best and Worst Dow Days.

The Bottom Line

Investors should always be cautious with their investments, as it does not take a disaster within a company to bring down its share price. On the flipside, investors must also realize that bad press does not always mean that the stock price will plummet.