The price-to-earnings ratio (P/E) is one of the most common metrics used in fundamental analysis. Analysts and traders often use this ratio to determine if a stock is over or undervalued relative to its peers and the market as a whole.

What Is a Price-to-Earnings Ratio?

A price-to-earnings ratio (or price earnings ratio) consists of a simple calculation that is one of the most often-quoted fundamental attributes of any stock. The price to earnings ratio formula consists of a company’s stock price divided by its earnings per share. The majority of P/E ratios fall anywhere from the low double digits to around 50 (the S&P 500 has a current P/E ratio of 20.09), but there are some stocks that see that metric skyrocket, leaving investors scratching their heads.

When it comes to dividend investing, many take the P/E ratio into account as they try to buy into a stock at a fair value, which is why it can be difficult to analyze a stock with a P/E metric into the 100s. Below, we outline some of the most common reasons that P/E multiples get out of whack, including an example of each.

1. The Non-Recurring Expense

Keeping a close eye on the income statement can help you spot this one, the non-recurring expense. Some years and/or quarters will see companies reflect a one-time expense, like a write-off of goodwill, that can drag down net income and do the same to EPS. When EPS is drastically reduced due to a one-time occurrence, investors may continue to buy the stock and buoy its market price, which will balloon its P/E ratio [see also The Ten Commandments of Dividend Investing].

Two perfect examples come from Starbucks (SBUX ) and Waste Management (WM ) on 3/7/2014. Both stocks saw a major jump in non-recurring expenses for their FY2013, shooting their P/Es through the roof. The following table shows both stocks, their P/E ratios as of 3/7/2014, and what their P/E metric would be, had it not been for the one-time expenses:

| Company | P/E as of 3/7/2014 | Change in Non-Recurring Expenses | Amended P/E |

|---|---|---|---|

| Starbucks | 462.5 | $0 to $2.784 billion | 19.26 |

| Waste Management | 196.5 | 560% | 17.62 |

2. Narrow Profit

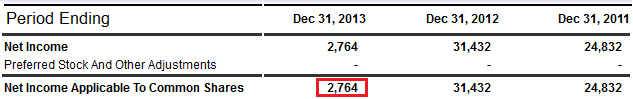

When a firm has a narrow profit margin, it doesn’t take much for it to have a down year. Firms with low profits can watch their P/Es skyrocket in a year when net income takes a big hit, as it drags down the EPS metric. A great example comes from World Wrestling Entertainment (WWE ). The image below shows the net income metric for three of the firm’s fiscal years, and investors will note that 2013′s income dropped 91% as high operating expenses made a major impact.

On 3/7/2014, WWE’s P/E ratio was 718.

3. Expectations of Future Growth

Another factor that can make a P/E irrelevant is a high expectation of future growth. While EPS could be low for the time being, investors and analysts expecting the company to grow may continually buy the stock and raise the stock price. In some cases, the earnings may catch up to a stock’s price and bring the P/E back in check, but others may see investors lose faith, which will drop the share price and bring the P/E down.

Netflix (NFLX) is one of a few stocks that has exhibited this pattern (with a P/E of 243.5), as the expectations for the firm’s growth have been high for quite some time (with the company notching some solid growth in recent years to boot). Here’s what NFLX looks like for the beginning of 2013:

The firm had some solid earnings wins, but it is clear that investors are piling into the stock as they feel it has the potential for strong gains in the future.

4. Hard to Explain

Simply put, some companies leave even the most adept analysts confused. Though not a dividend stock, Amazon (AMZN) is probably the best example of this. The stock is one of the largest retailers in the world and is constantly able to win price wars over the competition. With such a stranglehold on the market, investors have a lot of faith in the company. That being said, the company is known for missing earnings estimates and even showing declining earnings over some periods. That fact does little to ward off investors, as they continue to buy the stock and support its market price.

It should also be noted that AMZN has an extremely narrow profit margin as well, which combines with the aforementioned behavior to make up its current P/E ratio of 631. Even Jim Cramer has noted this unusual behavior and has gone on record stating that AMZN is a stock in which he gives the P/E multiple no weight in his investment decisions.

The Bottom Line

P/E ratios can be a powerful multiple when it comes to fundamental analysis, but there are a number of factors that can cause a P/E to skyrocket. Be sure to look under the hood to find out exactly why a stock is trading at its current price-to-earnings multiple and whether or not that ratio is especially applicable for the security you are analyzing.

Be sure to follow us on Twitter @Dividenddotcom.